ReadyForRetirement

Dryer sheet aficionado

Hi All,

First let me say I am a 54 year old, the nervous investor type and have been stricken by analysis paralysis for some time, tending to leave 401k allocations alone, and a lot of cash in the bank. I have accumulated an asset base that should allow me to retire late this year (~$2MM). I need to finalize a plan for the investment and start the execution into the appropriate accounts. Through the kind help of this forum (thanks to all), I believe I have gained the knowledge and insight to begin to build a plan for retirement. I have been working for a while to really understanding portfolio allocation. I have spent lots of time reading about the Ultimate Buy & Hold plan, Perm Portfolio, IVY Portfolio, etc. At this point, I believe I should be in a B&H with as much risk as I can tolerate, likely 50/50 or 40/60.

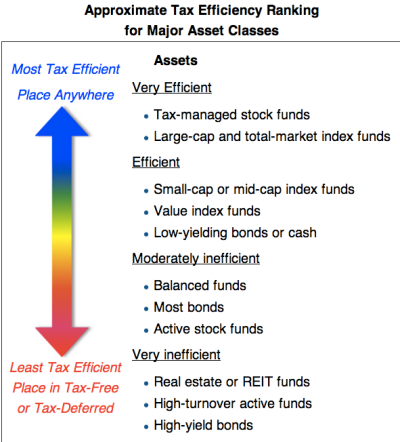

The current problem I am faced with, is I have three 401Ks, wife also has one plus an IRA, then there is a large taxable account with E-Trade. I am not sure the best approach to build this blended portfolio. As I analyze each of the 401Ks I am amazed at the different levels of operating costs (.55% to .05). It appears I need to get into lower cost solutions were possible, plus in the current plans, I am unsure of which funds to group for equivalent B&H portfolios. In reading the forums I also see the advantages of pooling Bonds in specific accounts since the tax rate is higher. All this together is a bit overwhelming to digest.

I have the ability to roll over my two old 401Ks ($450k) to my current employer which has a Wells Fargo plan. This plan has a Schwab PCRA option that might be a good vehicle to get all of my 401K monies into a simple place that provides the common ETFs for a B&H portfolio. Are there good reasons I should roll over to the WF 401k or should I roll over to a Vanguard IRA? I searched and really couldn't find a lot of info (at least that made sense for me) about 401k vs. IRA. Are there forum topics addressing this that I just didn’t find?

Thanks any suggestions or pointers to information you folks can provide!

First let me say I am a 54 year old, the nervous investor type and have been stricken by analysis paralysis for some time, tending to leave 401k allocations alone, and a lot of cash in the bank. I have accumulated an asset base that should allow me to retire late this year (~$2MM). I need to finalize a plan for the investment and start the execution into the appropriate accounts. Through the kind help of this forum (thanks to all), I believe I have gained the knowledge and insight to begin to build a plan for retirement. I have been working for a while to really understanding portfolio allocation. I have spent lots of time reading about the Ultimate Buy & Hold plan, Perm Portfolio, IVY Portfolio, etc. At this point, I believe I should be in a B&H with as much risk as I can tolerate, likely 50/50 or 40/60.

The current problem I am faced with, is I have three 401Ks, wife also has one plus an IRA, then there is a large taxable account with E-Trade. I am not sure the best approach to build this blended portfolio. As I analyze each of the 401Ks I am amazed at the different levels of operating costs (.55% to .05). It appears I need to get into lower cost solutions were possible, plus in the current plans, I am unsure of which funds to group for equivalent B&H portfolios. In reading the forums I also see the advantages of pooling Bonds in specific accounts since the tax rate is higher. All this together is a bit overwhelming to digest.

I have the ability to roll over my two old 401Ks ($450k) to my current employer which has a Wells Fargo plan. This plan has a Schwab PCRA option that might be a good vehicle to get all of my 401K monies into a simple place that provides the common ETFs for a B&H portfolio. Are there good reasons I should roll over to the WF 401k or should I roll over to a Vanguard IRA? I searched and really couldn't find a lot of info (at least that made sense for me) about 401k vs. IRA. Are there forum topics addressing this that I just didn’t find?

Thanks any suggestions or pointers to information you folks can provide!