Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 414

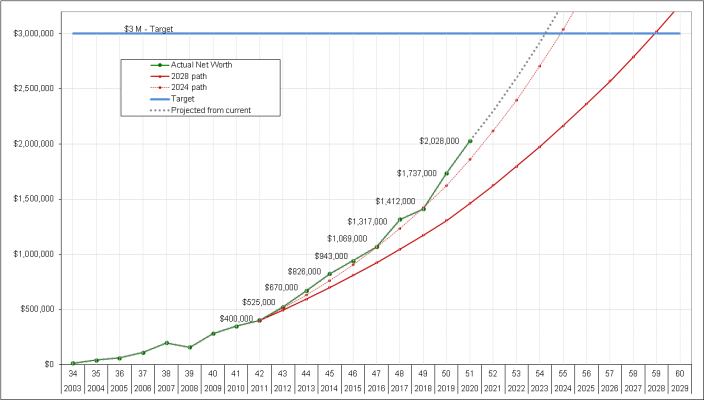

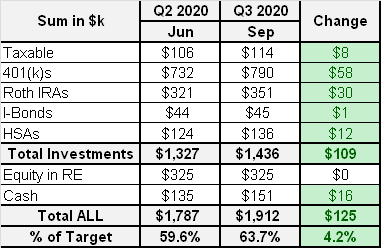

Crazy but looks we made all our losses back and a little bit more compare to our Jan 1 number of $1,737k. We are still below our all time high of $1,800k that we hit on February 19, but getting close. Will be interesting to see how Q2 will finish. Just short one month to go...

And hear we are, just one week later crossed our all time high and closed Friday at $1,808k, all looks too unreal considering what is going on in this country and economy overall.

that is temporary job but with decent pay and opportunity to become long term employment after 6 months, so she should be able to afford payments on her student loans and now officially off our payroll

that is temporary job but with decent pay and opportunity to become long term employment after 6 months, so she should be able to afford payments on her student loans and now officially off our payroll