You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

60 Minutes /401 K

- Thread starter ferco

- Start date

MikeD

Full time employment: Posting here.

I saw it. Sounded like they usually complaining when people with too much equity lost money. They hit the jackpot with the crying woman victim. The paperwork she showed looked like a Vanguard statement to my wife.

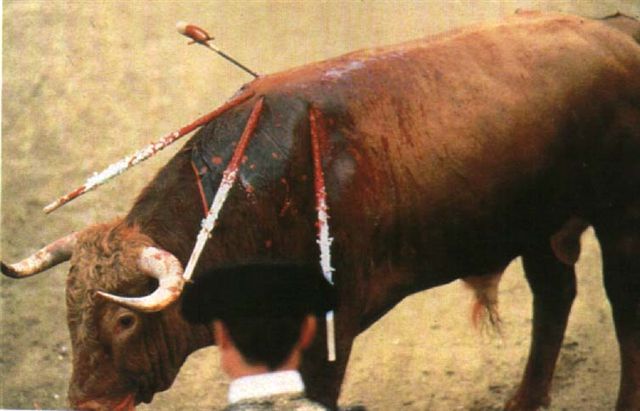

I changed the channel when they started airing the animal abuse segment about bull fighting.

Mike D.

I changed the channel when they started airing the animal abuse segment about bull fighting.

Mike D.

TeeRuh

Recycles dryer sheets

actually you missed a pretty good segment on the bull fighting. (don't think they hardly touched upon the animal abuse angle; may have been one comment about the bull's chances on surviving the match) Story was about a couple of 3rd generation bull fighters. One (having spent most of his life in U.S.A) wasn't very good and "lost" a couple of matches ...

How many of you saw the showing last night of 60 minutes (Sunday 4/19)? What's your opinion of the state of the union of American's 401k's.

I saw this segment on the 401k's and feel badly for the people that lost a bunch; however, didn't they tell the people that you should never bet more than you can lose ala don't put more into stocks than you can afford to lose? Didn't those people know? Over the years I've made some and lost some in my 401k; but the closer I got to retirement the less I had in stocks. More bonds and CD's, less stocks. Even in retirement I only had 20% stocks and once I reached 70 I was 100% in CD's. In that segment, I don't understand all the fees they were talking about. My 401k was managed by Fidelity and I never saw those fees that were discussed. It tells me you have to read all the fine print.

I thought it was a pretty good piece.

Yes, many people have lost a lot of money in their portfolio. But I thought it was good that they got both sides of the story.

For those close to retirement, they should have had less exposure to equities. And many, even if they lost 40%-50% still have all the money they invested as many companies match at least 50%.

I found the bull fighting distastful. Seeing the killing with the bull's back and side covered in blood was about all I could take during dinner. If I do ever watch another bull fight I am rooting for the bull

Yes, many people have lost a lot of money in their portfolio. But I thought it was good that they got both sides of the story.

For those close to retirement, they should have had less exposure to equities. And many, even if they lost 40%-50% still have all the money they invested as many companies match at least 50%.

I found the bull fighting distastful. Seeing the killing with the bull's back and side covered in blood was about all I could take during dinner. If I do ever watch another bull fight I am rooting for the bull

tmm99

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 15, 2008

- Messages

- 5,221

And many, even if they lost 40%-50% still have all the money they invested as many companies match at least 50%.

What?? Match at least 50%

Maybe match 50% of the first 0-5% of your contribution. I've never worked for a company that matched 50% of the max (15%) I've put in. The lowest percentage a company contributed for me was 0% (no match whatsover) and the highest - 100% up to 3% and 50% match for other percentages up to 5%. This is not to say that company match doesn't count. I am just saying if you lost 40%-50% of your total contribution, the loss cannot be sustained by the company match alone. Not even close. But maybe like you say, some companies do give better contribution than I get.

Yeah, I agree, people should reconsider the equity/bond ratio as they near retirement. The fact is that many people probably had the asset allocation etc on auto pilot and half of them probably don't even understand the implication of which fund works in what way. I used to be a little bit like one of those people. Set it and forget it (although I did study the funds and diversified, I never rebalanced). Looking back, I could have done more, but that is only in hindsight. I am now a bit worried that people who lost a lot of money nearing retirement age cannot afford to be conservative at this point in their asset allocation.

I actually called Fidelity a year or so ago asking about administrative and expense fees involved in some of the funds available in one of my 401K's (they look like regular index funds but they look slightly different - they are institutional funds) and Fidelity's response was that they didn't have to publish the fees for those funds (by law), so I still don't know the overhead involved with them.

I also know, reading diehards in the past, some 401K have very lousy funds to choose from (high expense, limited, etc) so that is a big negative for some people.

Yes, I did watch the 401K segment (I sped through bull fighting. I never understood the fascination with any violet sports). The one who cried on TV that were showing the 401K statement had the total balance of about $4000 in the statement (I guess it was double that before the crash.) Any money loss can be painful, but if you don't compare it to the peak, it shouldn't feel so bad.

One of my rolled over 401K money which I stopped contributing to in 1996 doubled in 5 years between 2002-2007, and now it is back to 2003 (25% less than the peak). Do I feel bad? Sure, but not as bad as I feel about my active 401K which I am pumping in the max amount every year. It's like all the money I put in in the last 2 years has evaporated, but that is only because I am looking at the last 2 years only.

You are taking a chance when you invest in equities; otherwise, you should be investing in CD's.

Poundkey

Recycles dryer sheets

I had a 401K at a rinky dink shop in a small town years ago. The trustee was a local bank and the admin. was some accounting firm in Dallas. Not a bad plan. Matched 25% up to 6% and had 3 decent investment choices. We only got one statement per year and when I compared my returns to that of the actual fund I was in there was a pretty big difference, so the hidden fees were significant.

The thing that irked me the most was when I left the job and rolled the 401 into VG. I resigned mid year, but was only credited with what was on the most recent statement which came out in January. In that time my account should have grown several hundred dollars according to my calculations. I called the trustee and the admin. and neither gave me a good explanation of where that money went. I think the best I got was that the money would "probably" be split between the employees still in the plan.

The thing that irked me the most was when I left the job and rolled the 401 into VG. I resigned mid year, but was only credited with what was on the most recent statement which came out in January. In that time my account should have grown several hundred dollars according to my calculations. I called the trustee and the admin. and neither gave me a good explanation of where that money went. I think the best I got was that the money would "probably" be split between the employees still in the plan.

I had the 100% match up to 3% and 50% match up to 6%. I suppose your overall match drops quickly if you invest more than the company will match.

And I am sure some people don't get any match, but I am also sure some do

I think the most important point out of that section was the need for people to have some education about investments.

And I am sure some people don't get any match, but I am also sure some do

I think the most important point out of that section was the need for people to have some education about investments.

I had a 401K at a rinky dink shop in a small town years ago. The trustee was a local bank and the admin. was some accounting firm in Dallas. Not a bad plan. Matched 25% up to 6% and had 3 decent investment choices. We only got one statement per year and when I compared my returns to that of the actual fund I was in there was a pretty big difference, so the hidden fees were significant.

The thing that irked me the most was when I left the job and rolled the 401 into VG. I resigned mid year, but was only credited with what was on the most recent statement which came out in January. In that time my account should have grown several hundred dollars according to my calculations. I called the trustee and the admin. and neither gave me a good explanation of where that money went. I think the best I got was that the money would "probably" be split between the employees still in the plan.

one time i looked at someone's plan that was managed by Blackrock. there were so many fees, i thought it was a merchant credit card agreement at first

clifp

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 27, 2006

- Messages

- 7,733

I thought it was a pretty good piece.

Yes, many people have lost a lot of money in their portfolio. But I thought it was good that they got both sides of the story.

For those close to retirement, they should have had less exposure to equities. And many, even if they lost 40%-50% still have all the money they invested as many companies match at least 50%.

Actually I thought it was a lousy piece, since "other side" consisted of the 401K lobbyist. He sounded like a out of touch netwit with a Scrouge like compassion. How do these highly paid lobbyist sound so bad on 60 Minutes. Are they really this stupid, or are the 60 Minutes editors particularly clever.

The irony is that not too long ago 60 Minutes did a piece about the problems with pensions of bankrupt companies. Something millions of retired GM workers are about learn first hand.

Over the years 60 Minutes has done a number of stories of the funding problems of Social Security. What they also need to do is a story about the massive underfunding of state and local pensions.

In fact they should have 60 Minutes special just about the challenges of retirement, basically all three legs of the stool are wobbly. Then after they had completely depressed everyone, if they were somewhat responsible they do any hour on possible solutions.

The retirement system for Federal workers is actually a pretty good model for both the private and state and local to use. A generous, but not ridiculously so, pension funded partially by employee contributions. The excellent Thrift Savings Program, with extremely low cost. easy to understand funds, plus Social security.

If you are dumb, irresponsible, and/or unlucky you can have an adequate retirement with just Pension+ SS. If you want to have a better retirement or early retirement you'll need to save via the TSP.

Story was about a couple of 3rd generation bull fighters. One (having spent most of his life in U.S.A) wasn't very good and "lost" a couple of matches ...

Was I the only one cheering when the one brother got gored at the end?

I sat through the whole disgusting segment, just stunned that they didn't bother with any mention at all of the whole barbaric cruelty of the spectacle.

clifp

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 27, 2006

- Messages

- 7,733

Now I liked the bullfight piece. No I was not cheering. I find it remarkable that a family can produce so many talented bullfighters. I was more than bit jealous, how damn handsome the brother are.

Personally, I see little difference between UFC, Boxing, Bullfighting, Hockey, and NASCAR the blood is big part of the attraction.

Personally, I see little difference between UFC, Boxing, Bullfighting, Hockey, and NASCAR the blood is big part of the attraction.

People in sports choose to play it and at a high level are motivated by very big reward.Personally, I see little difference between UFC, Boxing, Bullfighting, Hockey, and NASCAR the blood is big part of the attraction.

Given a choice I suspect the bull would prefer to be left alone.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

One (having spent most of his life in U.S.A) wasn't very good and "lost" a couple of matches ...

If it were up to me these would be fair fights and no one would ever have the opportunity to lose more than once.

clifp

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 27, 2006

- Messages

- 7,733

People in sports choose to play it and at a high level are motivated by very big reward.

Given a choice I suspect the bull would prefer to be left alone.

Given my choice between being reincarnated as bull that goes into ring, or cow or bull that is in factory farm, where they never see sunlight, have sex or graze in a pasture. I'll take the bullfighting option please. I suspect that 95% of farm animals have far worse lives.

Actually I thought it was a lousy piece, since "other side" consisted of the 401K lobbyist. He sounded like a out of touch netwit with a Scrouge like compassion.

Well I agree he wouldn't win any personality contests. But is there any statement you can point out that you disagree with?

Would you disagree with his comment that people need education about their financial investments? I rather thought that one was at the crux of not only some of the worse 401K losses, but the general financial trouble many people find themselves in.

Picking the lesser of two evils doesn't rationalize approval or support of either one.Given my choice between being reincarnated as bull that goes into ring, or cow or bull that is in factory farm, where they never see sunlight, have sex or graze in a pasture. I'll take the bullfighting option please. I suspect that 95% of farm animals have far worse lives.

Forcing a bull to be harassed or injured for the entertainment of others is not in any way comparable to someone deciding to be a UFC fighter or hockey player.

CyclingInvestor

Thinks s/he gets paid by the post

What?? Match at least 50%

Maybe match 50% of the first 0-5% of your contribution. I've never worked for a company that matched 50% of the max (15%) I've put in. The lowest percentage a company contributed for me was 0% (no match whatsover) and the highest - 100% up to 3% and 50% match for other percentages up to 5%. This is not to say that company match doesn't count. I am just saying if you lost 40%-50% of your total contribution, the loss cannot be sustained by the company match alone. Not even close. But maybe like you say, some companies do give better contribution than I get.

I owe a large part of my retirement at 48 to my 1st 401k, from 1983-1997 at a small aerospace firm. For most of that time they matched 50% of your contribution to 10%, plus 10% in addition. This meant that since I put in the max 10% each year, they added 15% more (=25% of my base salary + overtime). I knew at the time it was a good deal, but I did not realize just how valuable those $$ would be until I closed in on retirement.

clifp

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 27, 2006

- Messages

- 7,733

Well I agree he wouldn't win any personality contests. But is there any statement you can point out that you disagree with?

Would you disagree with his comment that people need education about their financial investments? I rather thought that one was at the crux of not only some of the worse 401K losses, but the general financial trouble many people find themselves in.

No I didn't think he said anything wrong. He came across as being unsympathetic to the losses people suffered and did a horrible job defending his product.

If I was hired to be the spokesman for the 401K industry, I come to a 60 Minute interview and I want to make 3 points.

1.) If you invest say 10% got a 3% employee match, since you were in your mid 20s worked for 30 years and now are in 55. You still have a lot more money than you put in. A nice little chart showing contributions vs expected value using a life cycle fund or a gradually increasing bond AA using the Vanguard Total Stock Market index and Bond index fund.

2.) Acknowledge that financial education has been crappy, but point out that folks had asset allocations appropriate to there age typical lost in 20-30%. A large a painful blow, but it is entirely possible that this losses would be recovered in a several years.

3. Point out recent improvements in the 401K field, Lifecycle funds, employers providing more education. Finally, let people that unlike with an IRA you can withdraw money penalty free from a 401K at 55 not 59.5, if you were terminated.

Lifecycle/target date funds should be huge in 401k plans for automatic enrollment. Use age of new hire to automatically drop 'em into the appropriate lifecycle fund bucket, give them literature explaining how lifecycle funds work and why they were put there.

If person wants to dig in to manage their fund more fine, the rest should be (relatively) okay. Hell maybe even give 'em an option to automatically shift their assets if a birthday makes them more suitable for a different bucket.

If person wants to dig in to manage their fund more fine, the rest should be (relatively) okay. Hell maybe even give 'em an option to automatically shift their assets if a birthday makes them more suitable for a different bucket.

Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,266

No I didn't think he said anything wrong. He came across as being unsympathetic to the losses people suffered and did a horrible job defending his product.

If I was hired to be the spokesman for the 401K industry, I come to a 60 Minute interview and I want to make 3 points.

1.) If you invest say 10% got a 3% employee match, since you were in your mid 20s worked for 30 years and now are in 55. You still have a lot more money than you put in. A nice little chart showing contributions vs expected value using a life cycle fund or a gradually increasing bond AA using the Vanguard Total Stock Market index and Bond index fund.

2.) Acknowledge that financial education has been crappy, but point out that folks had asset allocations appropriate to there age typical lost in 20-30%. A large a painful blow, but it is entirely possible that this losses would be recovered in a several years.

3. Point out recent improvements in the 401K field, Lifecycle funds, employers providing more education. Finally, let people that unlike with an IRA you can withdraw money penalty free from a 401K at 55 not 59.5, if you were terminated.

Who knows if he did or did not say any or all of the above... we do not have the whole interview...

But IMO he was right in that most people do NOT know what to do and chase the best total return without thinking about the risks...

Also, that lady that was so upset.... she had a balance that was less than $5K... it was a profit sharing plan... she said (IIRC) that she had another account with $80K or thereabout... I do not think that her retirement would be much different IF she had another $80K saved.. if you live in NY, you can burn through that amount of money in one year...

And to me that was the rub... most people did not have enough money in the first place... and now that they have only half as much will blame the crisis on their plight... even though they could not have retired like they had wanted with the money they had... so in a way, for some... the crisis has forced them to look at what they have and to continue to work... if they had retired with no crisis, they would have run out of money anyhow....

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

The problem rests more with the "bundled" approach insurance companies like Principal Financial and others have been dealing for years. They bamboozle the senior management of firms by saying there is "no yearly cost" for their services, when in reality they are paying up to 3% or so.........

No I didn't think he said anything wrong. He came across as being unsympathetic to the losses people suffered and did a horrible job defending his product.

If I was hired to be the spokesman for the 401K industry, I come to a 60 Minute interview and I want to make 3 points....

Very well said, I apologize for mistaking your criticism of the interview for criticism of the facts presented in the interview.

I would be very interested in seeing the entire raw footage of the interview. As already mentioned, it would be interesting to see the raw footage and then the edited version.

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

I would be very interested in seeing the entire raw footage of the interview. As already mentioned, it would be interesting to see the raw footage and then the edited version.

I would like to see that for ALL Dateline and 60 minutes segments, as well as ANY political interviews.........

Who knows if he did or did not say any or all of the above... we do not have the whole interview...

But IMO he was right in that most people do NOT know what to do and chase the best total return without thinking about the risks...

Also, that lady that was so upset.... she had a balance that was less than $5K... it was a profit sharing plan... she said (IIRC) that she had another account with $80K or thereabout... I do not think that her retirement would be much different IF she had another $80K saved.. if you live in NY, you can burn through that amount of money in one year...

And to me that was the rub... most people did not have enough money in the first place... and now that they have only half as much will blame the crisis on their plight... even though they could not have retired like they had wanted with the money they had... so in a way, for some... the crisis has forced them to look at what they have and to continue to work... if they had retired with no crisis, they would have run out of money anyhow....

i've heard of people in NYC outliving their retirement money and still living comfortably on SS. key is to have your home paid off completely

NYC property taxes are a lot lower than the ones in the suburbs and seniors get a discount as well

Similar threads

- Replies

- 41

- Views

- 3K

- Replies

- 61

- Views

- 3K

- Replies

- 35

- Views

- 4K