RonBoyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If only it were 50... there are something like 16000 different sales jurisdictions in the US (not just states, but some counties and cities).

And online sellers need to register, and then file (on different schedules with different jurisdictions). Some of these require you to file every period even if you have zero to collect. Oh, and of course, state DoR's have crappy websites already, very manual and old-school setups to begin with.

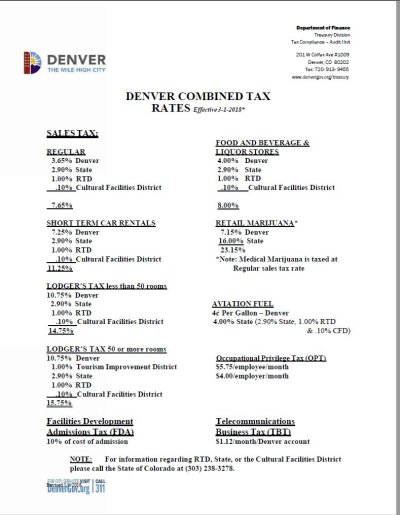

Yeah, It's been a couple years since I visited Denver's Tax site but it was not very "modern" in any sense of the word. This is what Denver Tax Rates look like:

OT: Notice the OPT. If you live and work in Denver, you are taxed on that privilege.