I see there are a quite a few young retired people with one or more kids on their way to college. How are you all planning on paying for that? Are you planning on your kids paying for their own college? Or do you have enough money to cover it? Or are you planning on a lot of financial aid? I read some of the other threads on financial aid, and the general picture for people with significant assets seemed pretty grim. If I didn’t have four kids I might be FI today, but one of the thing that scares me is anywhere from 2-600k of college costs (at present value for kids entering college in 10-17 years).

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retired college costs

- Thread starter bongo2

- Start date

yakers

Thinks s/he gets paid by the post

This is an issue close to my heart. One son left at home starting his 3rd year of high school. I do not expect I will have to work through his college days but I want to work until I know what his college costs will be. If he goes to a junior college no problem and a local state school I have it covered. If he ends up at Stanford I expect to keep working.

I do not expect any real financial aid, meaning any financial scholarships or grants, loans don't count as aid to me. I expcet my son to work and pay some of his expenses, how much depends on how involved he is in studies and what jobs are avialable. But he wants to work, wants to go to college and is doing pretty well. I have always emphasized education and it is something I am happy to support financially.

I am quite willing to delay retiring to support his studies, but I may not have to. I have saved some and he will work and we will consider loans (I just don't consider them "aid"). I will know more in a year and a lot more in two years. And we will explore various scholarships from organizations I am involved with.

I do not expect any real financial aid, meaning any financial scholarships or grants, loans don't count as aid to me. I expcet my son to work and pay some of his expenses, how much depends on how involved he is in studies and what jobs are avialable. But he wants to work, wants to go to college and is doing pretty well. I have always emphasized education and it is something I am happy to support financially.

I am quite willing to delay retiring to support his studies, but I may not have to. I have saved some and he will work and we will consider loans (I just don't consider them "aid"). I will know more in a year and a lot more in two years. And we will explore various scholarships from organizations I am involved with.

T

TromboneAl

Guest

Hi Bongo,

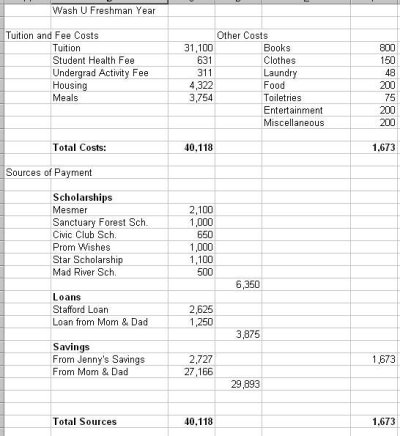

I can help you out with this. DD starts college at Wash University in St. Louis in a month.

Fees and tuition come to 40,118 with an addition 2K expected for books, laundry, travel, etc.

She got a total of $6,350 in merit-based scholarships (six different scholarships out of 26 applied for).

She'll get a subsidized student loan of 2625, and we will loan her 1250 with the same terms as the student loan.

She'll contribute 4,300 from her savings and we will contribute $27,166.

We figure we'll save about $5,000 in lower car insurance, tax credits, less driving, hot water, no sports fees, etc.

We may get more financial aid next year, because we had $23K of savings in her name, that we will spend first. Also, I'll expect her to get a job during the school year next year.

Bottom line, we figure our savings will be reduced by $100,000 due to college costs. That's doable.

If I could go back a year, I'd have pushed more for a state university. Wash U is a great school, but no bargain.

Here's the spreadsheet (without the travel included):

I can help you out with this. DD starts college at Wash University in St. Louis in a month.

Fees and tuition come to 40,118 with an addition 2K expected for books, laundry, travel, etc.

She got a total of $6,350 in merit-based scholarships (six different scholarships out of 26 applied for).

She'll get a subsidized student loan of 2625, and we will loan her 1250 with the same terms as the student loan.

She'll contribute 4,300 from her savings and we will contribute $27,166.

We figure we'll save about $5,000 in lower car insurance, tax credits, less driving, hot water, no sports fees, etc.

We may get more financial aid next year, because we had $23K of savings in her name, that we will spend first. Also, I'll expect her to get a job during the school year next year.

Bottom line, we figure our savings will be reduced by $100,000 due to college costs. That's doable.

If I could go back a year, I'd have pushed more for a state university. Wash U is a great school, but no bargain.

Here's the spreadsheet (without the travel included):

Attachments

I think I'm going to have to substantially expand my range. If college costs outpace investment results by 5% a year for the next 14 years (not inconcevable), and I have 4 kids at Wash U with no scholarships then we're looking at roughly 40 x 4 x 4 x 1.05 ^ 14 (to use the average 14 years until my kids go to college) = $1.3mil present value. If they all go to Instate U and investment returns outpace college costs by 5% a year for the next 14 years, then we have about 15 x 4 x 4 x 0.95^14 = $0.1mil present value. How the heck do you plan for that!?!

grumpy

Thinks s/he gets paid by the post

- Joined

- Jul 1, 2004

- Messages

- 1,321

We saved for my daughter's college education (in her name) from the time she was born. When it came time for her to decide on a college I told her that if she went to an in-state public shool (Salisbury State College), then when she was done she would still have enough money to spend 6 months touring Europe, buy a car and make a down payment on a house. On the other hand, if she decided to go to a small private college (Muhlenburg) then after 4 years she would have a degree. She went to Muhlenburg. We also helped with expenses not covered by her loans for two years of grad school. Oh well, that's why we saved. I think she got a better education at Muhlenburg and she discovered her true calling there (theater). She now has a Master's of Fine Arts and several years of experience working in theaters in the D.C. area. She plans to head for the bright lights of Broadway soon.

I guess my point is that its hard to plan ahead for college costs. The best thing is to save as much as possible and then adjust as necessary.

Grumpy

I guess my point is that its hard to plan ahead for college costs. The best thing is to save as much as possible and then adjust as necessary.

Grumpy

T

TromboneAl

Guest

So many other little expenses too. I'm bugged right now because she just got a medical history form from Wash U that has to be filled out and signed by a doctor. So that means $120 for a physical (not covered by health insurance).

Then there's the $450 enrollment deposit, that isn't returned until she graduates.

But I don't think college cost increases will necessarily outpace investment performance. And remember that though the college costs 40K per year, we'll only end up paying 23K.

Then there's the $450 enrollment deposit, that isn't returned until she graduates.

But I don't think college cost increases will necessarily outpace investment performance. And remember that though the college costs 40K per year, we'll only end up paying 23K.

Re: ERs sending their kids to college.

Darn, bongo, from the title of your post I thought you were looking for a college for retirees! The thought of having people pay me to teach them about ER was almost enough to make me want to go back to work. Then I realized that I'd be going back to work... never mind.

FWIW we thoroughly enjoyed our tour of Florida's Eckerd College. (We were even more impressed that they took the time to tour a 12-year-old in between DisneyWorld visits.) Our kid has been infatuated with the idea of a military academy, although she tried paintball last weekend and may decide that the military isn't for her after all.

I have a spreadsheet too. PM me an e-mail address if you want a copy.

Darn, bongo, from the title of your post I thought you were looking for a college for retirees! The thought of having people pay me to teach them about ER was almost enough to make me want to go back to work. Then I realized that I'd be going back to work... never mind.

We've been saving $100/week since 1992 and that's part of the ER budget. Savings & compounding matter more than anything else, although Tweedy, Browne & Berkshire Hathaway have done us proud. Projecting this savings rate, a 6% college inflation rate, and a 7% before-tax rate of return will just make it at the College Board's private-school expenses. And it'll cover anything that UH has to offer.bongo2 said:I see there are a quite a few young retired people with one or more kids on their way to college. How are you all planning on paying for that?

No, but we're not paying for the whole thing either. It could be argued that we're just looking for shared misery, but the military paid for our college educations and our kid has the same opportunity. We're able to help with the expense (if we don't need it for ER in the next five years!) but I think college students do better if they're paying (at least some of) the expenses. Some of the savings are in her UTMA and the rest is in our college-savings portfolio. When she starts choosing a college we can emphasize shopping for value (Loren Pope's book helps a lot) and hopefully her asprations match our budget. If not then she's REALLY gonna get an education.bongo2 said:Are you planning on your kids paying for their own college?

I sure hope so. College Board numbers are quite discouraging, aren't they? Anyone have better data?bongo2 said:Or do you have enough money to cover it?

That's our kid's challenge to solve. Scholarships, financial aid, work/study, part-time work, or wearing a uniform-- how much more help does she need?!?bongo2 said:Or are you planning on a lot of financial aid?

FWIW we thoroughly enjoyed our tour of Florida's Eckerd College. (We were even more impressed that they took the time to tour a 12-year-old in between DisneyWorld visits.) Our kid has been infatuated with the idea of a military academy, although she tried paintball last weekend and may decide that the military isn't for her after all.

I have a spreadsheet too. PM me an e-mail address if you want a copy.

If anyone is wondering how to make college expenses match family finances and are willing to make a career move, there are colleges and universities that wave the tuition if you work for them.

Also, there is a network of about 570 private colleges that do what is called a "tuition exchange". You apply around Sept., a year ahead of the freshman year, at the college that you work at- there will be a TE officer on staff that will shepherd it through - indicate the college(s) in the network that your child will apply to - they send the info to the Tuition Exchange headquarters who in turn notifies the colleges.

You have to repeat this every year, but for some colleges it is a formality and will continue giving the TE out all 4 years as long as the student is in good standing and you contine to work at your college.

Some of the colleges are more popular than others and only reserve a limited number of these exchanges and have many times more requests - so can be very competitive and will judge based on academics and SAT/ACT primarily (USC for example)

The bonus: award ($22,000 this year) is not taxable to you and is not considered a fringe benefit.

There are other exchange programs - some quite small - there are a few private Colleges/Universities in the Twin Cities for example, where if you work at one your student can get free tuition at your school or one of the other member schools.

Hope this can be useful to you...

http://www.tuitionexchange.org/

DanTien

Also, there is a network of about 570 private colleges that do what is called a "tuition exchange". You apply around Sept., a year ahead of the freshman year, at the college that you work at- there will be a TE officer on staff that will shepherd it through - indicate the college(s) in the network that your child will apply to - they send the info to the Tuition Exchange headquarters who in turn notifies the colleges.

You have to repeat this every year, but for some colleges it is a formality and will continue giving the TE out all 4 years as long as the student is in good standing and you contine to work at your college.

Some of the colleges are more popular than others and only reserve a limited number of these exchanges and have many times more requests - so can be very competitive and will judge based on academics and SAT/ACT primarily (USC for example)

The bonus: award ($22,000 this year) is not taxable to you and is not considered a fringe benefit.

There are other exchange programs - some quite small - there are a few private Colleges/Universities in the Twin Cities for example, where if you work at one your student can get free tuition at your school or one of the other member schools.

Hope this can be useful to you...

http://www.tuitionexchange.org/

DanTien

I was with you until my eyeballs slammed into that "work" word...DanTien said:If anyone is wondering how to make college expenses match family finances and are willing to make a career move, there are colleges and universities that wave the tuition if you work

Imagine if your college kid could brag to her friends: "Yeah, that's my dad over there unclogging the bathroom urinals. Later on I think he's going to prune the bushes and mow the lawn." How cool would that be?

I'm not sure the landscapers and food service workers get the free tuition benefit for their children. But professors do. When I was teaching it occured to me that I might be able to make some money by agreeing to a phony adoption scheme. I adopt your kid so he/she gets free tuition and you pay me some fraction of the tuition cost.Nords said:I was with you until my eyeballs slammed into that "work" word...

Imagine if your college kid could brag to her friends: "Yeah, that's my dad over there unclogging the bathroom urinals. Later on I think he's going to prune the bushes and mow the lawn." How cool would that be?

Nords said:Imagine if your college kid could brag to her friends: "Yeah, that's my dad over there unclogging the bathroom urinals. Later on I think he's going to prune the bushes and mow the lawn." How cool would that be?

This doesn't seem like a good fit for you and is it a serious option for you anyway...

To give the Forum a different perspective:

I was taught and I taught my three kids that all work is honorable.

((^+^)) SG said:I'm not sure the landscapers and food service workers get the free tuition benefit for their children. But professors do. When I was teaching it occured to me that I might be able to make some money by agreeing to a phony adoption scheme. I adopt your kid so he/she gets free tuition and you pay me some fraction of the tuition cost.

Tuition Exchange program is open to all employees of the member schools.

The small group of private colleges in twin cities is open to all employees.

Can't speak for other colleges universities throughout the US.

Maybe I'm weird, but this issue doesn't stress me out much. No kids yet, but plan to in the future. The spouse and I plan to set aside enough for future kids to attend a decent in-state school for 4 years. If they want to go someplace more expensive, or if tuition prices outpace our estimates, then they can work or take out student loans like we did. A motivated kid will find a way to get the education they want.

BTW, AP classes are another way to knock some money off the tuition bill. Also, in order to speed students through expensive subsidized public universities, some states allow high school students to take community college classes for free. A few of my classmates managed to finish their AA degrees during high school, saving themselves 2 years of college tuition, room, and board.

BTW, AP classes are another way to knock some money off the tuition bill. Also, in order to speed students through expensive subsidized public universities, some states allow high school students to take community college classes for free. A few of my classmates managed to finish their AA degrees during high school, saving themselves 2 years of college tuition, room, and board.

FlowGirl said:Maybe I'm weird, but this issue doesn't stress me out much. No kids yet, but plan to in the future. The spouse and I plan to set aside enough for future kids to attend a decent in-state school for 4 years. If they want to go someplace more expensive, or if tuition prices outpace our estimates, then they can work or take out student loans like we did. A motivated kid will find a way to get the education they want.

BTW, AP classes are another way to knock some money off the tuition bill. Also, in order to speed students through expensive subsidized public universities, some states allow high school students to take community college classes for free. A few of my classmates managed to finish their AA degrees during high school, saving themselves 2 years of college tuition, room, and board.

You certainly are not weird. No reason to sweat it if you don't yet have children.

My young son has APs and a course from U of Mn given thru his H.S. that have been accepted at his University - but he will do a solid 4 years with extra electives anyway...school charges the same no matter what your load!

Mr._johngalt

Thinks s/he gets paid by the post

- Joined

- Dec 3, 2002

- Messages

- 4,801

FlowGirl said:A motivated kid will find a way to get the education they want.

Yep! I ended up in court in order to be squeezed to pay for

a ridiculously expensive college.

Oh, how much sharper than a serpent's tooth is an ungrateful

child.

JG

R

rsboone

Guest

We still have one in college (2 years to go). We gave ours the choice of attending an in-state public college (all expenses paid by Mom & Dad) or an out of state school (Mom & Dad will contribute the equivalent amount of an in-state public school - child is on their own for the rest). Both of ours decided to go in-state - James Madison University and Virginia Tech - both great schools. That's about $12K per year (couldn't imagine paying $40K+ per year). We pay for tuition, room, food and books. All other expenses our kids paid (pay) for from money earned at summer jobs. We are funding a semester abroad this year for our youngest (an extra $5K.)

We have been able to manage this on our retirement income. We only had one year when both were in school, that was a bit tight. I do have to admit that Grandad has contributed some towards their education - which I think is great and I plan to do the same someday for my grandchildren.

Oldest is starting grad school in August (at a state university) - going to work and go part-time. Her place of employment will pay for some of it. We have told both kids they are on their own for grad school (although we might kick it a portion of it).

We have been able to manage this on our retirement income. We only had one year when both were in school, that was a bit tight. I do have to admit that Grandad has contributed some towards their education - which I think is great and I plan to do the same someday for my grandchildren.

Oldest is starting grad school in August (at a state university) - going to work and go part-time. Her place of employment will pay for some of it. We have told both kids they are on their own for grad school (although we might kick it a portion of it).

dex

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 28, 2003

- Messages

- 5,105

The cost of a college education is amazing - Why is it so high? What is driving the costs?

My mother said to me when I graduated high school "I got you through high school the college is up to you." I was able to pay for my Fordham University education by working - no loans - I paid as I went - did it in 4 years. This was in the mid 1970s. I lived at home - that was all the financial support I got. If I was smart enough or had some direction I would have gone out of state for my education and got loans (if I they even were available at that time.) I don't know what I would do if I was faced with that question today.

Currently working with current graduates of collegs I wonder if they are only receiving the level of education I received in high school.

My mother said to me when I graduated high school "I got you through high school the college is up to you." I was able to pay for my Fordham University education by working - no loans - I paid as I went - did it in 4 years. This was in the mid 1970s. I lived at home - that was all the financial support I got. If I was smart enough or had some direction I would have gone out of state for my education and got loans (if I they even were available at that time.) I don't know what I would do if I was faced with that question today.

Currently working with current graduates of collegs I wonder if they are only receiving the level of education I received in high school.

T

TromboneAl

Guest

Mom & Dad will contribute the equivalent amount of an in-state public school - child is on their own for the rest

This was the system I wanted to use, but the problem is that the private schools are so much more expensive, that there's no way the kid can pay the difference.

For example, let's say we said "We'll pay $15,000 max." Since many private schools (e.g. Cornell, MIT, Washington U, Northwesten), cost around $40,000, there's no way the kid could pay the remaining $25,000 per year, unless he/she got major financial aid (which for us frugal savers isn't an option). There's no way for a kid to to get enough loans and jobs to pay $25,000 per year while studying.

So, practically speaking, what we'd really be saying is "You can't go to a college that costs more than about $20,000.

The cost of a college education is amazing - Why is it so high? What is driving the costs?

The way I figure it, the main cause is: Financial aid.

People spend all their money, get need-based financial aid, and the government and other big institutions pay for a good portion of the tuition. Thus they can afford an overpriced education, and the college can charge even more.

Imagine that tomorrow, all financial aid were eliminated. The colleges could no longer fill the seats at $40,000 a pop.

TargaDave

Full time employment: Posting here.

- Joined

- Jul 22, 2005

- Messages

- 588

I'm a believer in rsboone's general approach, especially with more than one kid. With just one (T-Al, Grumpy) you always have more flexibility.

Thought I would throw in a few words about the hi-tech area where I interview-recruit all the time, and where small businesses dominate (I can't speak for other fields and fortune 500's). Where you got an undergrad degree doesn't carry much weight. An MS doesn't take much more effort, it's worth more, and you have an excellent shot at a free TA/RA ride into many good grad schools. After a just a few years of work experience I hardly even look at the school(s) someone attended. Food for thought.

Thought I would throw in a few words about the hi-tech area where I interview-recruit all the time, and where small businesses dominate (I can't speak for other fields and fortune 500's). Where you got an undergrad degree doesn't carry much weight. An MS doesn't take much more effort, it's worth more, and you have an excellent shot at a free TA/RA ride into many good grad schools. After a just a few years of work experience I hardly even look at the school(s) someone attended. Food for thought.

grumpy

Thinks s/he gets paid by the post

- Joined

- Jul 1, 2004

- Messages

- 1,321

TargaDave said:I'm a believer in rsboone's general approach, especially with more than one kid. With just one (T-Al, Grumpy) you always have more flexibility.

For the record, Mrs. Grumpy and I have two children. College expenses for our oldest child were a snap because we had been saving since his birth and he got a partial scholarship (50%) to a public university for swimming. Of course, we had lots of expenses prior to that flying him (and us) all over the country to compete in high level meets. During his college years we also made international trips to see him compete.

Grumpy

grumpy said:For the record, Mrs. Grumpy and I have two children. College expenses for our oldest child were a snap because we had been saving since his birth and he got a partial scholarship (50%) to a public university for swimming. Of course, we had lots of expenses prior to that flying him (and us) all over the country to compete in high level meets. During his college years we also made international trips to see him compete.

Grumpy

Swimming is the best competitive sport - indivdual and team...

My 3 started competitve swimming at age 5 (polliwogs!) and stayed with it through H.S. and all lifeguard qualified now..Wife and I really had a great time timing and watching...although sitting for all those hours on some pretty uncomfortable bleachers can really test your resolve...

DanTien

grumpy

Thinks s/he gets paid by the post

- Joined

- Jul 1, 2004

- Messages

- 1,321

DanTien said:Swimming is the best competitive sport - indivdual and team...

My 3 started competitve swimming at age 5 (polliwogs!) and stayed with it through H.S. and all lifeguard qualified now..Wife and I really had a great time timing and watching...although sitting for all those hours on some pretty uncomfortable bleachers can really test your resolve...

DanTien

I agree. We are a swimming family. I met my wife while I was the waterfront director of a camp for retarded and emotionally disturbed children and she was one of my swimming instructors. Both of our kids learned to swim before they could walk. I was the meet manager for their summer league team for many years and was a stroke and turn judge for high school meets. I swam in Master's competitions for many years and I still swim a mile several times a week. My son was Atlantic Coast Conference champ 4 times in the 100 and 200 yard breaststroke and was a finalist in the 200 breast at the 1996 Olympic Trials. It's a great sport that can be enjoyed your whole life.

Grumpy

T

TromboneAl

Guest

I have to say that I don't like swimming from the parent's perspective. Sit on bleachers for 8 hours in a humid, loud environment to watch 3 minutes of action. No likey.

TargaDave

Full time employment: Posting here.

- Joined

- Jul 22, 2005

- Messages

- 588

grumpy said:For the record, Mrs. Grumpy and I have two children.

Grumpy

Sorry Grumpy. Sounded like one. Glad to see you have managed two quite well.

TromboneAl said:I have to say that I don't like swimming from the parent's perspective. Sit on bleachers for 8 hours in a humid, loud environment to watch 3 minutes of action. No likey.

Yeah, have to be careful not to start gabbing with other parent and miss a race you been waiting an hour for and an hour before the next one.

"Dad, did you see what time I had?"

Similar threads

- Replies

- 15

- Views

- 1K

- Replies

- 13

- Views

- 797