You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Your 2013 Investment Return

- Thread starter bondi688

- Start date

My asset increased 15%, not counting the 401K contribution and the surplus from the paychecks in checking account. We are still working. Hopefully, we can call it done this year.

My AA in 401K accounts (abount 1.2M) is 50/50. But I have stocks in brokerage accounts (1.3M with ESPP shares, GOOG, and BRK, etc). I am getting nernous of these holdings but do not want to unload them until my tax bracket is below 15% for long term capitabl gain reason.

My AA in 401K accounts (abount 1.2M) is 50/50. But I have stocks in brokerage accounts (1.3M with ESPP shares, GOOG, and BRK, etc). I am getting nernous of these holdings but do not want to unload them until my tax bracket is below 15% for long term capitabl gain reason.

golfersailor

Dryer sheet aficionado

12.1% with 45/45/10 split. My age is all about being conservative but I'll take it.

obgyn65

Thinks s/he gets paid by the post

About 3%.

NW Landlady

Recycles dryer sheets

My first year of "real investing" in the market as I received a windfall from selling part of my bizness in May. Before that every penny ++ went into my bizness.

I am in an odd financial state in my first year of retirement -- My income level is higher than it was when was w*rking! So is my tax rate...gulp

Plus I have a lot of income from notes from buyer of my bizness...so sort of like a bond or fixed income that is taxable. Grrrr

Like many here...I did poorly on my REITs & Bond funds & sold most of them.

But I did invest a good amount in Muni Bonds so my income of these bonds was moderate, but on a taxed basis, still pretty good.

Because of my situation, Vanguard is 80% equities now, but I did not put $$ in until about June/July of this year -- so I am thrilled with my 20% return for half a year, especially since this is my largest investment account.

I also found their CFP program helped provide good guidance for this investment newbie.

SO Officially I say WEEE DOGGIES!

This has been a great year & I hope 2014 is kind to us FIRED folk.

I am in an odd financial state in my first year of retirement -- My income level is higher than it was when was w*rking! So is my tax rate...gulp

Plus I have a lot of income from notes from buyer of my bizness...so sort of like a bond or fixed income that is taxable. Grrrr

Like many here...I did poorly on my REITs & Bond funds & sold most of them.

But I did invest a good amount in Muni Bonds so my income of these bonds was moderate, but on a taxed basis, still pretty good.

Because of my situation, Vanguard is 80% equities now, but I did not put $$ in until about June/July of this year -- so I am thrilled with my 20% return for half a year, especially since this is my largest investment account.

I also found their CFP program helped provide good guidance for this investment newbie.

SO Officially I say WEEE DOGGIES!

This has been a great year & I hope 2014 is kind to us FIRED folk.

Last edited:

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Its a little complicated to calculate because we had contributions to 401ks and a major vesting at the end of the year, in the most conservative fashion I can figure it we had a 35.8% return on a portfolio that spent most of the year between 60 and 65% equity, roughly 5% in merger arbitrage (low return, low volatility) and the rest in some kind of fixed income (about 50/50 high grade bond funds and CDs/cash). The outperformance was due to individual stock selection. Maybe I should start managing money like people keep telling me.

This was a transition year for my portfolio. Previously I have been more aggressive and concentrated while trying to accumulate wealth and go for total return. Now that I am fat, old and about to kill the day job, I need to be much more risk constrained. So although my portfolio has about the same equity content, I have gone from 38% funds and cash/CDs to 65% over the course of the year and will probably trend that higher over the next year.

This was a transition year for my portfolio. Previously I have been more aggressive and concentrated while trying to accumulate wealth and go for total return. Now that I am fat, old and about to kill the day job, I need to be much more risk constrained. So although my portfolio has about the same equity content, I have gone from 38% funds and cash/CDs to 65% over the course of the year and will probably trend that higher over the next year.

medtech

Confused about dryer sheets

- Joined

- Nov 2, 2013

- Messages

- 6

13.69 % on 56/35/9 stock/bond/short term allocation

nvestysly

Full time employment: Posting here.

- Joined

- Feb 19, 2007

- Messages

- 599

19.1% with approximately a 90/10 portfolio mix with heavy emphasis on dividends. I'm pleased to see the 19.1% gain even after withdrawals were made.

The 90% equity is 80 domestic/large cap and 10 emerging market.

The 10% short term is mostly cash with a smattering of bond funds.

The 90% equity is 80 domestic/large cap and 10 emerging market.

The 10% short term is mostly cash with a smattering of bond funds.

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

15.8% here. Yep, I've got quite a bit of EM which dragged down the whole portfolio, despite having very little bond. Oh, the big wad of cash returning a bit more than 2% also helps diluting out a few stock positions with gains exceeding S&P500. And I harvested some wonderful US stocks too early throughout the year.

Oh well, such is the "price" for being diversified. Besides, what would I do with 30% or 40% gains? Buy another house or two?

US stocks: 42%

Int stocks (lots of EM): 26%

Bonds: 6%

Cash: 26%

Oh well, such is the "price" for being diversified. Besides, what would I do with 30% or 40% gains? Buy another house or two?

US stocks: 42%

Int stocks (lots of EM): 26%

Bonds: 6%

Cash: 26%

Last edited:

Retirement Accounts 13.75%

Taxable Accounts 11.8%

According to Financial Engines our overall AA is:

Cash 18%

Bonds 22%

Lg Cap 18%

Mid/Sm Cap 19%

Intl 23%

Very happy with 2013 for my first year of ER. The bigger metric is we only spent 64% of our ESPlanner Cautious spending level. The bad news is my DW overheard DD tell a friend she didn't have a cell phone yet because her dad is "too cheap"

Taxable Accounts 11.8%

According to Financial Engines our overall AA is:

Cash 18%

Bonds 22%

Lg Cap 18%

Mid/Sm Cap 19%

Intl 23%

Very happy with 2013 for my first year of ER. The bigger metric is we only spent 64% of our ESPlanner Cautious spending level. The bad news is my DW overheard DD tell a friend she didn't have a cell phone yet because her dad is "too cheap"

SoReady

Recycles dryer sheets

16.4% on 65/27/9 allocation. This includes retirement and after tax funds.

Hermit

Thinks s/he gets paid by the post

Quicken says 15.8%. 55/35/10 The 10 is in a stable value fund drawing a whopping 1.1%.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

A great year for most of us here. But 2014, who knows.

Ours:

portfolio 65/34/1 stocks/bonds/cash at start of 2013

portfolio return 17.6%

international varied from 0% to 26% during year (I move this between US and international based on momentum, no tax consequences for us)

now 6% above inflation adjusted starting ER portfolio (started 2003)

spending 3.5% of portfolio with plenty of discretionary money in this (DW was kept happy)

Ours:

portfolio 65/34/1 stocks/bonds/cash at start of 2013

portfolio return 17.6%

international varied from 0% to 26% during year (I move this between US and international based on momentum, no tax consequences for us)

now 6% above inflation adjusted starting ER portfolio (started 2003)

spending 3.5% of portfolio with plenty of discretionary money in this (DW was kept happy)

truenorth418

Full time employment: Posting here.

About 14% here. I'm satisfied but was expecting a little better.

My strong gain in small caps was offset by weakness in REIT and international positions, plus I held a fair amount in cash as "dry powder" for the correction that never came.

My strong gain in small caps was offset by weakness in REIT and international positions, plus I held a fair amount in cash as "dry powder" for the correction that never came.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Same here. We need more "Wh***".... I held a fair amount in cash as "dry powder" for the correction that never came.

12% on my big nest egg portfolio that didn't have any additions.

I rolled an old 401k out to an IRA - and was contributing to it till April - so that one is harder to figure out return vs contribution.

My overall net assets (less house value and 529 value) went up 20% - but that includes 401k contributions, other savings, and mortgage paydown. Considering I funded $12k into the 529's (reducing my net assets)... I'm pleased with this.

(I don't count the house value or 529 because those aren't spendable in *my* plan. I do count the mortgage - which is a tangible liability.)

Asset allocation is 60/25/15.

I rolled an old 401k out to an IRA - and was contributing to it till April - so that one is harder to figure out return vs contribution.

My overall net assets (less house value and 529 value) went up 20% - but that includes 401k contributions, other savings, and mortgage paydown. Considering I funded $12k into the 529's (reducing my net assets)... I'm pleased with this.

(I don't count the house value or 529 because those aren't spendable in *my* plan. I do count the mortgage - which is a tangible liability.)

Asset allocation is 60/25/15.

John Galt III

Thinks s/he gets paid by the post

- Joined

- Oct 19, 2008

- Messages

- 2,803

Pretty awful. Only 3%. Due to not setting a stop-loss point for my REIT and a commodities fund.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,703

My IRA which I contributed zero to this year and is 50/50 stock/bond grew at 15.4%.

My taxable portfolio which is about 65/35 in favor of bonds grew at 6.7% although I used most of its (monthly) dividends to pay my expenses.

The taxable portfolio is about 2/3 of my total portfolio so if you weight the two percentages you get 9.6% combined so I'll got with that as the final number.

My taxable portfolio which is about 65/35 in favor of bonds grew at 6.7% although I used most of its (monthly) dividends to pay my expenses.

The taxable portfolio is about 2/3 of my total portfolio so if you weight the two percentages you get 9.6% combined so I'll got with that as the final number.

wingfooted

Recycles dryer sheets

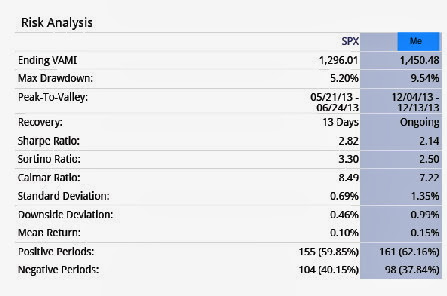

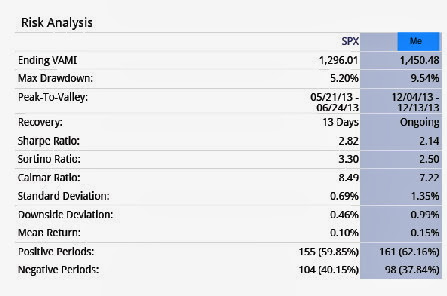

45.1% - this is the time weighted return, net of dividends, commissions, margin debt interest and not including any deposits/withdrawals during the year.

Noteworthy events:

Second half surge - Apple finally kicking in after dragging down returns in the first half of the year

December swoon - Anadarko tanking after negative court ruling on Tronox

One of my goals for 2013 was to beat the market, adjusted for risk. I failed to achieve that goal, i.e. I took too many risks for the realized returns. Final Sharpe ratio was 2.14 versus 2.84 for the SPX benchmark.

The other downside is I now have a significant tax bill to pay as a lot of this is short term capital gains. And an even bigger tax bite as this will be subject to the new 'Obama Care' 3.8% tax on investment income. First world problems to be sure.

All in all, obviously I am a happy camper.

Noteworthy events:

Second half surge - Apple finally kicking in after dragging down returns in the first half of the year

December swoon - Anadarko tanking after negative court ruling on Tronox

One of my goals for 2013 was to beat the market, adjusted for risk. I failed to achieve that goal, i.e. I took too many risks for the realized returns. Final Sharpe ratio was 2.14 versus 2.84 for the SPX benchmark.

The other downside is I now have a significant tax bill to pay as a lot of this is short term capital gains. And an even bigger tax bite as this will be subject to the new 'Obama Care' 3.8% tax on investment income. First world problems to be sure.

All in all, obviously I am a happy camper.

10.34%

AA at end of year 43/45/12 (most of the 12% cash is I-Bonds)

AA at end of year 43/45/12 (most of the 12% cash is I-Bonds)

Meadbh

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 22, 2006

- Messages

- 11,401

~18%

Portfolio is 43.5% equities (Canadian 19%, US 14.2% and International 10.3%); Fixed Income 22%, Real Estate 22%, Alternatives 6.5%, Precious Metals 1.5% and Cash 4.8%. (figures are rounded so do not add up to 100%).

I do not use leverage for investing except for except for real estate, and I am reducing that as fast as I can. Gains would have been a little higher if I had not recently realized the capital gains in a TFSA account to pay down some real estate debt. Let's call it rebalancing.

A very good year. Let us pray for more like this one!

Portfolio is 43.5% equities (Canadian 19%, US 14.2% and International 10.3%); Fixed Income 22%, Real Estate 22%, Alternatives 6.5%, Precious Metals 1.5% and Cash 4.8%. (figures are rounded so do not add up to 100%).

I do not use leverage for investing except for except for real estate, and I am reducing that as fast as I can. Gains would have been a little higher if I had not recently realized the capital gains in a TFSA account to pay down some real estate debt. Let's call it rebalancing.

A very good year. Let us pray for more like this one!

Last edited:

Similar threads

- Replies

- 67

- Views

- 9K