I am organizing my asset allocation into:

Cash, Bonds

Conservative Equities (index funds, managed funds, SPY etc.)

Risky Equities (aggressive growth stocks, ARKK etc.)

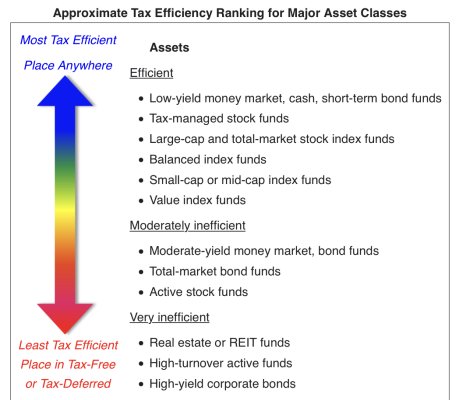

Currently I have the VNQ REIT ETF in the Conservative Equities group, but I am wondering if I should have it in the Cash, Bonds group.

Thanks.

Cash, Bonds

Conservative Equities (index funds, managed funds, SPY etc.)

Risky Equities (aggressive growth stocks, ARKK etc.)

Currently I have the VNQ REIT ETF in the Conservative Equities group, but I am wondering if I should have it in the Cash, Bonds group.

Thanks.