Q4 2019 update

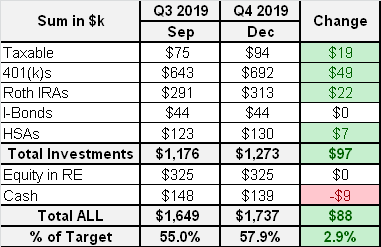

- We finished Q4 and whole 2019 at all time high NW of $1,737k - that is above our original end of year target of $1,625k by $112k, thanks to the blockbuster market run

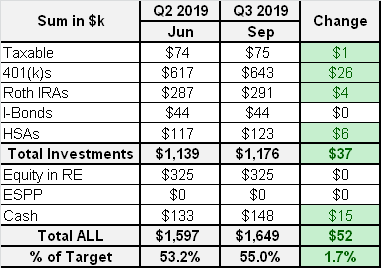

- Investable assets got boost of $97k, cash decreased by $9k, total NW change +$88k

- Decreased cash position was due to adding 10k to taxable, we are still looking to replace one of our cars - expect cash to go down even more.

- After-tax contributions to spouse's new 401k still not fixed, we pretty much gave up on the hope to get into Mega backdoor Roth, will continue with taxable account

- one more wrinkle that happend to our finances in Q4 and will continue through full Q1 - we took over our child's student loans as they went from deffered status to payable in December, she graduated in June but still in the process of getting her licence. We promised to help her till March as we hope by that time she will get full time job and will start paying all by herself. We will continue to make additional payments on those loans (we planned for it) but expect her to pay required minimums plus some extra first. Will decide on amount of help later, when we see how big her paycheck will be and how dedicated she is to get done with those loans quicker

- we went on our Christmas cruise and it was great, mostly due to having great company with us. Cruise itself was ok, we did not care much about full days in see, wish we had more stops in different ports. Due to waves we could not get on Half moon island, so out of full 6 days on the ship we had only 2 stops - Aruba and Curacao, both were very interesting and a lot of fun.

-overall good quarter, and excellent year, despite the setback with spouse's job loss and 3 months of unemployment.

- we earned $60k less this year, saved $35k less than in 2018, net worth went up by $325k for the full year - not bad considering all the headwinds in our earnings

- Looking forward to 2020, original year end target was $1,860k and we should hit it much earlier unless we will have major market meltdown.

- We have 18 Qs to go...

obviously no one in the company ever used it before but she promised to investigate

obviously no one in the company ever used it before but she promised to investigate