Recently visited a FP who advised me to purchase a $500,000.00 Jackson Variable Annuity,hold for about 5 years which would earn 5% then start to withdraw from it.

Some Google work on 'Jackson Variable Annuity commission

Independent Review of the Jackson National Perspective II Annuity

Here are a couple excerpts:

<<<Typically variable annuities pay a 6-7% commission to the agent/broker. That’s why the insurance company charges you a surrender charge or what this brochure calls a contingent deferred sales charge. if you don’t stay in the annuity long enough for the company to make a profit, you pay a surrender charge.

A surrender charge is a way for the insurance company to recover the costs of the commission they pay and it decreases over time.>>>

$500,000 x 6% = $30K. The FP could be objective, but I suggest he is much more of a salesman looking for that commission.

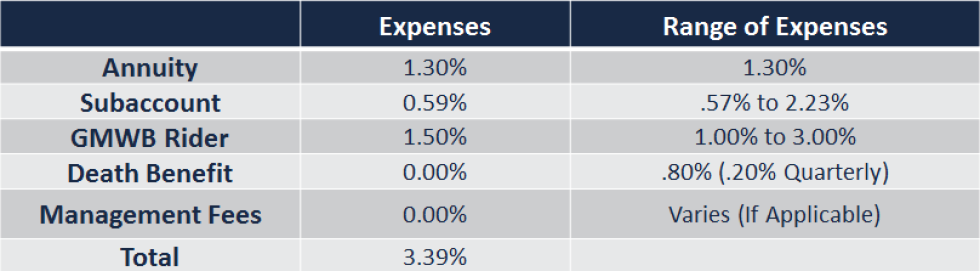

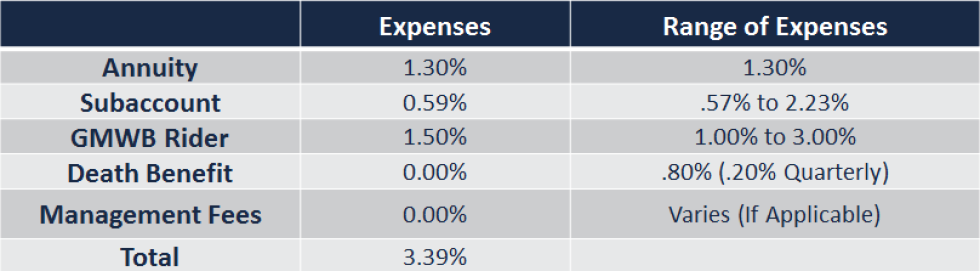

<<<The following is a list of the various expenses of the Jackson National Perspective II Annuity:>>>

There is a table which details the expense charges. For an S&P index type fund, which is the lowest expense charge, Jackson annual fees come out to 3.39%. If you were to hold an S&P index fund in Fidelity, the annual expense is 0.07%. (FUSVX, which rung up a 20% increase last year...)

<<<

This is a very complex annuity rider with a lot of moving parts so pay close attention.

This version of the Perspective II annuity has two components, the income base and the contract value. The income base is the amount that the income guarantee of the contract is based on. The contract value is the value of your subaccounts.

For the first 10 years of your contract the income base will be credited by the percentage that you’ve chosen. The fee associated with your annuity will vary based upon the percentage you’d like your annuity to “step up” each year. Here are the expenses for the various income rider options:>>

Another table showing that these additional 'features' will add annual costs from 1% to 2.5%. They are looking to get into your returns somewhere from 4.5% to 6% every year. By the time you figure out that you have been had, you have either had 6 years of very low to negative return investing, or you are looking at surrender charges to get out of the annuity.

Surrender charges: There is a table in the link. 1st year- 7.5%, 2nd- 6.5%, 3rd- 5.5%, 4th- 5%, 5th- 4%, 6th- 2%.

These annuities are very confusing, lots of options and riders that make them a joy for the salesman to pitch. Whatever market fear a person might have, they can sell you a rider that only costs another 1 or 2% per year.

I have a second concern- it sounds like you made 4% last year on some of your investments, and thought it was a good year? It is possible that this union-based retirement is not in the best interests of the membership. I know there are some of those around. Just saying that I would be more interested in getting my money out of this under performing fund and into either Fidelity or Vanguard. There are many examples of simple 3 or 4 fund allotments that will do a good job of hands-off investment. There is no such thing as a guarantee in the market, but there is also no such thing as a guaranteed 5% return with no risk.