Boho

Thinks s/he gets paid by the post

- Joined

- Feb 7, 2017

- Messages

- 1,844

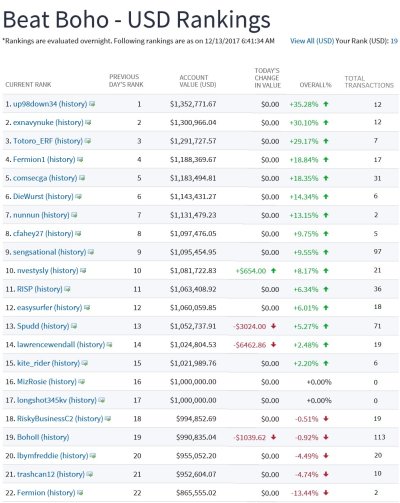

Nice! Keep it up with your new strategy, and you will bypass nunnun sometime next week!

What makes me think that is unlikely?

-ERD50

I'm not counting on my current rate of earnings but it would be nice. I feel like I'm battling my own stock - the insurance company. In five years they've steadily been rising despite occasional payouts. If they stay flat this year I'm OK, so I think I'm OK but you never know.