Well, maybe. "What does the cushion cost me?" is an important question you may have missed.

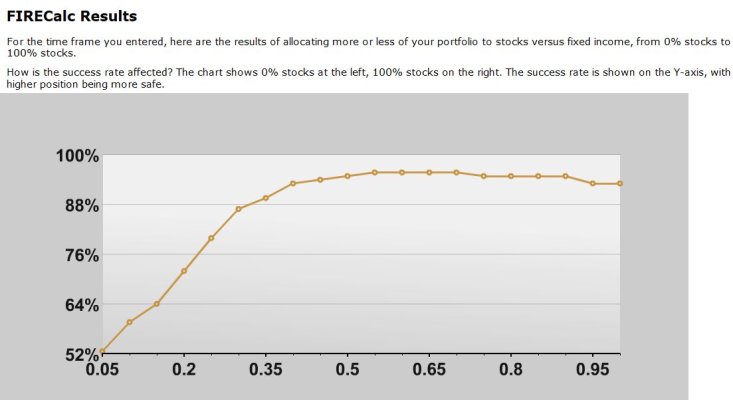

Boring, I know, but here is a chart I have posted a couple of times before:

(Note that the Y-axis is logarithmic.) What you may be missing is that fear of volatility is causing you to put close to half of your portfolio in assets that (if history is any guide) grow very slowly. If that major hit to the potential growth of your portfolio will still leave you where you want to be for the many decades in your future, then that's fine. You are where you want to be during your accumulation phase.

To your thread-title question, I think there's a strong argument that one needs some conservative money (cash, bonds) during the drawdown phase in order to reduce or eliminate SORR risk. For ourselves we were close to 100% equities until we started to phase into retirement. Then we were 60/40 for a while until we realized that 40% fixed income was far more than we would ever need. So we were at 75/25 prior to the current excitement. I have not bothered to recalculate (a) because the input signal is changing faster than I can change the output and (b) because it doesn't matter anyway. The market drop has, for us, turned our cash and bonds tranche into a bucket that we expect to use for at least a few years. We take a serious portfolio look once a year right after Christmas and no doubt we'll do the same this year.

Be well and be careful.