pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

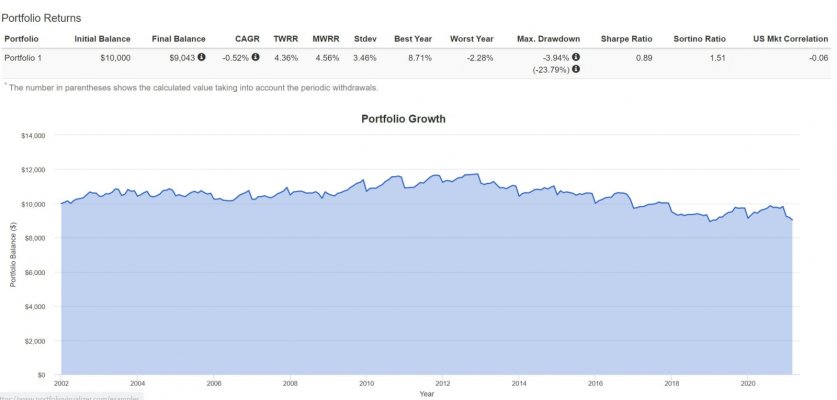

Look at the numbers in relative terms though. In 2021 yields increased 65%. But the actual yield only rose from .89% to 1.20%. So that was only 31 basis points.

For the yield to increase a full 100 basis points it would need to almost double. How likely is that to happen in the near future?

I dunno... given that it has increased from 0.93% at th beginning of 2021 to 1.54% today... a 0.61% increase in a tad over two months... a 100 bps increase if the ecomony recovers and we have an inflation threat seems very possible to me. YMMV.