slowsaver

Recycles dryer sheets

+13.55% @ 50% US Stock (7% REIT), 20% Foreign Stock, 30% Bonds.

Only up half a point from October and finishing November YTD with 12.65% on the upside.

| Date | YTD return |

| 12/29/17 | 14.55% |

| 11/30/17 | 13.77% |

| 10/31/17 | 12.27% |

| 09/30/17 | 10.95% |

| 08/31/17 | 9.56% |

| 07/31/17 | 9.17% |

| 06/30/17 | 7.47% |

| 05/31/17 | 6.89% |

| 04/30/17 | 5.60% |

| 03/31/17 | 4.54% |

| 02/28/17 | 3.82% |

| 01/31/17 | 1.78% |

I close out the year with 21.1% return.

AA is 70-73% stock, with the rest in cash with low yield like I-bonds.

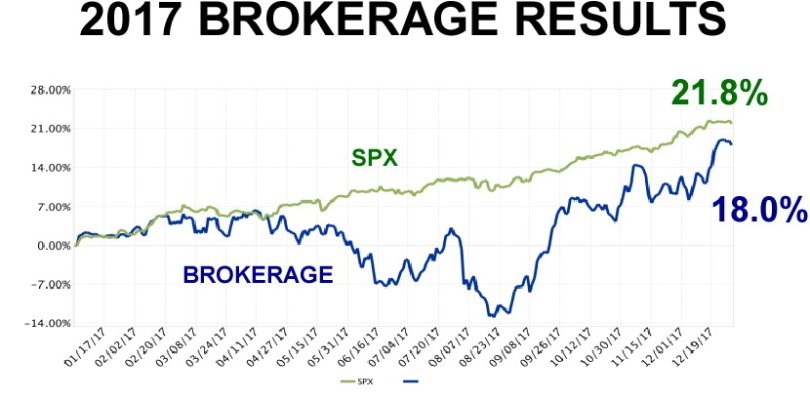

Time weighted return of 18.02% inclusive of dividends, margin interest and brokerage fees.

View attachment 27482

SPX benchmark index was 21.8%, so returns lagged the passive index.

Overweight in energy names, which hurt performance and caused anxiety mid year as prices sagged during a bout of shale oil pessimism . The big tech names were the winners this year, of which I did hold AAPL as well as AMZN (partial year). But not enough to offset the poor performance in energy.

Of course no one can be dissatisfied with a 18% annual return.

And 2018 is another year starting on Tuesday, best luck to all.