You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Plan for Exit 2024

- Thread starter Exit 2024

- Start date

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

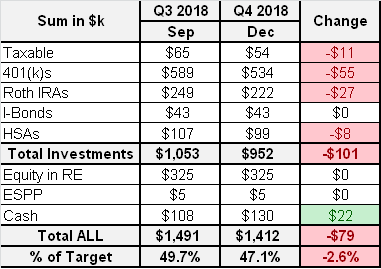

Q4 2018 update

- NW dropped this quarter by $79k, so we closed year well below $1.5M target

- Investable assets dropped by whooping $101k

- Increased our cash position during this quarter again,

- Still looking to buy rental, so far no good deal found, but we stay hopeful

- Silver lining: we are both turning 50 this year, so we are now eligible for 401k and IRA catch up contributions, that is additional $14k that we can stash away in tax advantaged accounts

- so far we are doing good on tolerating market fluctuations, actually even excited and looking forward to bigger drops to start adding more money to the taxable account. Not to time the market but we are in holding mode right now as Spouse's contract ended and new job still to be found.

and looking forward to bigger drops to start adding more money to the taxable account. Not to time the market but we are in holding mode right now as Spouse's contract ended and new job still to be found.

We have 22 Qs to go

- NW dropped this quarter by $79k, so we closed year well below $1.5M target

- Investable assets dropped by whooping $101k

- Increased our cash position during this quarter again,

- Still looking to buy rental, so far no good deal found, but we stay hopeful

- Silver lining: we are both turning 50 this year, so we are now eligible for 401k and IRA catch up contributions, that is additional $14k that we can stash away in tax advantaged accounts

- so far we are doing good on tolerating market fluctuations, actually even excited

We have 22 Qs to go

Attachments

Right, given the market situation it's no big surprise there, same as my situation.

Yay for the catch-up contributions. I haven't qualified for IRA contributions in many years due to the low income limits for us single peeps.

22 Qs...that doesn't sound like a lot when you put it that way!

Yay for the catch-up contributions. I haven't qualified for IRA contributions in many years due to the low income limits for us single peeps.

22 Qs...that doesn't sound like a lot when you put it that way!

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

dvalley, we also do not qualify for straight IRA contributions, traditional or ROTH, but actively use "back door" approach - contribute to non-deductible TIRA and then convert them to the Roth. It is very straight forward process but requires to file one extra form with our tax return every year.

dvalley, we also do not qualify for straight IRA contributions, traditional or ROTH, but actively use "back door" approach - contribute to non-deductible TIRA and then convert them to the Roth. It is very straight forward process but requires to file one extra form with our tax return every year.

Ah ok, I haven't done the backdoor ROTH yet I just keep stashing any extra money into my brokerage. I figured with a higher income tax I'm not going to benefit much from the back door ROTH. I'd rather have more in my brokerage since I plan to retire before age 59. Once I retire and my income drops I'll be converting my IRA (which is old rolled over 401ks) to ROTH up to the limits of the lower tax bracket.

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

If you have roll over IRA right now - it will prohibit you from doing "back door" without paying extra taxes. So brokerage is the only way to go for you, or you need to "hide" that IRA into 401k plan first (not many plans allow it) and only then you can start doing "back door" Roth.Once I retire and my income drops I'll be converting my IRA (which is old rolled over 401ks) to ROTH up to the limits of the lower tax bracket.

corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

If you have roll over IRA right now - it will prohibit you from doing "back door" without paying extra taxes. So brokerage is the only way to go for you, or you need to "hide" that IRA into 401k plan first (not many plans allow it) and only then you can start doing "back door" Roth.

Roth conversion of 401k or TIRA is different than backdoor Roth conversions. Although as I type that, they are exactly the same, but the tax considerations are different.

The goal of doing a backdoor Roth is to get after tax money into a Roth when your income exceeds the limits of direct Roth contribution. In the backdoor case, you don't want any TIRA's mucking up the taxes via the pro rata rule.

When you are doing TIRA or 401k or whatever pre-tax conversions to Roth, you expect and plan to pay tax. The ideal is to pay that tax with non-pretax dollars to maximize the amount that goes into the Roth. You will have to deal with the pro rata rule but that is ok.

I could be completely wrong.

I haven't looked into it in a while but you're right moving IRA money to 401k first to hide it is the clean way of doing it. However, I thought I remembered reading that you could open a brand new IRA account and use that to transfer new money from after-tax -> new IRA -> ROTH all within a short period of time without touching your old IRA...but I could be remembering completely wrong.

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

I haven't looked into it in a while but you're right moving IRA money to 401k first to hide it is the clean way of doing it. However, I thought I remembered reading that you could open a brand new IRA account and use that to transfer new money from after-tax -> new IRA -> ROTH all within a short period of time without touching your old IRA...but I could be remembering completely wrong.

IRS treats all your IRA accounts as one for purpose of conversion, so it will be pro-rata taxes if you have non-deductible and deductible money in any of them.

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

You are correct, that is why I mentioned "hiding" any TIRA into 401k before starting "back door" Roth contributions.The goal of doing a backdoor Roth is to get after tax money into a Roth when your income exceeds the limits of direct Roth contribution. In the backdoor case, you don't want any TIRA's mucking up the taxes via the pro rata rule.

- NW dropped this quarter by $79k

Don't feel bad, Exit. Our balance dropped by $209k from Q3 to Q4!

Standard Staples

Recycles dryer sheets

- Joined

- Sep 3, 2014

- Messages

- 104

Q4 2018 update

- NW dropped this quarter by $79k, so we closed year well below $1.5M target

- Investable assets dropped by whooping $101k

- Increased our cash position during this quarter again,

- Still looking to buy rental, so far no good deal found, but we stay hopeful

- Silver lining: we are both turning 50 this year, so we are now eligible for 401k and IRA catch up contributions, that is additional $14k that we can stash away in tax advantaged accounts

- so far we are doing good on tolerating market fluctuations, actually even excitedand looking forward to bigger drops to start adding more money to the taxable account. Not to time the market but we are in holding mode right now as Spouse's contract ended and new job still to be found.

We have 22 Qs to go

Excellent progress. Given the current market conditions, only being down a hair over 5% for the quarter across your entire portfolio is great to see. And you still managed six figure NW growth from end of 2017.

You're a model of well planned diversification!

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

Don't feel bad, Exit. Our balance dropped by $209k from Q3 to Q4!

Ouch

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

Excellent progress. Given the current market conditions, only being down a hair over 5% for the quarter across your entire portfolio is great to see. And you still managed six figure NW growth from end of 2017.

You're a model of well planned diversification!

Thank you, Staples

Ouchare you adding more money to the market?

I am. Added ~70k in 2018. What got me was that, as part of my portfolio, I am a long time owner of AAPL, NVDA and FB (10 years for the 1st 2 and since IPO for the last) and they got absolutely hammered the last quarter (Around 90K can be attributed to just these 3 stocks). Granted, they also have really helped my portfolio over all those years, so can't really complain that much.

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

I am. Added ~70k in 2018. What got me was that, as part of my portfolio, I am a long time owner of AAPL, NVDA and FB (10 years for the 1st 2 and since IPO for the last) and they got absolutely hammered the last quarter (Around 90K can be attributed to just these 3 stocks). Granted, they also have really helped my portfolio over all those years, so can't really complain that much.

I hear you, we have AAPL too and some other individual stocks like MA since IPO or MNST since it was HANS, and some others but not a much, those def added a lot to the loss, but have been overperforming market on the way up, so no complaints here from me either

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

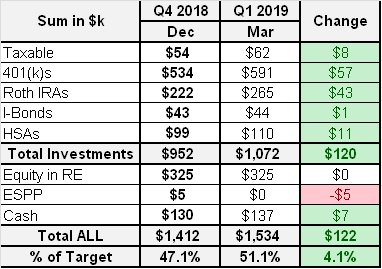

Q1 2019 update

- Market was good for us in Q1 and we are not only restored all Q4 losses but also surpassed our all time high NW - finished at $1,534k, and we finally crossed 50% mark of our target

- Investable assets got boost of $120k

- Contributed total $14k to our Roth IRAs for 2019

- Need to review asset allocation. I have a feeling that we need to move some money to bonds to keep targeted balance

- My better half is out of the job and looking for new one as of March, so we are currently down to one income and one unemployment benefit, savings will slow down till we get back to 2 incomes.

- Cash position slightly increased due to exiting ESPP

- We are working to move HSA and 401k money from spouse's former employer to HSA Bank and to Fidelity Solo 401k, those are our consolidation accounts, will use those to re-balance our AA

- Filed our returns: we earned more in 2018 and paid less in Federal taxes than year before. I am not complaining at all

We have 21 Qs to go...

- Market was good for us in Q1 and we are not only restored all Q4 losses but also surpassed our all time high NW - finished at $1,534k, and we finally crossed 50% mark of our target

- Investable assets got boost of $120k

- Contributed total $14k to our Roth IRAs for 2019

- Need to review asset allocation. I have a feeling that we need to move some money to bonds to keep targeted balance

- My better half is out of the job and looking for new one as of March, so we are currently down to one income and one unemployment benefit, savings will slow down till we get back to 2 incomes.

- Cash position slightly increased due to exiting ESPP

- We are working to move HSA and 401k money from spouse's former employer to HSA Bank and to Fidelity Solo 401k, those are our consolidation accounts, will use those to re-balance our AA

- Filed our returns: we earned more in 2018 and paid less in Federal taxes than year before. I am not complaining at all

We have 21 Qs to go...

Attachments

N02L84ER

Thinks s/he gets paid by the post

You do know Fidelity now offers HSA accounts?

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

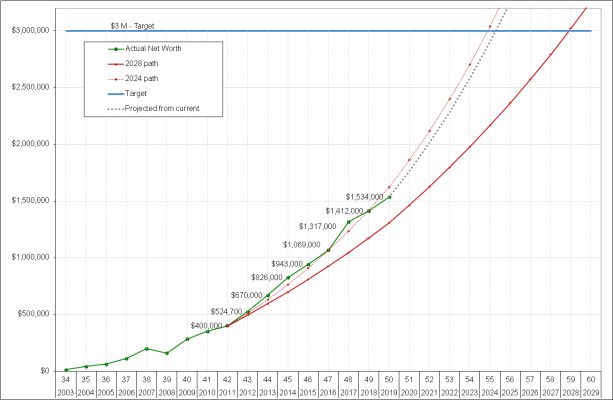

Are you still tracking to your 2024 exit i.e. doubling the assets in 5 yrs?

dvalley, that is a million dollar question

We are slightly behind the schedule as of today, but I do not expect to achieve NW growth at the same rate on short term intervals anyways. Original target for 2019 was $1,625k, we need $90k more this year, which is not unreasonable to expect but all will depend on market cooperation plus how fast spouse will find new job and what would be the pay.

I have a chart with 2028 path line and 2024 one, and I plug actuals every quarter to see how we are doing, and as you can see we have been fluctuating around 2024 line very consistently. Will that change due to job loss? Possible.

But we discussed that and current plan B is:

- semi-retire in 2024 if will not get to our target,

- earn just enough for our living

- do not touch nest egg, and not add to it

- let investments grow to the target and then retire completely

You can click on chart to see it better.

Attachments

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

Thanks, brokrken

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 416

You do know Fidelity now offers HSA accounts?

N02L84ER, yes I heard, but I ran in such debacle with Fidelity last year, that I am very leary to open any new accounts with them. We still keep Solo 401k one there as no other place to go with that one. HSA Bank is not optimal by any means, wish Vanguard would start offering HSAs also...

dvalley, that is a million dollar questionmillion and half actually

We are slightly behind the schedule as of today, but I do not expect to achieve NW growth at the same rate on short term intervals anyways. Original target for 2019 was $1,625k, we need $90k more this year, which is not unreasonable to expect but all will depend on market cooperation plus how fast spouse will find new job and what would be the pay.

I have a chart with 2028 path line and 2024 one, and I plug actuals every quarter to see how we are doing, and as you can see we have been fluctuating around 2024 line very consistently. Will that change due to job loss? Possible.

But we discussed that and current plan B is:

- semi-retire in 2024 if will not get to our target,

- earn just enough for our living

- do not touch nest egg, and not add to it

- let investments grow to the target and then retire completely

You can click on chart to see it better.

That's a simple yet fantastic way to track progress and sounds like you guys have a few options there plus I'm sure the target of $3MM has some room for adjustments too.

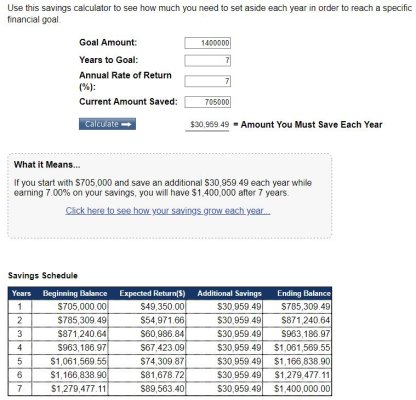

Your chart inspired me to run a calc for my target goal since I too am about 50% of my goal. For me it looks like 7/7 is key i.e. 7yrs with 7% interest and $31k additional savings YoY. I think all those are very reasonable (provided no gaps in my employment and savings) so we shall see.

https://investinganswers.com/calcul...-should-i-save-each-year-reach-my-financ-3353

Attachments

Similar threads

- Replies

- 36

- Views

- 2K