From today's webinar at Fidelity: Headwinds and tailwinds: The importance of fixed income in portfolios

This was one of the better presentations. Fidelity should feature people form outside Fidelity more often that their own clueless fund managers. I have attached the presentation material.

Here are my notes from the Q&A section. We actually had some good questions:

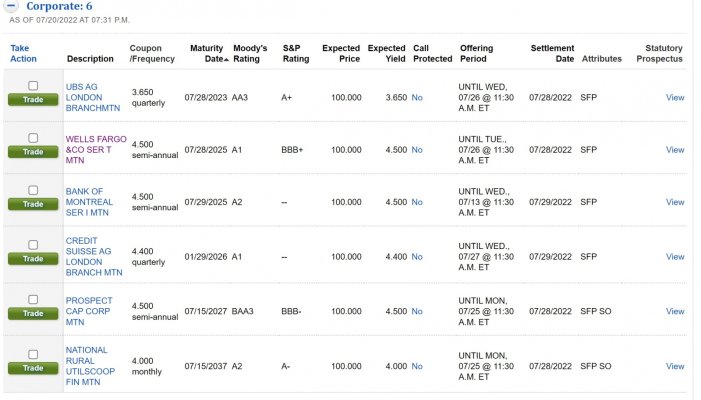

What duration should be purchased with new money? Answer: 1-5 years for treasuries or corporates. The yield curve is too flat to buy longer durations. Buy high investment grade credit now.

Should we wait to get higher yields or start to invest now? Answer: Step into short duration high grade bonds now. The rates are more compelling now for high grade bonds than prior years.

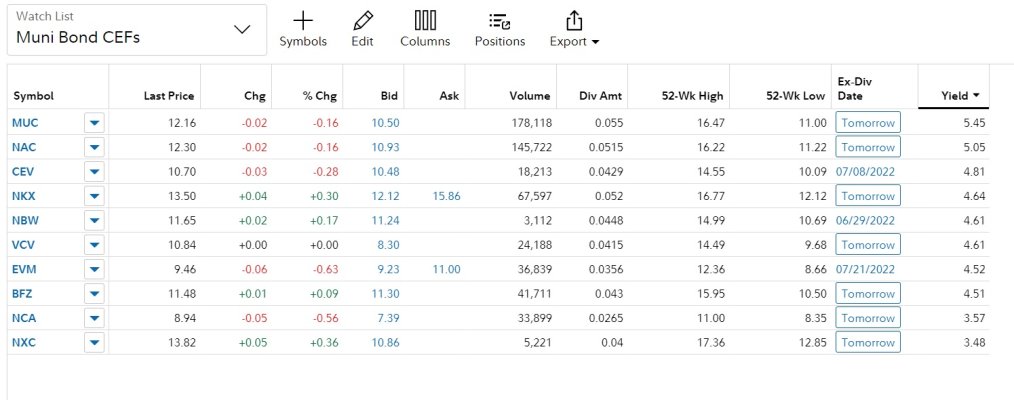

What about Muni Bonds? Answer: Fundamentals are good and will improve with funding from the infrastructure bill. A lot of state issuers are sitting on funds that have been allocated from the stimulus and the infrastructure bill will add to that.

Where do you see the best individual bonds values? Answer: We have seen the most of the interest rise already priced into the market. Buy high grade short duration bonds now (treasuries and corporates) and then focus on high yield once the rate uncertainty stabilizes.

Any foreign market bonds look compelling? Answer: The yields in the US are the most compelling. When you move into Euro bonds the yields are lower. Emerging markets have lower credit ratings and you introduce credit risk. Now is not the time to invest in emerging markets but they could be in a few month.

Are preferred stocks considered part of fixed income portfolio? Answer: A preferred stock is more like a bond than common stock. They are higher in the capital structure than common stock but is the lowest part of the capital structure relative to bonds.

How can the Fed bring down inflation with a target fed funds rate 6 points lower than inflation and what is a realistic rate to break inflation? Answer: The Fed is not only raising rates but a lot of their policy is balance sheet reduction. The Fed has held trillions in treasuries and mortgage backed securities. The lack of buying buy the fed is another weight to the financial system. They are no longer a source of demand. The shadow rate is actually the target Fed funds rate over 3.8% and close to double that when you factor in the lack of buying of treasuries and mortgage back securities. Higher rates will eventually cool demand for homes and car loans. Eventually we hit a recession that results in inflation being controlled naturally.

What are your thoughts on high yields and floating rates? Answer: The rise in rates have created some compelling opportunities but you will be taking more risk. The Fed is still running an experiment with their interest rate policy with this level of inflation. They may overtighten and cause a hard landing. If you get higher spreads from high yield it makes sense to "leg" in and over the long term, if you hold those bonds to maturity you will lock in very attractive yields and income generation.

What is American Century's View of the market? Answer: If the chief problem is inflation, you want products that address that such as TIPS and funds and products that address that. Focus on the short duration part of the market.

Would you please talk about I-bonds? Answer: I-bonds have some of the benefits that TIPS have but have to be purchased individually. One of the disadvantages is liquidity and the penalties associated with early exit.

What are the chief concerns of risk right now? Answer: When does the Fed shift policy? Will people return to the labor force and cool wage growth. We don't expect the large number of people who retired early in 2020 to return but many are sitting on the sidelines contemplating a return to work. Commodity prices trends will also cool inflation. Control of COVID is another concern.

Here is a link to their next

free seminar on bond pricing:

https://fidelityevents.com/bond-pricing-study