It occurred to me that a balanced portfolio would be best. Therefore I would prefer both investments. Probably balanced 60/40

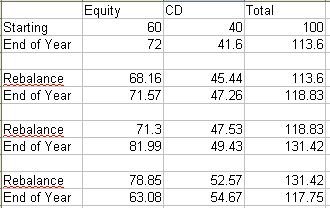

If one decided to create a portfolio with 60% stock at the gains/losses listed and 40% at the CD rate and rebalanced at the end of each year, the portfolio would wind up being larger than either single class of security. The results of the three portfolios based on an initial investment of $100 iis shown below (hope I didn't make a mistake).

100% Stock: $115.99

100% CD: $ 116.99

60% Stock / 40% CD: $117.75

Now if one makes a marginal tax assumption of a 25% on interest and 15% on long-term capital gains with a Mutual Fund fee of .0018% (Like a Vanguard S&P 500 index fund) and cash out of the potfolios at the end of the period, you would get slightly different results.

100% Stock: $112.84 net after fees & taxes

100% CD: $ 112.55 net after taxes (no fees on the CD)

60% Stock / 40% CD: $113.50 net after fees & taxes

It looks like a balance portfolio is better even considering a basic tax scenario. Because of the lower rate of long-term capital gains, it looks like the 100% stock portfolio beats the 100% CD also.