You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Preparing for changes

- Thread starter imoldernu

- Start date

KCGeezer

Thinks s/he gets paid by the post

- Joined

- Jan 2, 2015

- Messages

- 1,539

I see fairly consistent estimates of $2b a week (.1% of gdp) per week impact on the economy when I use the google machine. A few articles go on to say 1.5% if it’s a month or more. Not sure how that math works it makes sense there’d be some time multiplier.

So my existing financial model which assumes 0 real growth in the current year is still as good a guess as any other. No changes necessary as of now. There are definitely other issues that I have a vested interest in, but those are for a different forum.

So my existing financial model which assumes 0 real growth in the current year is still as good a guess as any other. No changes necessary as of now. There are definitely other issues that I have a vested interest in, but those are for a different forum.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

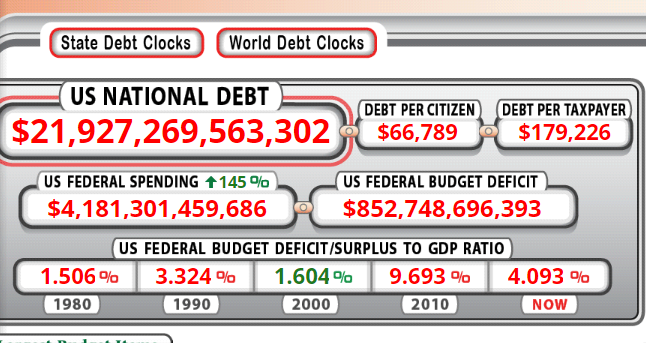

The gov is running 1 TRILLION $ a YEAR in additional deficits.

A friend of mine became a US citizen in August. As a gag gift I handed him a bill for his share of the national debt. It totaled $1,012,038 per citizen (not per tax payer which is a much smaller population to distribute the bill across) not including local bonds collected through property taxes.

Maybe it should be shutdown to stop the bleeding.

Where did you get $1 million per citizen? It is a lot lower than that.... about $67k.

Attachments

Not suggesting that any of the things that are discussed in the NBC News article linked below, will actually happen. Of course, a long term Government shutdown is unthinkable, still... it broadens the overview of changes that have occurred already, with a look forward to some possibilities that might linger after the shutdown is settled.

Some of the more serious problems have become serious enough to require immediate action, while there are already economic implications that will affect the stockmarket in the short term.

One small part of the overall problem that I've seen, from talking to local farmers, is that crop planning is already behind due to the USDA shutdown.

https://www.nbcnews.com/politics/politics-news/doomsday-scenario-here-s-what-happens-if-shutdown-drags-n955946

The other worrisome part of the current situation that has not been in the news very much, is the effect that national departmental closures will have on local governments. One city ... Dayton Ohio.

https://www.daytondailynews.com/news/local/government-shutdown-could-still-impact-more-than-400-local-jobs/aJqXNSDR87hHHr25NXr7mL/

Some of the more serious problems have become serious enough to require immediate action, while there are already economic implications that will affect the stockmarket in the short term.

One small part of the overall problem that I've seen, from talking to local farmers, is that crop planning is already behind due to the USDA shutdown.

https://www.nbcnews.com/politics/politics-news/doomsday-scenario-here-s-what-happens-if-shutdown-drags-n955946

The other worrisome part of the current situation that has not been in the news very much, is the effect that national departmental closures will have on local governments. One city ... Dayton Ohio.

https://www.daytondailynews.com/news/local/government-shutdown-could-still-impact-more-than-400-local-jobs/aJqXNSDR87hHHr25NXr7mL/

Last edited:

ncbill

Thinks s/he gets paid by the post

In previous shutdowns my kid's classes were canceled (USNA) but since DOD was funded separately last fall that's not happening this time.

Where did you get $1 million per citizen? It is a lot lower than that.... about $67k.

Attachments

Where did you get $1 million per citizen? It is a lot lower than that.... about $67k.

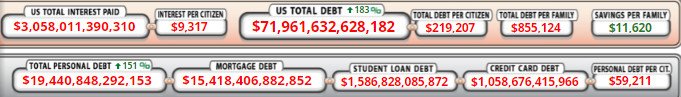

The $1M is calculated using the GAAP accounting rules that corporations have to use. The main 21T debt figure does not include "unfunded liabilities"

that GAAP standards would force a corp to include like retirement obligations. Those additions alone bring the debt up to just under 100T.

https://www.justfacts.com/nationaldebt.asp

I'll go back through my search history from August to find the sources if I haven't cleared it since then.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

No actually the source that you referenced is wrong... much of what they include as liabilities would NOT be recognized as liabilities by a public corporation. The $30.8 trillion of SS shortfall and $34.6 trillion of Medicare shortfall would not be accrued as a liability under GAAP (I spend my career in corporate accounting and know this well).

The SS shortfall is not a liability... there is no legal obligation to provide what is promised and that is why benefits may be reduced by 23% in 2034... the only obligation is to provide benefits to the extent that tax revenues allow... even if a liability was recognized it would be mesured as zero because the PV of future benefits is equal to the PV of future tax revenues since once the trust fund runs out benefits are limited to revenues.

The same concept would apply to the Medicare liabilities... there is no legal obligation to provide specified benefits. If a public company reporting under GAAP had the same obligations they would not be recognized because there is no legal obligation to provide specified benefits.

The $9.2 trillion, $7.7 trillion of which are liabilites for employee and veterans benefits, is probably valid. Similiarly though, the other thing to consider is that land and buildings owned by the US government are not recognized as assets in their financial statements and those have considerable value. https://fiscal.treasury.gov/files/r...eport/notes-to-the-financial-statements24.pdf

The SS shortfall is not a liability... there is no legal obligation to provide what is promised and that is why benefits may be reduced by 23% in 2034... the only obligation is to provide benefits to the extent that tax revenues allow... even if a liability was recognized it would be mesured as zero because the PV of future benefits is equal to the PV of future tax revenues since once the trust fund runs out benefits are limited to revenues.

The same concept would apply to the Medicare liabilities... there is no legal obligation to provide specified benefits. If a public company reporting under GAAP had the same obligations they would not be recognized because there is no legal obligation to provide specified benefits.

The $9.2 trillion, $7.7 trillion of which are liabilites for employee and veterans benefits, is probably valid. Similiarly though, the other thing to consider is that land and buildings owned by the US government are not recognized as assets in their financial statements and those have considerable value. https://fiscal.treasury.gov/files/r...eport/notes-to-the-financial-statements24.pdf

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The $72 billion that you posted includes U.S. goverment debt and private debt (US corporations and individuals)... we are talking just about the former.

No actually the source that you referenced is wrong... much of what they include as liabilities would NOT be recognized as liabilities by a public corporation. The $30.8 trillion of SS shortfall and $34.6 trillion of Medicare shortfall would not be accrued as a liability under GAAP (I spend my career in corporate accounting and know this well).

The SS shortfall is not a liability... there is no legal obligation to provide what is promised and that is why benefits may be reduced by 23% in 2034... the only obligation is to provide benefits to the extent that tax revenues allow... even if a liability was recognized it would be mesured as zero because the PV of future benefits is equal to the PV of future tax revenues since once the trust fund runs out benefits are limited to revenues.

The same concept would apply to the Medicare liabilities... there is no legal obligation to provide specified benefits. If a public company reporting under GAAP had the same obligations they would not be recognized because there is no legal obligation to provide specified benefits.

The $9.2 trillion, $7.7 trillion of which are liabilites for employee and veterans benefits, is probably valid. Similiarly though, the other thing to consider is that land and buildings owned by the US government are not recognized as assets in their financial statements and those have considerable value. https://fiscal.treasury.gov/files/r...eport/notes-to-the-financial-statements24.pdf

Technically congress can completely eliminate SS and medicare with the stroke of a pen. While its hard to imagine senior citizens rioting, there would be proverbial torches and pitch forks. The reality is those funds are either going to be paid (recognize it as a debt owed) or plan for martial law scenarios equivalent to defaulting on the "recognized" debt.

I'm so confused we shut down a government over one demand, where in the interim government employed DoD personell are filling the gap for the aforementioned demand. So basically isn't this just shooting one's self in the foot, if we shut down the troops and support that protect our borders (TSA, border patrol, national guard, soldiers, military etc) then we are effectively weakening the border, as a barter to strengthen it? Anyone else confused?

I'm so confused we shut down a government over one demand, where in the interim government employed DoD personell are filling the gap for the aforementioned demand. So basically isn't this just shooting one's self in the foot, if we shut down the troops and support that protect our borders (TSA, border patrol, national guard, soldiers, military etc) then we are effectively weakening the border, as a barter to strengthen it? Anyone else confused?

Immediately after reading your post I came across this on another website:

“if you aren’t confused, you aren’t paying attention”

But there is a difference between immediate vs. long term impacts.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm not sure how that relates to the point that we were debating, but whatever. Under current law, SS benefits will be paid to the extent of taxes collected once the trust fund runs out in 2034 or so...thus no liability to be recognized.Technically congress can completely eliminate SS and medicare with the stroke of a pen. While its hard to imagine senior citizens rioting, there would be proverbial torches and pitch forks. The reality is those funds are either going to be paid (recognize it as a debt owed) or plan for martial law scenarios equivalent to defaulting on the "recognized" debt.

The $1M is calculated using the GAAP accounting rules that corporations have to use. The main 21T debt figure does not include "unfunded liabilities"

that GAAP standards would force a corp to include like retirement obligations. Those additions alone bring the debt up to just under 100T.

If you are going to use corporation reporting though, the net assets of the USA look pretty good. We could spin off Alaska for probably 10T. How much does a fully equipped nuclear sub go for these days? A lot I bet.

$5.6 Billion?

Depending, perhaps as much as $100 Billion... and even that doesn't count the cost of land, two thirds of which is not owned by the U.S. Further, the length of time for litigation, even with eminent domain, could be as long as 15 years.

No proof... just watching pieces of the news that are exploding.

Who really thought the government would still be shut down now?

My farmer friend, is seriously worried. For him, and his family, it's real. That's close enough for me to be concerned.

Depending, perhaps as much as $100 Billion... and even that doesn't count the cost of land, two thirds of which is not owned by the U.S. Further, the length of time for litigation, even with eminent domain, could be as long as 15 years.

No proof... just watching pieces of the news that are exploding.

Who really thought the government would still be shut down now?

My farmer friend, is seriously worried. For him, and his family, it's real. That's close enough for me to be concerned.

KCGeezer

Thinks s/he gets paid by the post

- Joined

- Jan 2, 2015

- Messages

- 1,539

If air traffic controllers are starting to drop, that will have a direct effect on many areas of the economy. Unbelievable.

ExFlyBoy5

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My SIL just got her furlough notice (contract worker for National Weather Service). Thankfully, she is pretty smart when it comes to money, so she is looking forward to the "down time". But, she's not thrilled that she will most likely *not* get back pay.

I think as more and more folks are affected, there will be a lot of calls to elected officials to stop playing games which will eventually bring resolution.

I think as more and more folks are affected, there will be a lot of calls to elected officials to stop playing games which will eventually bring resolution.

KCGeezer

Thinks s/he gets paid by the post

- Joined

- Jan 2, 2015

- Messages

- 1,539

Just saw an article saying that Canada economic statistics will not be released since they utilize Commerce department info as inputs. The impact includes projections for 2019. Wonder how the Feds models may or may not be affected?

- Joined

- Oct 13, 2010

- Messages

- 10,735

They were all IPAs anyway. They can't seem to release any of the other dozens of stylesOk, this may affect some of you:

Local breweries can't release new beers nationally due to government shutdown

Breweries making new labels for national releases need federal approval, which is on hold right now during the shutdown.

https://www.kgw.com/article/news/lo...down/283-13c7ceac-aaae-430f-80a3-0c78597dfaa4

- Joined

- Oct 13, 2010

- Messages

- 10,735

Choice of things to defund

It always annoyed me that they shut down the things everyone likes and uses.

Why not go back through the recent legislation intended to cut the size of government that almost, but didn't quite pass, and start there? I'll tell you why: because everyone would cheer!

It always annoyed me that they shut down the things everyone likes and uses.

Why not go back through the recent legislation intended to cut the size of government that almost, but didn't quite pass, and start there? I'll tell you why: because everyone would cheer!

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,435

My SIL just got her furlough notice (contract worker for National Weather Service). Thankfully, she is pretty smart when it comes to money, so she is looking forward to the "down time".

Just met some furloughed folks down here on the beach in Florida who are just digging the sunshine. Snow where they're from.

Lemons/lemonade in their mind I suppose.

People traveling thru airports going thru extreme hell. TSA employees calling sick or working for free. 2-3 hours expected time alloted to get to your gate in the airports in my state. Terminal A is the drop off for food and supplies for TSA and air traffic controllers working without a paycheck.

foxfirev5

Thinks s/he gets paid by the post

- Joined

- Mar 22, 2009

- Messages

- 2,988

Just met some furloughed folks down here on the beach in Florida who are just digging the sunshine. Snow where they're from.

Lemons/lemonade in their mind I suppose.

Nice insulated perspective.

I would love to have us adopt something similar to Israel.... if the Knesset doesn't pass a budget before it is due then the Knesset is disolved and new elections are held. If Congress doesn't pass a budget within 3 months of the start of the fiscal year then Congress is disolved and new elections are held.

Given our congresscritters insatiable thirst for self-interest, do you think that we would ever have a government shutdown if we had something like that in place?

Great idea in my opinion, for what it is worth.

Similar threads

- Replies

- 15

- Views

- 7K

- Replies

- 127

- Views

- 11K