corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

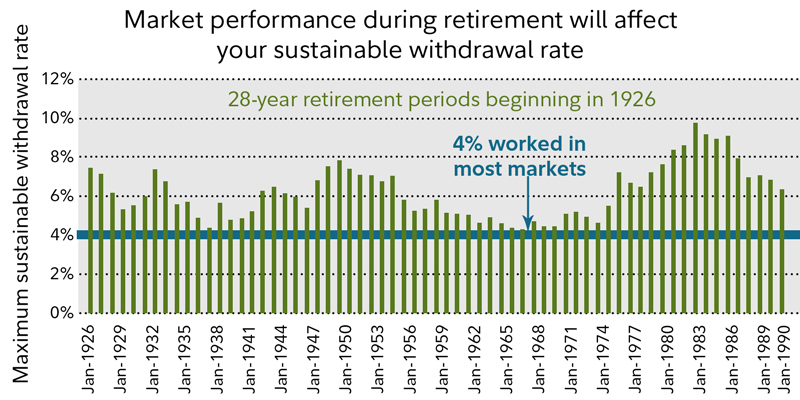

I found the below chart fascinating. Over on bogleheads, they are convinced 3% is the new 4% SWR and then data like this pops up.

I found the below chart fascinating. Over on bogleheads, they are convinced 3% is the new 4% SWR and then data like this pops up.

I found the below chart fascinating. Over on bogleheads, they are convinced 3% is the new 4% SWR and then data like this pops up.

Does this say to you that no one below 5% SWR failed?

30 and 28 retirement periods fall short for some of us ER folks.

Thus the 4% guidance is still considered fairly conservative.

One of the things seldom mentioned in these discussions is that historical outcomes are all based on holding a specific AA with rebalancing. I think, in reality, few folks actually do this. For example, currently many folks are posting changes to their AA due to current economic conditions. Once you do that, you can be assured your back-testing no longer holds. You may have improved things. You may have made things worse. But you absolutely changed the parameters on which the back-testing was done.

Another issue would be the composition of the fixed portion of our AA. I check the 5 year treasury box in FireCalc. But, I don't any a single 5 year treasury! I own a mix of funds, TIPS, CD's, MM's, etc.

If it turns out that whatever you hold in your FIRE portfolio performs differently than what you said you had when setting up FireCalc (or any other tool based on history), then your results are inaccurate. You might turn out better. You might turn out worse. But it will be different.

Just other reasons to be conservative.

One of the things seldom mentioned in these discussions is that historical outcomes are all based on holding a specific AA with rebalancing. I think, in reality, few folks actually do this. For example, currently many folks are posting changes to their AA due to current economic conditions. Once you do that, you can be assured your back-testing no longer holds. You may have improved things. You may have made things worse. But you absolutely changed the parameters on which the back-testing was done.

Exactly. To me an SWR number is like a ruler; useful for measuring things. But I think virtually everyone's withdrawal rate varies during retirement. Some things, like travel, charitable donations, restaurant dining, special wines, etc. are highly discretionary. Other things, like inflation, investment returns, the effect of COVID-19, real estate taxes, insurance, nursing home, etc. are almost completely uncontrollable. Life cannot described accurately by a calculator, so there is not much point in getting excited about a particular number. When life is good we bask in the sun. When the storms come we trim our sails and go belowdecks until things settle down.One of the things seldom mentioned in these discussions is that historical outcomes are all based on holding a specific AA with rebalancing. I think in reality, few folks actually do this. For example, currently many folks are posting changes to their AA due to current economic conditions. Once you do that, you can be assured your back-testing no longer holds.

It's supposed to. SWR was never meant as anything but an axe to plan with, it's not a scalpel - and it does NOT predict the future, just as FIRECALC doesn't. SWR is obviously rear view mirror, all the original academic papers specifically said same, and many authors have had to repeat same over and over and over for some reason. I would think it would be wise to re-assess every 5 years or so, but not annually.Exactly. To me an SWR number is like a ruler; useful for measuring things. But I think virtually everyone's withdrawal rate varies during retirement. Some things, like travel, charitable donations, restaurant dining, special wines, etc. are highly discretionary. Other things, like inflation, investment returns, the effect of COVID-19, real estate taxes, insurance, nursing home, etc. are almost completely uncontrollable. Life cannot described accurately by a calculator, so there is not much point in getting excited about a particular number. When life is good we bask in the sun. When the storms come we trim our sails and go belowdecks until things settle down.

https://www.bogleheads.org/wiki/Safe_withdrawal_ratesTaken literally, such a plan has been criticized as unrealistic. Even if the tests showed that the plan had a 98% success rate over all past time periods, would a prudent person blindly go on steadily increasing withdrawals in a prolonged bear market? It also leads to apparent absurdities. Say that retirees A and B have saved $1 million in 2008, and the market crash reduces their portfolios to $800,000 in 2009. A, however, retires in 2008 while B waits until 2009. The Trinity study bases withdrawals the dollar value of the portfolio at the start of retirement. The value fluctuates with the vagaries of the stock market. Thus, even though their situations are almost identical, in the Trinity scenario, retiree A, by virtue of having retired in 2008, is allowed to withdraw $40,000 plus COLA in 2009; while retiree B, despite being in an almost identical situation, would be allowed only $32,000.

The authors of the paper, however, did not mean for their scenarios to be applied rigidly or uncritically. The article makes this very important statement:The word planning is emphasized because of the great uncertainties in the stock and bond markets. Mid-course corrections likely will be required, with the actual dollar amounts withdrawn adjusted downward or upward relative to the plan. The investor needs to keep in mind that selection of a withdrawal rate is not a matter of contract but rather a matter of planning.Nisiprius requested clarification from Professor Philip L. Cooley, senior author of the Trinity study:[3]

What the "4% SWR" means is not that you can treat a portfolio as if it were a guaranteed annuity. I think all the [Trinity] authors meant is that if it is late 2008 and your stocks halve in value, you don't need to halve your spending instantly. It's OK to cross your fingers and continue spending according to the 4%-then-COLAed plan, even though it means dipping into capital, and it's OK to go on doing that for a while.Professor Cooley's response:

You have hit the nail on the head! I've tried to explain that thought to journalists but they don't seem to get it. You've got it. Stay flexible my friend!, which is the advice we should give to retirees.[4]

There's one other aspect to failure with a 4% WR. Someone can say, I project a need for $40K (on top of SS), I have $1M, so I'm safe, right? While it's true that history says that market returns and inflation rates make this plan safe (assuming the future isn't worse than ever this time), it doesn't cover someone underestimating their expenses. A combination of running over budget with bad sequence of returns or runaway inflation can sink a 4% plan.

Right. Seems like a lot would have to go wrong for 4% to go wrong. I also read that 2/3 of the time not only does 4% work , but the balance is like 2x the original balance. Not sure what the source was though.

One of the things seldom mentioned in these discussions is that historical outcomes are all based on holding a specific AA with rebalancing. I think, in reality, few folks actually do this. For example, currently many folks are posting changes to their AA due to current economic conditions. Once you do that, you can be assured your back-testing no longer holds. You may have improved things. You may have made things worse. But you absolutely changed the parameters on which the back-testing was done.

Another issue would be the composition of the fixed portion of our AA. I check the 5 year treasury box in FireCalc. But, I don't a single 5 year treasury! I own a mix of funds, TIPS, CD's, MM's, etc.

If it turns out that if whatever you hold in your FIRE portfolio performs differently than what you said you had when setting up FireCalc (or any other tool based on history), then your results are inaccurate. You might turn out better. You might turn out worse. But it will be different.

Just other reasons to be conservative.

I put together a graph of historical 30 year 60/40 SWRs vs the P/E 10 for the S&P 500 (a measure of how pricey the market is). The data is from a portfolio that has small cap and international stocks, so its lowest historical SWR was 4.5%. At a P/E 10 of 30 (about what it is today), it suggests a SWR of 4.05, with a 50% chance of success. If you want an 84% chance of success, the SWR drops to 3.3%. There is reason to believe that even this withdrawal rate is too high because we have an aging population and slowing growth rate in the US, which indicates we will have slowing increases in GDP going forward. The bogleheads seem to be correct: a 3% fixed withdrawal rate seems to be reasonable for a 30 year retirement with fixed withdrawals.