Tuirc

Recycles dryer sheets

Perhaps I wasn't clear enough. Prices have ALREADY risen A LOT in housing. This in conjunction with higher mortgage rates makes housing unaffordable to many.

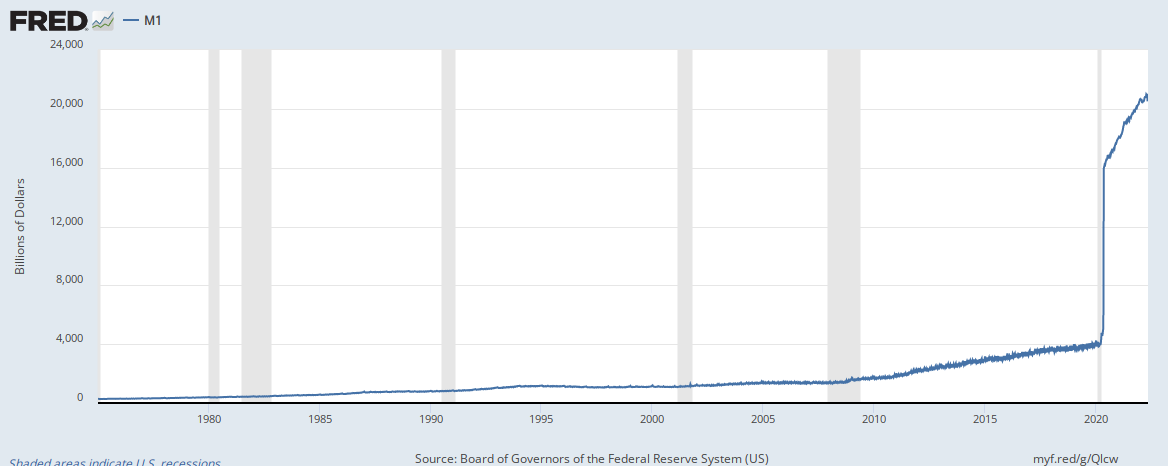

QT and what the Federal Reserve have done (so far) is a joke. When COVID hit, the Fed dropped rates from 1.5% to zero in two steps, on March 3, 2020 and March 15, 2020. They didn't talk about it for six months before hand, and they did not do a little bit and then wait for the next meeting (the second drop was between regularly scheduled meetings). It's all a game - first there is no inflation, then it is "transitory", then even when the geniuses knew it wasn't transitory - they still waited. Then they did a small increase, but still kept the QE in place. The result is that they are severely behind the curve...with inflation over 8% a .75%-1.00% federal funds rate is (repeated here) a joke.

Even now, QT has barely started - as I understand it the first items to mature won't take place until a couple weeks into June.

What has been interesting to me is the markets reaction to minimal hiking. The Q1 GDP had a negative print. If we get a negative print Q2 then we will "officially" be in a recession. More worrisome was the dramatic decline in GDP growth (to drop) from Q4 2021 (6.9%) to Q1 2022 (-1.5%).

Me? I don't think we've seen anything yet. The inflation we've seen so far does not really reflect food shortages due to the war in Ukraine.

It is now summer in the North East where 85% of the fuel oil for heating homes is used. How will people's spending (on other goods/services) be impacted this coming winter? In Nov. 2020, fuel oil averaged $2.12/gallon, now $5.13/gallon (and rising). Let's use my house as an example: Without burning wood, I would use around 1200 gallons of fuel oil per year (that includes domestic hot water) - and that is with keeping the house at 60 or so during the winter. So that would be $6156/year at current prices, $9600 if fuel oil/diesel reaches $8/gallon. Can I afford it? Yes, but that kind of coin is going to impact the spending of a LOT of people.

On the food front, Poland is racing to try to help Ukraine export its wheat crop, but estimate that they will be able to (at best) move 1/3 of the wheat in the upcoming weeks. My nephew keeps getting emails from the USDA telling him he can request early termination of CRP contracts w/o penalty (i.e. instead plant).

Each of us has to assess what is to come, and place our bets accordingly. Perhaps you will be correct, we will have a "moderate" recession. Certainly that is what most have been predicting. After all, both the government experts and the federal reserve think we have the best economy, and Powell (March 16) didn't see a recession in 2022. I am not among them.

Does this mean I've sold all my stocks and proceeded to my bunker? No. As I've stated, I think the fed will "pivot" sooner than expected...they will see some moderation in inflation and declared victory, but it really will be because of deteriorating economic conditions. So, I can't just sell out because stocks remain a better than nothing inflation hedge.

I'm very much in line with your views and causation. What I've recently been noticing though is the US is apparently out of line with the other currencies. In our case, we're attempting to take the lead in addressing our inflation problem. That makes US currency more expensive. To the extent others don't follow us, fairly quickly in addressing their inflation problem, the dollar will stay very strong (currently trading at $1.07 to the Euro and $1.25 to the Pound) which is a pretty significant change in just a couple months. QT will have an even stronger impact on currency pricing.

As we all know, the downside of strong currency is balance of trade goes south. Relatively expensive goods out of the US not finding a market overseas. Relatively cheap goods from overseas finding a ready market in the US. Less tourism as the US gets more expensive to visit. Greater tourism from the US to overseas locations as they become a value to us. All of that will have a negative impact on employment.

That said, I concur that the next 12 months will be in recession. I think "soft landing" is a fairy tale. This is gonna hurt. I don't think I'm being pessimistic at all. It's just when you add all of this up, "soft landing" just isn't in the cards. Frankly, I'm becoming concerned that it's going to take longer than 12 months to work our way through the recession and the people in charge don't impress me as smart enough to get us out of this. I hear "stagflation" getting thrown around a lot. Some of us were around when that was being used in earnest in the late 1970s and early 1980s. I saved a Time magazine from December 1980 when John Lennon was killed. The parts of the magazine not devoted to that story talked about the Reagan transition team and about the current economy. The Prime Rate was 21% (what we call the bank rate now). Inflation was bouncing between 12% and 16%. Experts were talking about South American style "hyperinflation" becoming a reality in the US. A line you cross when you hit 18%, apparently. When the Fed decreased rates to improve jobs, inflation would go crazy. But, when it raised rates to deal with inflation, unemployment would cross the 10% mark. That was Stagflation. I do think we have the apparacheki in place to recreate a really solid stagflation for us.

The only good news in all of this is that I'm still employed and I've pushed my retirement date out another year.