NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

I am quite happy with my 2019 result as reported earlier. I came close to the S&P return, while not being 100% in stock.

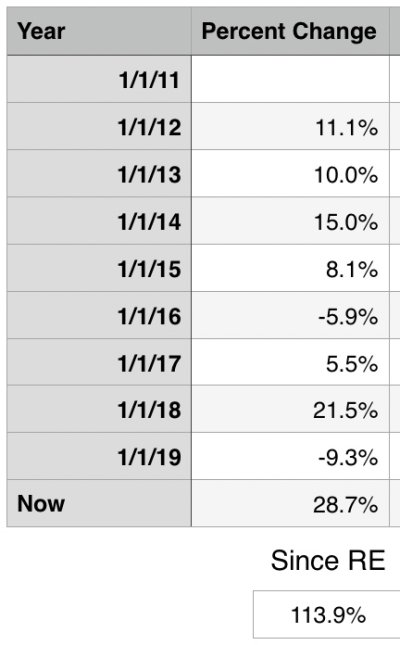

Is it the best I ever had? I don't think so, but I only have definite numbers going back to 2011, because that was when I started tracking in/outflow to do an accurate return calculation. And the 2019 number is the best of the last 9 years.

But here's something that I found. In 2013, the S&P returned more than 32%. Wowza! My return was a bit less than 1/2 of that, although I was usually about 70% in stock. I was trailing badly.

How did I miss that? Thinking back, it was the year I was having a bad health problem, and when your days on earth might be numbered, you don't spend too much time watching your stocks.

Is it the best I ever had? I don't think so, but I only have definite numbers going back to 2011, because that was when I started tracking in/outflow to do an accurate return calculation. And the 2019 number is the best of the last 9 years.

But here's something that I found. In 2013, the S&P returned more than 32%. Wowza! My return was a bit less than 1/2 of that, although I was usually about 70% in stock. I was trailing badly.

How did I miss that? Thinking back, it was the year I was having a bad health problem, and when your days on earth might be numbered, you don't spend too much time watching your stocks.