ears20

Recycles dryer sheets

- Joined

- Nov 11, 2013

- Messages

- 58

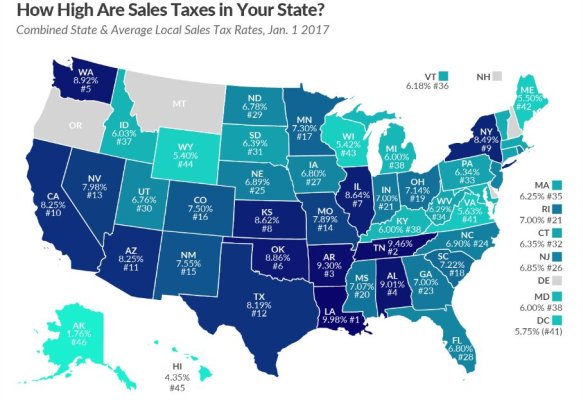

Middle and East Tennessee are great places to retire. No state income tax and low cost of living also. The lakes are also pretty incredible.

Re: TN state income tax - I understand TN has one of the highest tax rates (6%).