I have read the advice here and on the boglehead forums and in the recommended books (Millionaire Teacher) to invest in the lowest fee index funds. But is that the only thing to look at when making the choice(s)?

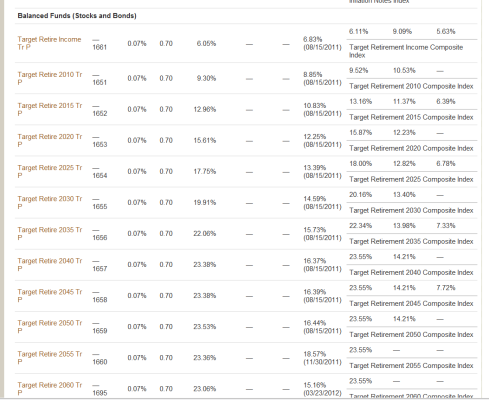

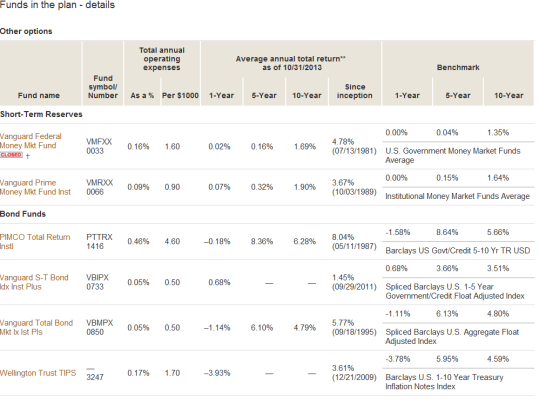

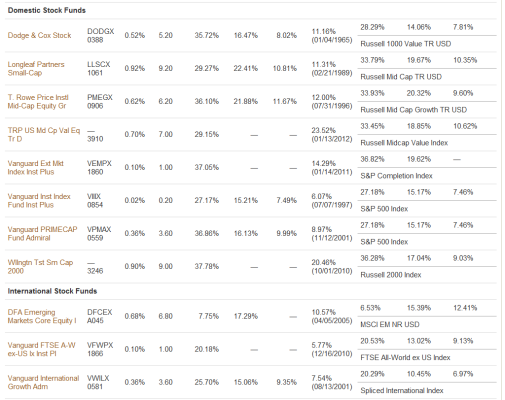

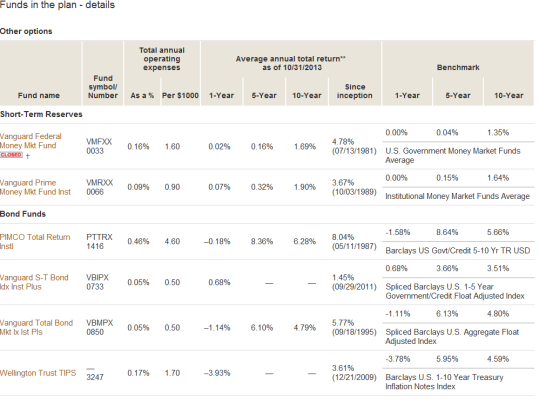

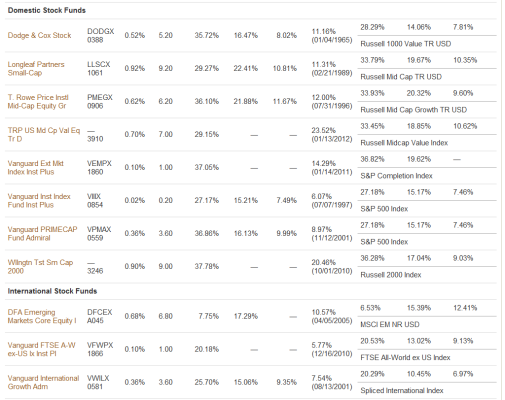

In looking at my 401K fund options with Vanguard (I tried to attach to this post, not sure if successful), they list not only expense ratios, but performance over 1, 5, 10 year returns (I know, past performance is not a future indicator of future performance) and also have some information on how many stocks are included in the index, what type - like mid cap, small cap, etc.

For me, the novice and super disorganized/lazy investor just trying to figure out a path forward, it would seem easiest to just pick a total market index fund with the lowest expense ratio. Pick a broad-based intl index fund with the lowest ER and then ditto for the bond fund. So all things being equal, do I just pick the lowest ER total index fund and not look at past performance or other fund info?

On a positive note, since I have taken on trying to learn about how to fix our retirement and budget better, we discovered yesterday that DH has an old rollover IRA from years back that we totally forgot about - we don't get mailed statements and it sort of fell off the radar (...sad, I know. We are THAT BAD in dealing with our finances ...but I'm trying to fix that!). It has grown a lot (almost 100K!), just sitting there untouched for years, invested in 100% vanguard stock index funds. Kind of like finding money in an old winter coat - but way better! It puts us closer to an earlier retirement.

...but I'm trying to fix that!). It has grown a lot (almost 100K!), just sitting there untouched for years, invested in 100% vanguard stock index funds. Kind of like finding money in an old winter coat - but way better! It puts us closer to an earlier retirement.

Thanks for input.

In looking at my 401K fund options with Vanguard (I tried to attach to this post, not sure if successful), they list not only expense ratios, but performance over 1, 5, 10 year returns (I know, past performance is not a future indicator of future performance) and also have some information on how many stocks are included in the index, what type - like mid cap, small cap, etc.

For me, the novice and super disorganized/lazy investor just trying to figure out a path forward, it would seem easiest to just pick a total market index fund with the lowest expense ratio. Pick a broad-based intl index fund with the lowest ER and then ditto for the bond fund. So all things being equal, do I just pick the lowest ER total index fund and not look at past performance or other fund info?

On a positive note, since I have taken on trying to learn about how to fix our retirement and budget better, we discovered yesterday that DH has an old rollover IRA from years back that we totally forgot about - we don't get mailed statements and it sort of fell off the radar (...sad, I know. We are THAT BAD in dealing with our finances

...but I'm trying to fix that!). It has grown a lot (almost 100K!), just sitting there untouched for years, invested in 100% vanguard stock index funds. Kind of like finding money in an old winter coat - but way better! It puts us closer to an earlier retirement.

...but I'm trying to fix that!). It has grown a lot (almost 100K!), just sitting there untouched for years, invested in 100% vanguard stock index funds. Kind of like finding money in an old winter coat - but way better! It puts us closer to an earlier retirement.

Thanks for input.

to admit. But also a truthful indication of our (past) investment approach.

to admit. But also a truthful indication of our (past) investment approach.