Ronnieboy

Full time employment: Posting here.

- Joined

- Feb 14, 2008

- Messages

- 748

Thanks everyone for the thoughtful and insightful replies!

Senator's comments and well thought-out portfolio remind me of other savvy posters at Bogleheads who've pointed out that Wellesley really doesn't have a "secret sauce" and that these days one can pretty much duplicate its performance with a 65:35 large cap value: IT corp. bond ETF approach. I would still choose Wellesley myself, but agree wholeheartedly that it'd be foolish to make such a concentrated portfolio one's whole enchilada. And of course it has no place in a taxable account. I will probably put my IRA (26% of total assets) in it and leave the rest in the Bogleheads 3 fund portfolio (though I have long since substituted Admiral shares of IT Treasury for Total Bond due to consistently better performance, benefitting from flight-to-safety [as we saw big-time this past week] and no state or local taxes]).

I love Paul Merman's generosity and overall investing savvy, but I've run the numbers on his "Ultimate Buy and Hold" and it has yielded around 5% during the entire time I've been ER'd. Other DFA slice-and-dice portfolios (check out Scott Burn's numbers over at AssetBuilder.com) are in the 3-3.5% range over the past 15 years - out of which you have to pay 1% portfolio mgmt/DFA access fees and the costs of a boatload of trades to keep the intricate slices balanced.

John Greaney, probably the earliest (and still one of the sharpest and most irreverent) ER site founders, has a great updated article on real world retiree returns on his site:

2015 Update: Real-Life Retiree Investment Returns

One of the portfolios he backtests is a William Bernstein MPT slice-and-dice, and Greaney's comment says it all, IMHO:

"While the MPT portfolio value has trailed the simple S&P500/fixed income portfolio (No. 1 above) by 21% as of Dec 31, 2015, advocates of this approach like its reduced volatility and sterling academic recommendations. Which brings us to an important investing truism -- it's OK to under perform as long as you're pleased with the results and proud of what you are doing."

Thanks again to everyone for sharing your thoughts. I learn a lot from this forum and am grateful to all of you.

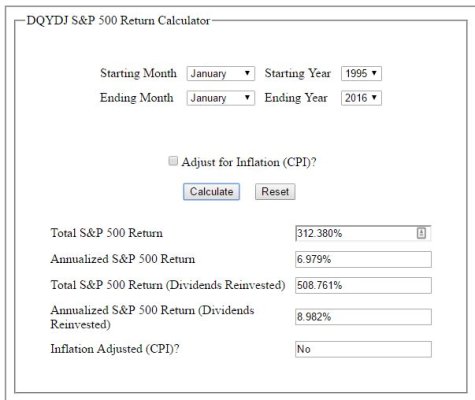

I checked out Greaney's site and it looks like the Buffett portfolio is the way to go in both scenarios

It has most success over both periods, 1994 to 2016 and 1999 to 2016.