Eric S

Dryer sheet aficionado

I've been asked to introduce myself. I'm 56, retired (I did lots of different things), and enjoy travel, cooking, craft beer, indie movies, and quality TV.

I'm planning on retiring to Portugal, one of my favorite countries, which offers first world standard of living/quality of life at nearly third world expense. Also, there's a sweetness you don't find in more bustling countries (Spain, France, UK, etc).

I plan to use super discounted plane fares to cheaply explore the continent and North Africa. Trains go everywhere in-country, so I might not even need a car.

I was an early adopter of Internet, so many of my friendships are virtual, anyway. Plus, having done lots of travel for both work and pleasure, I have friends all over the world. The move will take me away from American friends, but bring me closer to European ones. Zero sum.

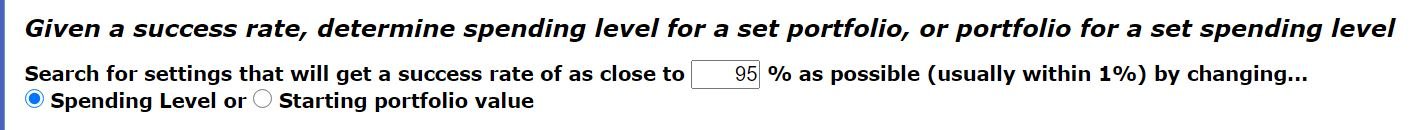

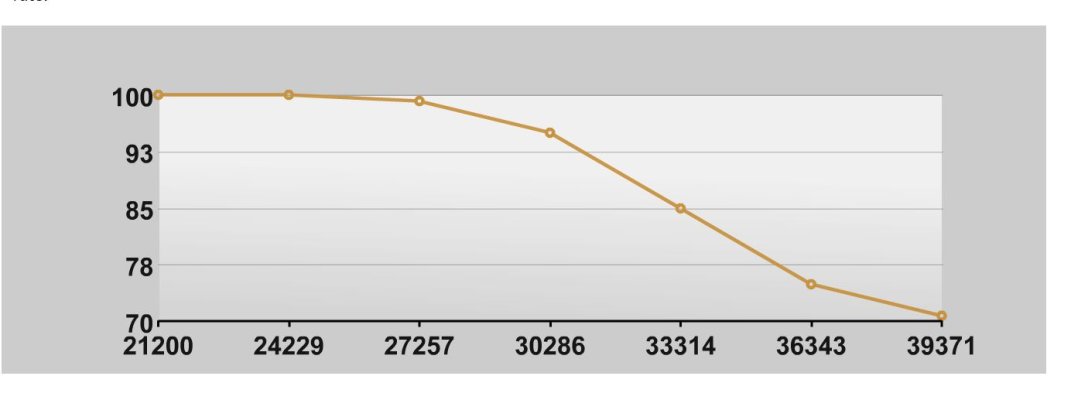

My primary concern, of course, is to not find myself destitute at age 90, when I may be less flexible and resourceful. I've posted to ask about budgeting a house purchase, and found it tricky to persuade forumites to focus on the central issue: not running out of money before I run out of life. My tastes and local expenses have nothing to do with it. There's a hard maximum I can prudently spend, regardless of external factors, and I'm hoping to determine what that is.

Once I do, I'll try to spend way less if possible. I dislike the stress of getting too close to the line. For me, the ultimate luxury is to have sufficient slack to enjoy minor indulgences freely. A big part of that is keeping them minor! Secondhand blu-ray disks, not Porsches. Pizza slices, not Château Lafite. I live like a poor guy who just found twenty bucks in an old pants pocket. Works for me!

I'm planning on retiring to Portugal, one of my favorite countries, which offers first world standard of living/quality of life at nearly third world expense. Also, there's a sweetness you don't find in more bustling countries (Spain, France, UK, etc).

I plan to use super discounted plane fares to cheaply explore the continent and North Africa. Trains go everywhere in-country, so I might not even need a car.

I was an early adopter of Internet, so many of my friendships are virtual, anyway. Plus, having done lots of travel for both work and pleasure, I have friends all over the world. The move will take me away from American friends, but bring me closer to European ones. Zero sum.

My primary concern, of course, is to not find myself destitute at age 90, when I may be less flexible and resourceful. I've posted to ask about budgeting a house purchase, and found it tricky to persuade forumites to focus on the central issue: not running out of money before I run out of life. My tastes and local expenses have nothing to do with it. There's a hard maximum I can prudently spend, regardless of external factors, and I'm hoping to determine what that is.

Once I do, I'll try to spend way less if possible. I dislike the stress of getting too close to the line. For me, the ultimate luxury is to have sufficient slack to enjoy minor indulgences freely. A big part of that is keeping them minor! Secondhand blu-ray disks, not Porsches. Pizza slices, not Château Lafite. I live like a poor guy who just found twenty bucks in an old pants pocket. Works for me!

Last edited: