Don46, I am surprised by $0.7mil number, is that a typo?

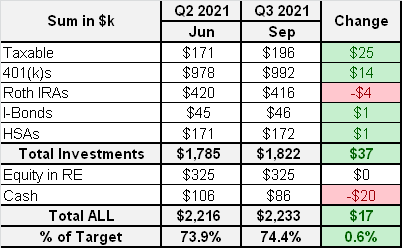

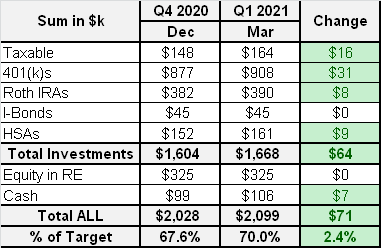

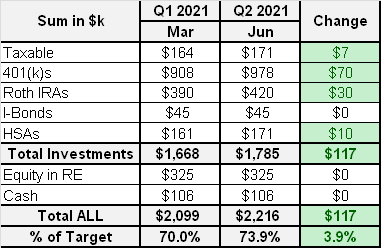

Total investment as of Q1 $1.67mil, if we add cash - $1.8mil.

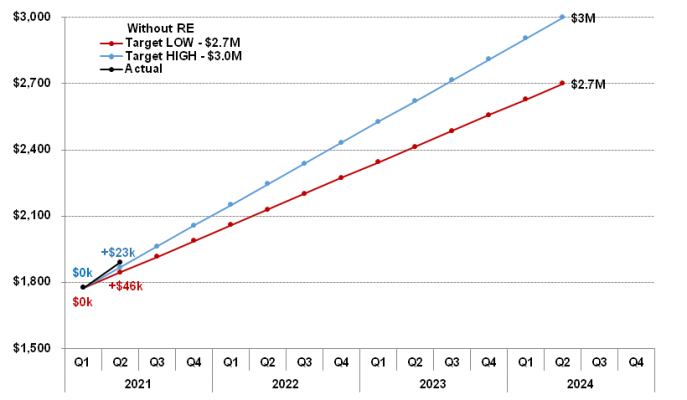

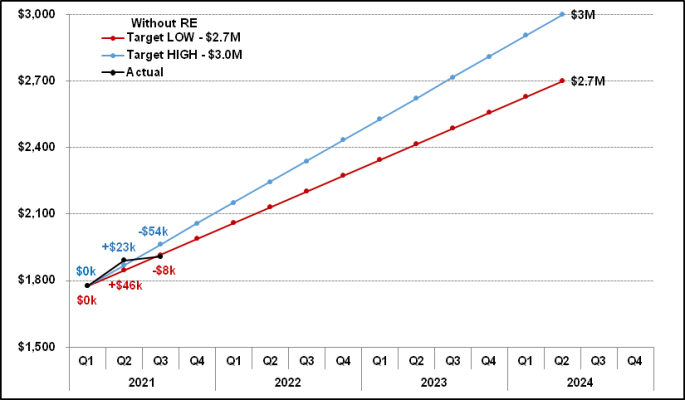

If you read my first post - target is $3.0mil including RE, and

$2.7mil not including RE, and we projecting $90k annual spending which is conservative 3.3% rate on all excluding RE.

RE include second property that we plan to sell, we currently account for it at purchase price of $140k, but it is sure appreciated as we hold it since 2010. It is our reserve to close the gap to $2.7 mil.

So we need about $0.9mil increase over 3 years, or $300k per year average. We are adding about $100k of new money/year, that leaves investment growth of $200k/year to book.

Is that aggresive on 1.7mil? Sure yes!

Will we cry if we will not get to the target on time - sure not!

No one knows what markets will bring in next 3 years, but there are always plan B - semi FIRE, and Plan C - OMY

Will see, it is a game

we above LOW target by $46K and above HIGH target by $23K

we above LOW target by $46K and above HIGH target by $23K