Thanks, those are interesting numbers 10M, 3% withdrawal rate. Why 3%, where is that coming from? Is there some research somewhere showing this?

If I do 3% of 10M = 300k per year. -> 33 years to spend 10M.

Retiring at say 45 -> out of $ at 78.

This number assumes you don't make any return on $ or don't have any other $ coming in? I see this realistic if one becomes a vegetable but not really otherwise.

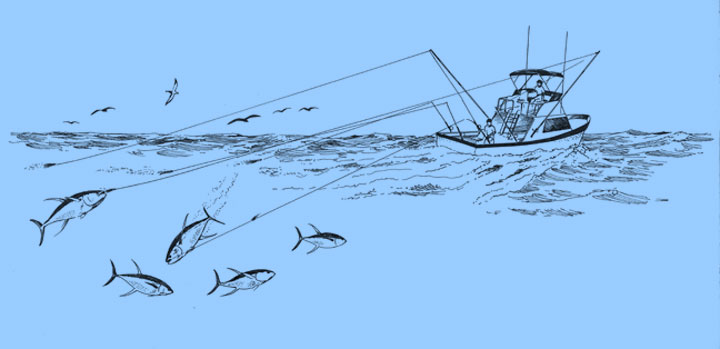

As far as expense go we love to eat, travel and I love my boat so things add up.

Next time you are on your boat or out eating, take along this as reading material and you'll learn all you need:

"How to Make Your Money Last: The Indispensable Retirement Guide"

https://www.amazon.com/gp/product/B00P434BTE/ref=oh_aui_d_detailpage_o03_?ie=UTF8&psc=1