RetiredAndLovingIt

Thinks s/he gets paid by the post

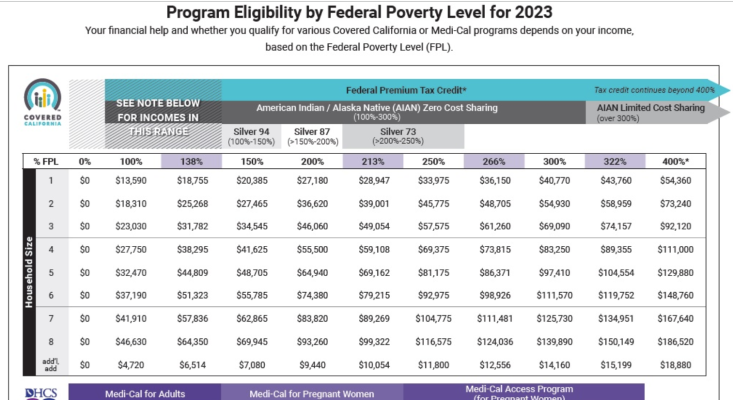

Am I correct that I should be using the 2022 FPL number for my 2023 Form 8962 line 4 reconciliation?

I could not figure out why I had to pay back more PTC than I expected when I used the 2023 number which bumped me over 200% of FPL.

I believe my income should be less than $27180 to cap how much I need to pay back at $350.

https://www.healthcare.gov/glossary/federal-poverty-level-fpl/

I could not figure out why I had to pay back more PTC than I expected when I used the 2023 number which bumped me over 200% of FPL.

I believe my income should be less than $27180 to cap how much I need to pay back at $350.

https://www.healthcare.gov/glossary/federal-poverty-level-fpl/

Last edited: