robnplunder

Thinks s/he gets paid by the post

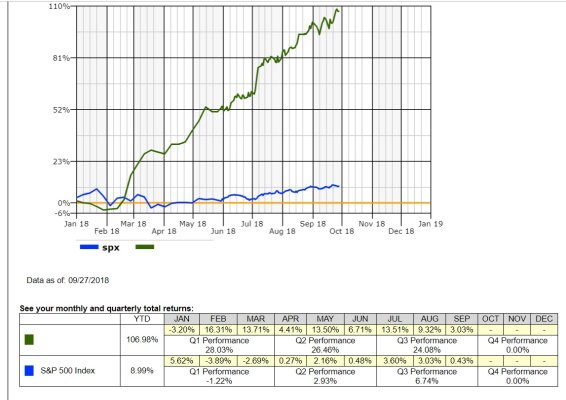

Up 3.8% ... on a pace to spend more than 4% of my investment/asset this year due to several unplanned expenses (e.g, paying 50% of DS's graduate school expense). Oh, well.

Dipped to +3.3%. Several of my stock funds took more hit than the rest.