Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'd say there's not really a significant enough difference to drive one way over another....

I am in Total Market Index and do use the S&P Index as one benchmark.

I'd say there's not really a significant enough difference to drive one way over another....

I might even say use SP500 to be broader than using a single sector like Energy.The point of using SP500 is to be broad. The point of using a sector fund is to be narrow.

Wow! Just when I was beginning to think that everything I read on the internet is true, this guy comes along. Ack!

Wow! Just when I was beginning to think that everything I read on the internet is true, this guy comes along. Ack!

The author says "... a total stock market fund does not really invest in the total stock market in a literal sense. " Actually, they do: Even the most cursory look at total market funds makes it obvious that what he says is untrue. For example, Morningstar says total US market fund VTSMX holds 3,580 US stocks. That is basically all of the investable stocks in the country. Total world market fund VTWAX holds 8,382. I have not personally counted but that sure sounds like every investable stock in the world.

The author's confusion may comes from his misunderstanding of cap-weighted funds. Or maybe just from ignorance. It is hard to tell.

Total market funds almost always hold stocks on a cap weighted basis. So, "large cap" stocks will automatically predominate in dollar value within a fund. For example, on a cap weighted basis I have read that the S%P 500 comprises 80% of the US market. So the other 3,080 stocks that VTSMX holds will be the other 20% in dollar value. That is something quite different than the article claims.

The Fund employs an indexing investment approach designed to track the performance of the CRSP US Total Market Index, which represents approximately 100% of the investable U.S. stock market and includes large-, mid-, small-, and micro-cap stocks regularly traded on the New York Stock Exchange and Nasdaq. The Fund invests by sampling the Index, meaning that it holds a broadly diversified collection of securities that, in the aggregate, approximates the full Index in terms of key characteristics. These key characteristics include industry weightings and market capitalization, as well as certain financial measures, such as price/earnings ratio and dividend yield.

• Index sampling risk, which is the chance that the securities selected for the Fund, in the aggregate, will not provide investment performance matching that of the Fund‘s target index. Index sampling risk for the Fund is expected to be low.

Yes, that is pretty standard language. I think it is both a CYA and a holdover from prior years where sampling and tracking error were discussed more. AFIK it has always been in the fund prospectuses and I think in Olden Times sampling strategies were more common. Assuming Morningstar's numbers are correct, though, the two VG funds I mentioned are going far beyond sampling. The number of investable US stocks is often quoted at 3600, so I think holdings of 3,580 has to be pretty much everything. And 8,382 certainly looks like a number that would pick up all the investable stocks in the world."Total market" funds don't actually own every stock in the market. ...

I'd say there's not really a significant enough difference to drive one way over another....

I will be interested to hear. I have always understood the 3600 number to refer to the universe of stocks available to mutual funds. Or maybe it is the number that receive analyst attention. That would exclude, I think, penny stocks and the pink sheets. Maybe that is the discrepancy?I will continue to look for better confirmation, but this screener on the NASDAQ site implies that there are 6234 tradeable stocks in the US. (that probably includes ADRs).

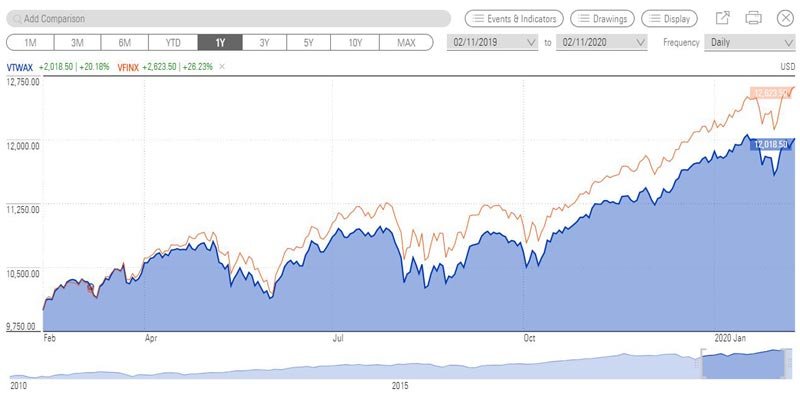

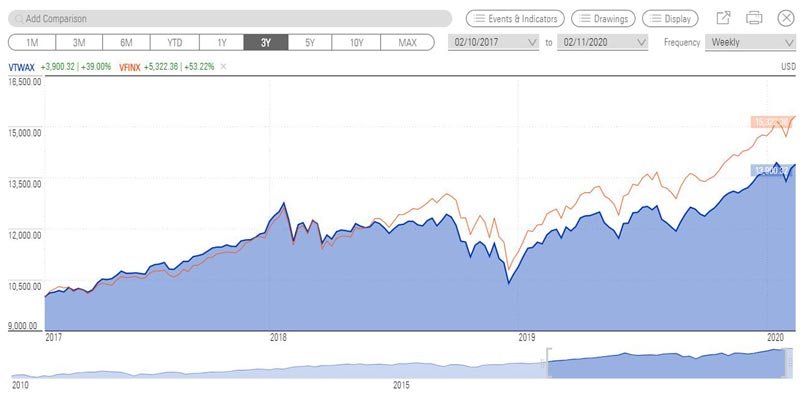

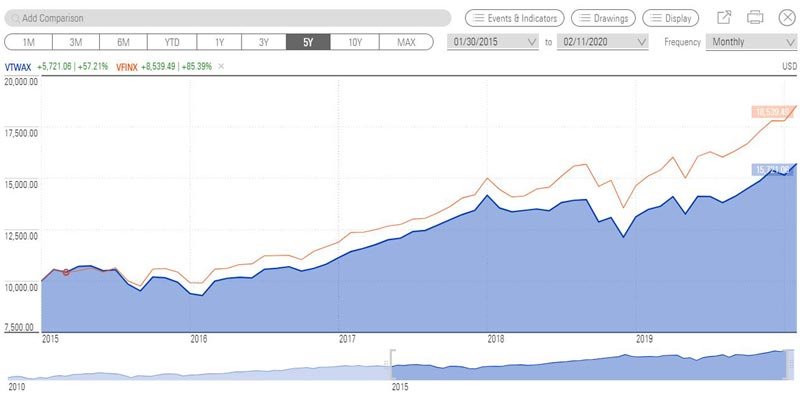

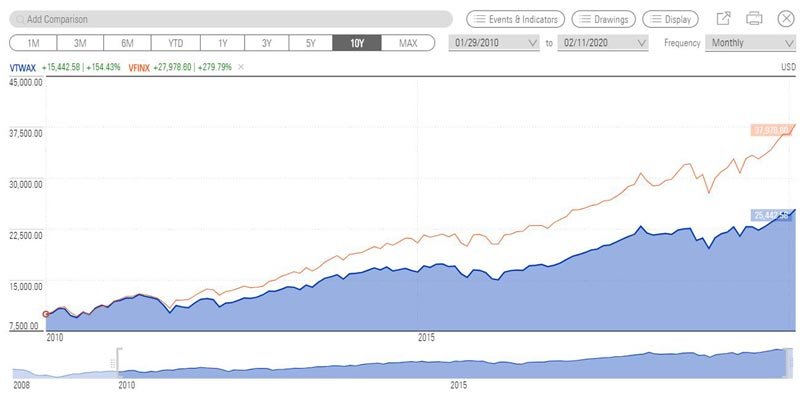

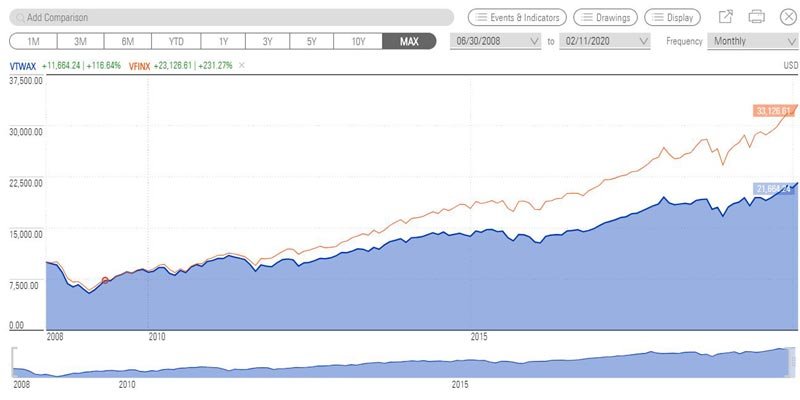

Here's a look at the Vanguard S&P500 index fund vs. the Vanguard Total World Stock Market index fund. Time periods are 1 year, 3 year, 5 year, 10 year, and since June 2008, so it includes the crash. I'd say there is a significant difference.

For example, $10,000 invested in the S&P500 index fund in June 2008 would have given you $33,127 today, whereas $10,000 invested in the Total World index fund would have given you $21,664 today. Do you think a 53% difference over 10 years is "not really significant one way or the other?"

Just in the past year the difference was $605, or 5%.

View attachment 33830

View attachment 33831

View attachment 33832

View attachment 33833

View attachment 33834

I will be interested to hear. I have always understood the 3600 number to refer to the universe of stocks available to mutual funds. Or maybe it is the number that receive analyst attention. That would exclude, I think, penny stocks and the pink sheets. Maybe that is the discrepancy?

He chose TWM because for the last decade international stocks have been weaker than the US, so it makes the S&P look relatively stronger. No real news there. In the roughly the previous decade it was the other way around.... Your attachments are based on Total WORLD Market, and I didn't understand that to be the statement I was questioning, at least no one said TWM.

After Sarbanes–Oxley there was a period where public companies were going private because of new burdensome reporting. That is certainly a factor in the Wilshire "5000" no longer being 5000. I'd think that was mostly over by your 2017 data point, tho.... This is an interesting question and I plan to research further.

My comment was based on the graph that I presented, so yes, I stand by my statement. No SIGNIFICANT difference in that graphed comparison.

Your attachments are based on Total WORLD Market, and I didn't understand that to be the statement I was questioning, at least no one said TWM.

He chose TWM because for the last decade international stocks have been weaker than the US, so it makes the S&P look relatively stronger. No real news there. In the roughly the previous decade it was the other way around.

Falling in love with concepts can lead one down the wrong path. Some concepts I've left behind:

always have a portfolio with a little of this and a little of that

you have to own international stocks all of the time

there is a value premium that is sure to show up

there is a small cap premium that is sure to show up ... someday

My 2 cents.

Can't argue with you, since the Great Recession. However, as the article indicates, the decade of 2000 told a different tale for the S&P (-.95% annual gains vs., say, +6.3% annual gains for small & midcaps over the decade).

https://www.forbes.com/sites/advisor/2010/09/13/its-not-really-a-lost-decade/#cd2333a7cf81

I'm skeptical the S&P's outperformance will continue, so I have included since 1997 (smaller percentages) of foreign, emerging, small and mid cap, and health/biotech. I got hammered the first 3-4 years (1998-2001), but then the small/mids way overperformed the S&P beginning (I think) in 2002 and the tech crash. I understand these sectors will often underperform, as in this decade; but they outperformed in the prior decade. Them's the breaks.

What will you say if/when the S&P underperforms for the next decade? (I see no signs of this occurring soon, to argue for you).