ER_Hopeful

Recycles dryer sheets

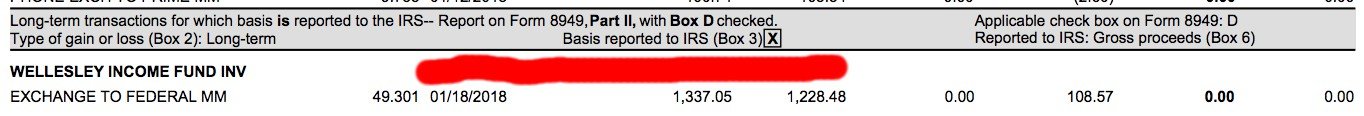

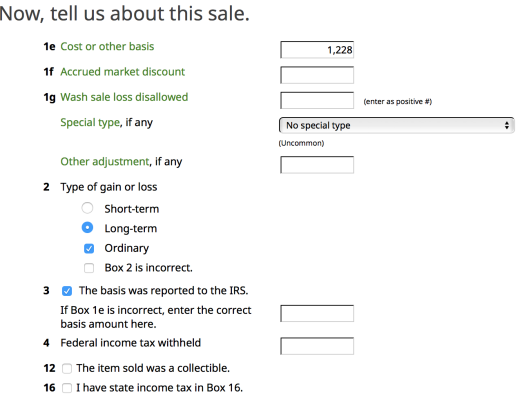

sold some MF for the first time in 2018. Just wondering if I'm reporting it correctly (using HR Block ), particularly should I check box 2 (Ordinary) and and box 3 (report basis to IRS). pls see attached.

shares have been acquired on various dates, gain is LT.

Also, there's another LT transaction but the 1099-B description says "the basis is not reported IRS", do I just leave box 3 unchecked then?

shares have been acquired on various dates, gain is LT.

Also, there's another LT transaction but the 1099-B description says "the basis is not reported IRS", do I just leave box 3 unchecked then?

Attachments

Last edited: