N02L84ER

Thinks s/he gets paid by the post

Vanguard Healthcare, up 14.0%. Extra return % was because it triggered a rebalance in June so I sold some shares at a relative high.

I actually don't know on a fund by fund level. I use an Excel workbook to track money in and out and calculate performance using the XIRR function. I have a sheet for each "account" (My IRA, my Roth, DW's IRA, DW's Roth, after-tax VG ETF's, & Cash), plus a sheet that totals everything so I can total ins and outs and calculate overall IRR. I don't calculate the performance of individual funds but I do use my own workbook, plus VG's portfolio analyzer, to calculate the AA against my target AA.

My idea is to concentrate on getting the mix right and not be distracted by individual fund performance.

Actually my best investment last year was 3.04% on PedFed CDs.

Since the winner by landslide is Vanguard Health Care VGHAX I had to look it up never having owned this fund. Wow - past performance is mighty impressive. Near as I can tell by looking at Vanguards stock list VGHAX is their best performing fund by a long shot for 1,5, and 10 years...

I guess all of the healthcare funds did well in 2015 and have done well since the 2010 time period. I wonder if this is due to increased business re Obamacare since then? If that program gets changed/eliminated that might impact this performance (along with a whole slew of other things - sorry for the self inflicted thread derail...)My best MF for 2015 was also a healthcare fund, at something close to 10% return.

Next was a large cap growth fund, and it returned 6.5%. I have held this fund for close to 30 years, so looked up its historical performance. Some years it beat the S&P, some years not. But after 30 years, the difference is not significant, and it ran neck-to-neck with the S&P.

Given the rates our health insurance premiums were rising even prior to Obamacare (like 7-10% a year), I'm not exactly surprised by the high returns.I guess all of the healthcare funds did well in 2015 and have done well since the 2010 time period. I wonder if this is due to increased business re Obamacare since then? If that program gets changed/eliminated that might impact this performance

3.00% Guaranteed Interest Fund in TSA

2.39% Vanguard REIT Index Fund Admiral Shares (VGSLX)

1.53% Stable Value Fund in 401(k)

On the 2015 Callan Table, S&P500 Growth is listed at top with 5.52%.

Very nice chart!Given the rates our health insurance premiums were rising even prior to Obamacare (like 7-10% a year), I'm not exactly surprised by the high returns.

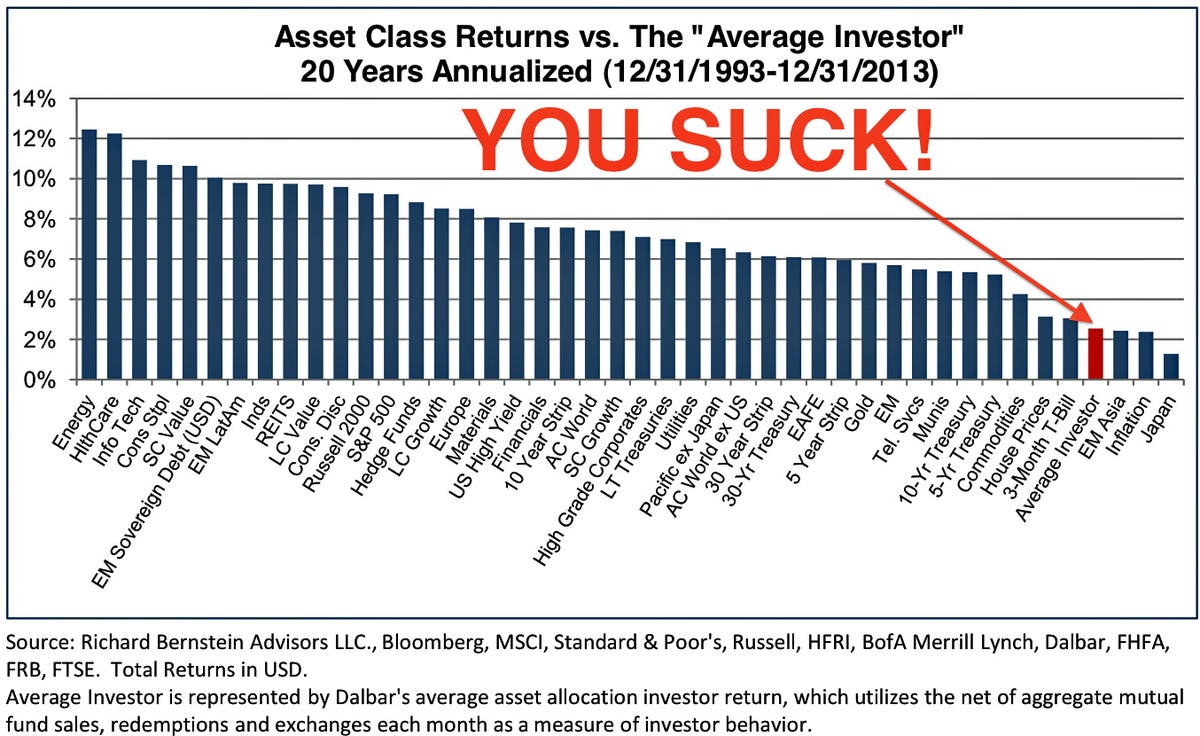

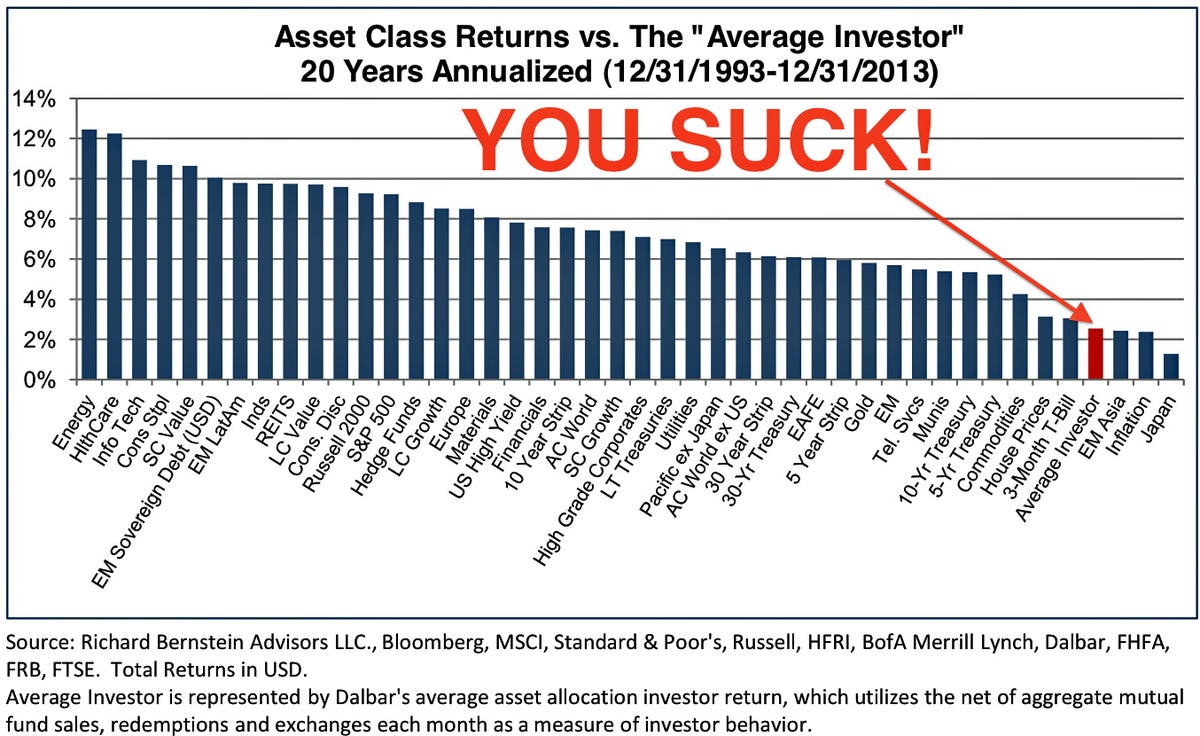

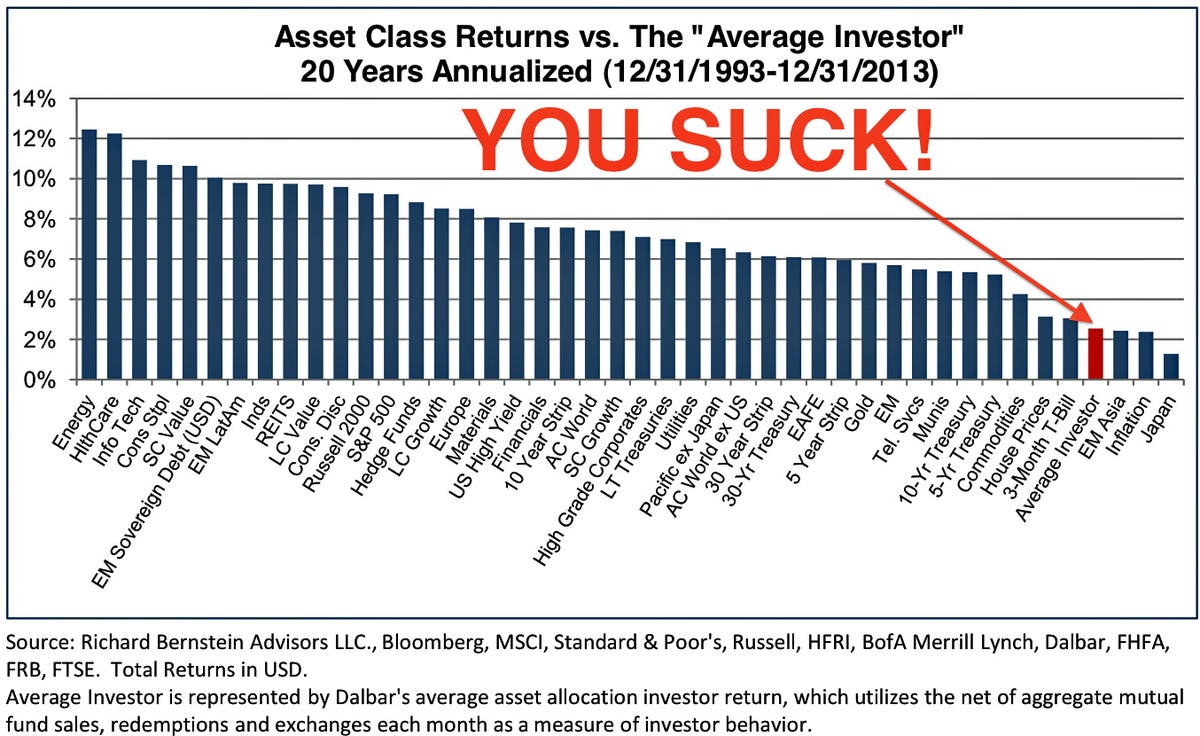

Investors Always Miss Rallies [CHARTS] - Business Insider

Do you have a link to the 2015 table? The Callan site now requires registration which I never had to do before.

Nice chart. Made me compare my results for the same period. Quicken says 7.64%. I guess that's not too bad particularly since the portfolio became 50/50 by the time I ER'd at the end of 2002.Given the rates our health insurance premiums were rising even prior to Obamacare (like 7-10% a year), I'm not exactly surprised by the high returns.

Investors Always Miss Rallies [CHARTS] - Business Insider