we currently have 2 UTMA accounts w/ balances of ~$20k, one for each child. currently, the money is invested 100% in S&P 500 index funds. we contribute $25 to each account twice a month. we also invest occasionally any gift they might get from grandparents.

of the ~$20k, about ~$12k will hit LTG status in the next week. subsequently, there are multiple small lots that will flip to LTG on a bi-weekly basis and any gifts deposited over the next year. none of the lots have losses.

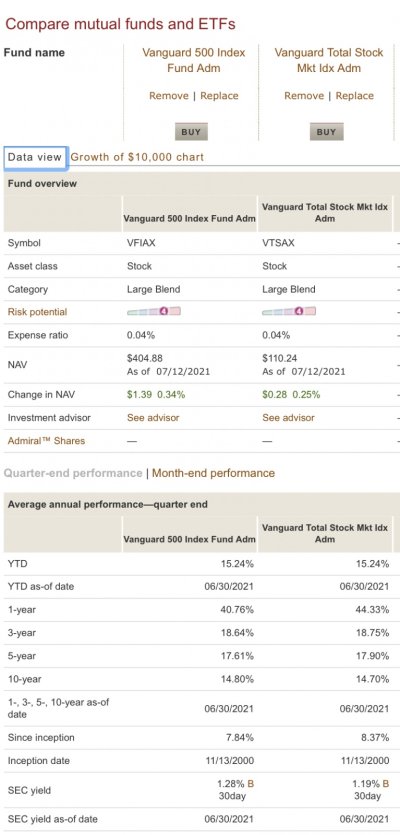

we were thinking of switching from the S&P 500 to a Total Stock Market Index fund. mostly to broaden the diversity a bit, capture the whole market, etc. we are fine w/ keeping it in S&P 500, but since a large chunk will flip to LTG thought of reallocating popped into our minds.

outside of the administrative portion on our part of reallocating funds over the next year, which we are fine in doing, is there any downside tax-wise to reallocation OR just keep it in the S&P 500?

*note* we are solidly in the 33+% fed and 6+% state for taxes.

thank you for any input

of the ~$20k, about ~$12k will hit LTG status in the next week. subsequently, there are multiple small lots that will flip to LTG on a bi-weekly basis and any gifts deposited over the next year. none of the lots have losses.

we were thinking of switching from the S&P 500 to a Total Stock Market Index fund. mostly to broaden the diversity a bit, capture the whole market, etc. we are fine w/ keeping it in S&P 500, but since a large chunk will flip to LTG thought of reallocating popped into our minds.

outside of the administrative portion on our part of reallocating funds over the next year, which we are fine in doing, is there any downside tax-wise to reallocation OR just keep it in the S&P 500?

*note* we are solidly in the 33+% fed and 6+% state for taxes.

thank you for any input