COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

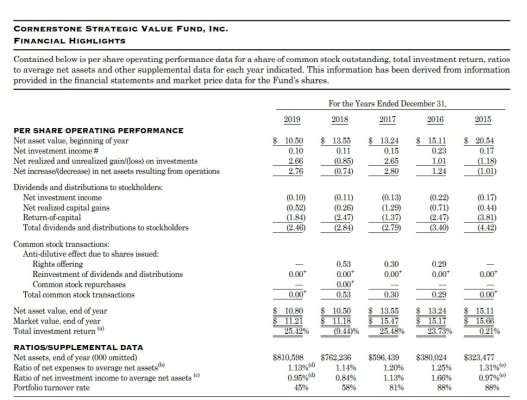

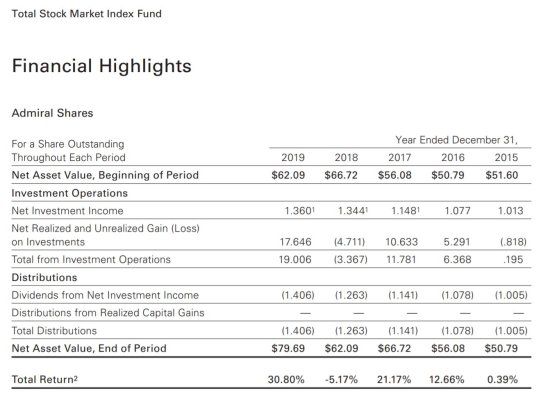

The 20% return on CLM is a joke. Almost 10% of it is return of capital, more than 6% is a long term capitol gain. Less than 2% is the actual dividend. It also is DOWN 8.5% over the last 52 weeks and sells at an almost 8% premium.

There are a whole lot better investments than this one.

There are a whole lot better investments than this one.