RetiredHappy

Thinks s/he gets paid by the post

- Joined

- Jun 27, 2021

- Messages

- 1,596

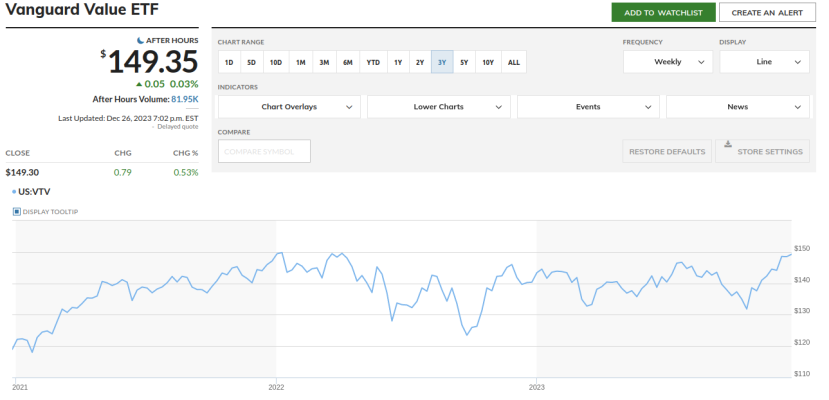

So... ever since we took back management of our investments in Sep 2021, we invested about 8% of our funds into VTV. Performance of 2022 was not too bad as it was not down as much as Tech and S&P 500. Then this year it totally sucks. Our goal has been to diversify amongst a few ETFs.

We are trying to lock in some capital losses to net off the capital gains that we have incurred this year and I can harvest some losses from VTV holdings in the taxable accounts.

If you look at VTV past performance, it did not perform poorly until the past 12 months or so.

I think the question that I have is whether to sell half or all of VTV and buy VOO instead. I understand that VTV is value ETF as opposed to VOO's S&P 500. I don't really need higher dividends.

We are trying to lock in some capital losses to net off the capital gains that we have incurred this year and I can harvest some losses from VTV holdings in the taxable accounts.

If you look at VTV past performance, it did not perform poorly until the past 12 months or so.

I think the question that I have is whether to sell half or all of VTV and buy VOO instead. I understand that VTV is value ETF as opposed to VOO's S&P 500. I don't really need higher dividends.