Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

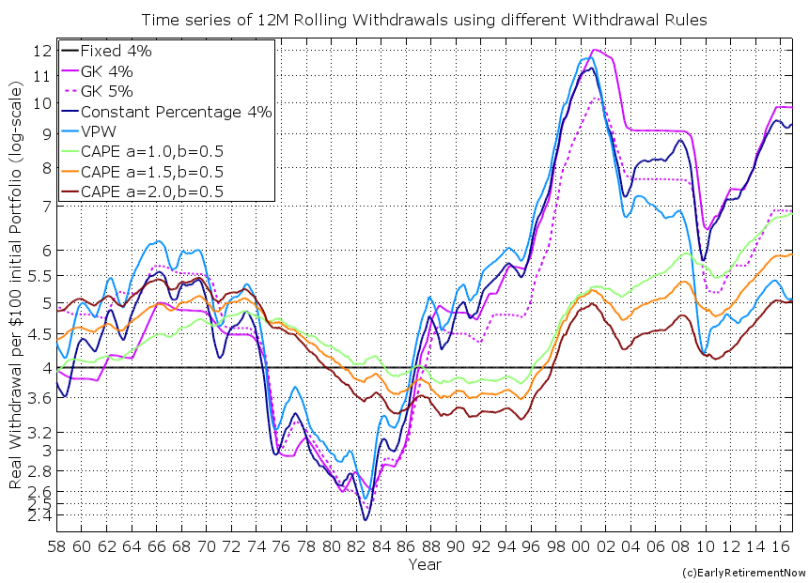

And that's why you have to make adjustments along the way, even the Trinity authors said that. For those who want something more systematic, there are hybrid withdrawal schemes, e.g. https://www.bogleheads.org/wiki/Variable_percentage_withdrawal.Safe in this context means "not run out of money".

The oft-unstated secondary condition is "...while maintaining a relatively steady income from the portfolio."

Nobody cares if the portfolio doesn't run out of money, but the income from it is $1.98.

The problem with taking an annual X% of the portfolio is that your income will vary wildly from year to year. People don't like that. People prefer to have a steady, predictable income.

But no matter what, the retiree(s) must watch and course correct and have a plan B. While some may have to tighten spending, historically some have been able to loosen...

Small non-cola pension at 55, SS at 62, married at 70. 4% is the mental benchmark.

Small non-cola pension at 55, SS at 62, married at 70. 4% is the mental benchmark.