Coach

Thinks s/he gets paid by the post

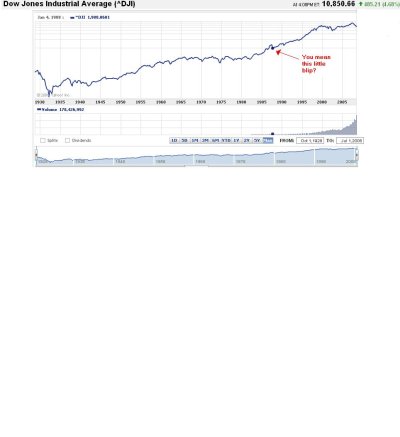

Does anyone have interesting memories of Black Monday, October 19, 1987? The DJIA dropped over 20% that day -- about three times the drop we saw on Monday, September 29.

I remember lots of doom and gloom, and lots of comparisons to 1929. I only had a few thousand dollars in retirement accounts at the time, and no stock outside of retirement accounts, with many years of work ahead of me, so it was more interesting than frightening. I did save the next day's newspapers for years, though.

It was all pre-WWW of course, and my retirement savings were at TIAA-CREF in funds that didn't get published in the financial pages, so I didn't have any personal sense of what I had lost on paper that day. By the time I got my next quarterly statement in January the market had recovered enough that it probably didn't look too bad. The DJIA actually ended the year up a little.

Sometimes a lack of information can be a good thing.

Coach

I remember lots of doom and gloom, and lots of comparisons to 1929. I only had a few thousand dollars in retirement accounts at the time, and no stock outside of retirement accounts, with many years of work ahead of me, so it was more interesting than frightening. I did save the next day's newspapers for years, though.

It was all pre-WWW of course, and my retirement savings were at TIAA-CREF in funds that didn't get published in the financial pages, so I didn't have any personal sense of what I had lost on paper that day. By the time I got my next quarterly statement in January the market had recovered enough that it probably didn't look too bad. The DJIA actually ended the year up a little.

Sometimes a lack of information can be a good thing.

Coach