ownyourfuture

Thinks s/he gets paid by the post

- Joined

- Jun 18, 2013

- Messages

- 1,561

**I have an appointment with a CPA this coming Saturday**

In addition to the main issue, which I'll get to next, there was one oddball area with TurboTax this year & I'm curious to know if anyone else experienced it.

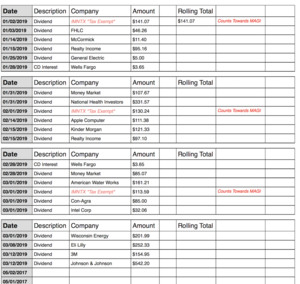

My return is fairly simple. My income is a set monthly amount from a private sector defined benefit pension, + dividends, interest, & capital gains from a large taxable brokerage account @ Fidelity. That's it for income. Not sure if it matters, but I reside in Minnesota, & after tax reform was passed, reports stated that tax returns for 2018 could be a nightmare for ’some people’ in high tax states, Minnesota is in that group. I also know that the outgoing governor refused to work with the ‘other side’ & to the best of my knowledge, Minnesota’s tax code was never synchronized with the feds.

Have used TurboTax Deluxe or it’s equivalent since 1999.

Have had a high deductible healthcare plan from Medica, via MNSURE since December 2015.

I also have an HSA account that I started in 2016, & contributed $3,000.00 for 2018

After entering all income & the estimated federal taxes paid, I'm due a refund of $173.00

At this time, the only thing left is the 1095-A (Health insurance marketplace statement) info.

Once that’s entered, the return goes from the aforementioned refund, to owing $5,486.00 (Pay back of all the premium subs I received in 2018)

At this point the problem seems very simple. I made too much money. The perplexing part is, that unless I misunderstand the income limits relating to receiving premium subsidies, it appears I’m under that limit ?

According to this, my MAGI income limit for 2018 was $48,240.00

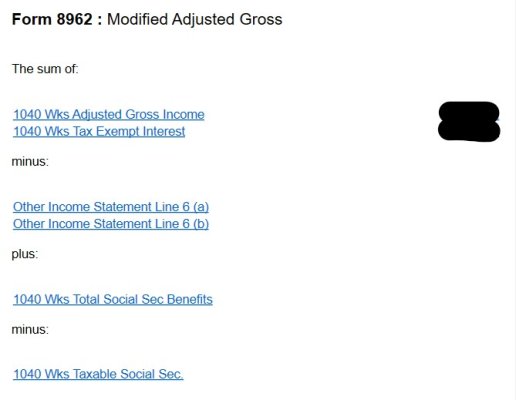

From the same site: “MNSURE uses modified adjusted gross income to determine the programs & savings you are eligible for. For most people, it's identical, or very close to adjusted gross income, which is a line on your federal tax return”

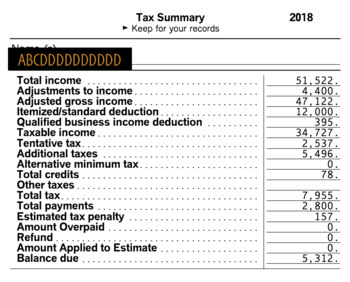

Here’s a screen capture of my ’tax summary’ showing adjusted AGI of $47,122.00, under the max by $1,118.00

Also note that the $4,400.00 shown behind ‘adjustments to gross income’ is the amount that I ‘allegedly’ contributed to my HSA, I actually only contributed $3,000.00 but on the last return, upped it to that amount to see if it would make a difference. The difference was nominal.

Here’s the oddball issue I ran into. If you look at the ’tax summary’ above. You’ll see a ‘qualified business income deduction’ of $395.00

I’ve never owned a business in my life. Could this have something to with the following questions, which came up after I entered my pension income ?

I answered ’no’ on all of them, but after that the following showed up.

These 2 make it sound as if I received some type of special hurricane distributions in 2016 & 2017. Very weird, considering I live in Minnesota!

Just about forgot. After doing the 1st 2 returns using TT, I purchased similar software from H&R block. Unfortunately, the results were the same. Pretty sure I'm gonna have to pay the piper

In addition to the main issue, which I'll get to next, there was one oddball area with TurboTax this year & I'm curious to know if anyone else experienced it.

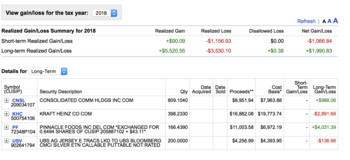

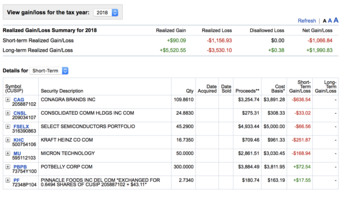

My return is fairly simple. My income is a set monthly amount from a private sector defined benefit pension, + dividends, interest, & capital gains from a large taxable brokerage account @ Fidelity. That's it for income. Not sure if it matters, but I reside in Minnesota, & after tax reform was passed, reports stated that tax returns for 2018 could be a nightmare for ’some people’ in high tax states, Minnesota is in that group. I also know that the outgoing governor refused to work with the ‘other side’ & to the best of my knowledge, Minnesota’s tax code was never synchronized with the feds.

Have used TurboTax Deluxe or it’s equivalent since 1999.

Have had a high deductible healthcare plan from Medica, via MNSURE since December 2015.

I also have an HSA account that I started in 2016, & contributed $3,000.00 for 2018

After entering all income & the estimated federal taxes paid, I'm due a refund of $173.00

At this time, the only thing left is the 1095-A (Health insurance marketplace statement) info.

Once that’s entered, the return goes from the aforementioned refund, to owing $5,486.00 (Pay back of all the premium subs I received in 2018)

At this point the problem seems very simple. I made too much money. The perplexing part is, that unless I misunderstand the income limits relating to receiving premium subsidies, it appears I’m under that limit ?

According to this, my MAGI income limit for 2018 was $48,240.00

From the same site: “MNSURE uses modified adjusted gross income to determine the programs & savings you are eligible for. For most people, it's identical, or very close to adjusted gross income, which is a line on your federal tax return”

Here’s a screen capture of my ’tax summary’ showing adjusted AGI of $47,122.00, under the max by $1,118.00

Also note that the $4,400.00 shown behind ‘adjustments to gross income’ is the amount that I ‘allegedly’ contributed to my HSA, I actually only contributed $3,000.00 but on the last return, upped it to that amount to see if it would make a difference. The difference was nominal.

Here’s the oddball issue I ran into. If you look at the ’tax summary’ above. You’ll see a ‘qualified business income deduction’ of $395.00

I’ve never owned a business in my life. Could this have something to with the following questions, which came up after I entered my pension income ?

I answered ’no’ on all of them, but after that the following showed up.

These 2 make it sound as if I received some type of special hurricane distributions in 2016 & 2017. Very weird, considering I live in Minnesota!

Just about forgot. After doing the 1st 2 returns using TT, I purchased similar software from H&R block. Unfortunately, the results were the same. Pretty sure I'm gonna have to pay the piper

Last edited: