Bouncing around the web after reading the Fed is going to start buying $60 billion worth of Treasury bills per month next week I ran into an interesting article about MMT.

https://carnegieendowment.org/chinafinancialmarkets/80054

"Advocates for modern monetary theory argue that, for a sovereign country with its own currency, there is no inherently unacceptable level of government debt—that country does not automatically begin to collapse when debt reaches 90 per cent of GDP, or even 200 per cent of GDP. The country appropriates what it believes is necessary for domestic programs, regardless of revenue."

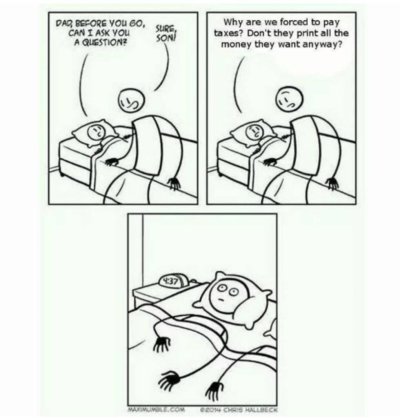

The author goes on to state this is an unfair description of MMT and explains why. I'll be honest, I never understood this stuff and after reading the article still don't. But I've read numerous times the US debt to GDP ratio is irrelevant. You can't compare it to how the american household manages its finances given that the US can just print, ahem, perform QE.

But I've read numerous times the US debt to GDP ratio is irrelevant. You can't compare it to how the american household manages its finances given that the US can just print, ahem, perform QE.

Do you agree with the above quoted statement?

https://carnegieendowment.org/chinafinancialmarkets/80054

"Advocates for modern monetary theory argue that, for a sovereign country with its own currency, there is no inherently unacceptable level of government debt—that country does not automatically begin to collapse when debt reaches 90 per cent of GDP, or even 200 per cent of GDP. The country appropriates what it believes is necessary for domestic programs, regardless of revenue."

The author goes on to state this is an unfair description of MMT and explains why. I'll be honest, I never understood this stuff and after reading the article still don't.

Do you agree with the above quoted statement?