Love This Community

Recycles dryer sheets

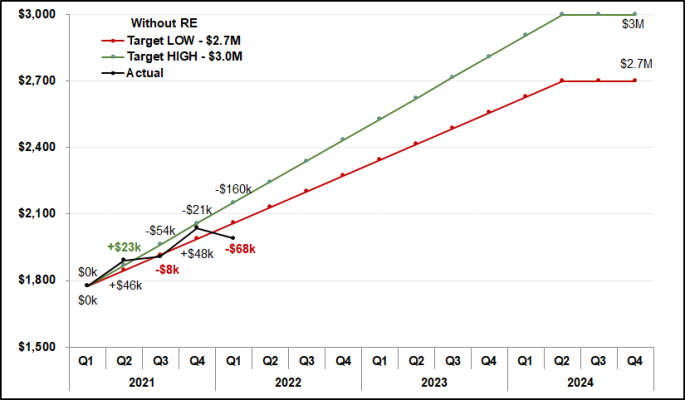

Q3 2021 update

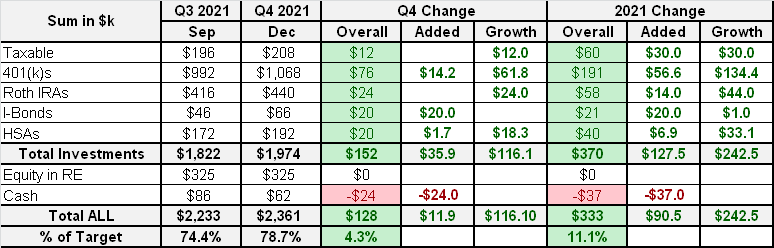

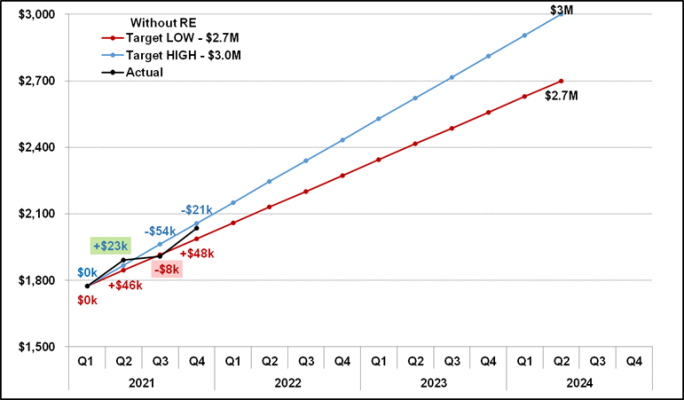

- We finished Q3 at $2,233k, 74.4% of the target.

Plus only $17k for last three months - very soft quarter for us.

- Quarter high was $2289 but September booked negative $56k.

- We continue to add new money to our $401ks and HSAs.

- Cash position went down as we added some money to taxable during September lows, plan to keep adding if market will continue to correct.

- So far 2021 is still good for us, +$205k for the first 9 months, will see how we will close full year.

- We have 11Qs to go...

Keep rocking! Love the way you planned and executed. I will take shamelessly steam your format for representing my data.