Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

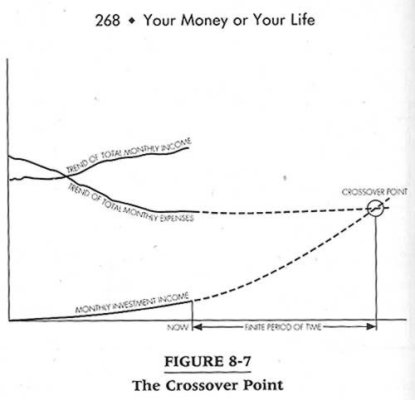

I enjoyed YMOYL a lot! But if you haven't read it and are considering it now, the "punch line" might leave you very disappointed. It's recommendation of relying entirely on bond income, while still possible, isn't nearly as realistic today as it was when the book was written. Indeed if you followed YMOYL's recommendation and retired well before the financial meltdown, yields since then may be cause for great concern.

MMM said:In the early 1980s, you could buy 30-year government bonds with a nominal yield of over 12%. Even in the surrounding time periods, yields were well over 7%. The YMOYL authors liked the guaranteed return and decided to use these bonds as a complete income source.

Due to our continued hangover from the financial crisis, the latest figure for the 30-year bonds is about 2.9%. While it is still possible to retire on bonds, I consider an over-50% reduction in investment returns in exchange for “safety” to be too high a price to pay. Safety is just an expensive illusion anyway.