pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Very few (hopefully none) have their entire portfolio in fixed income. It also assumes today's yields will continue.

Actually, a lot of us are 100% fixed or near to 100% fixed. We are in the "won the game" and no longer care or need to play category... so we took our ball and stick and have gone home.

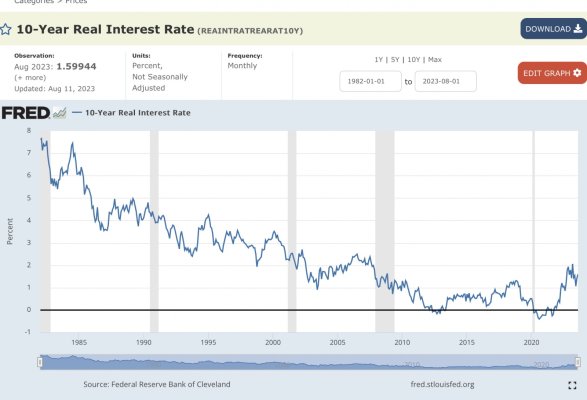

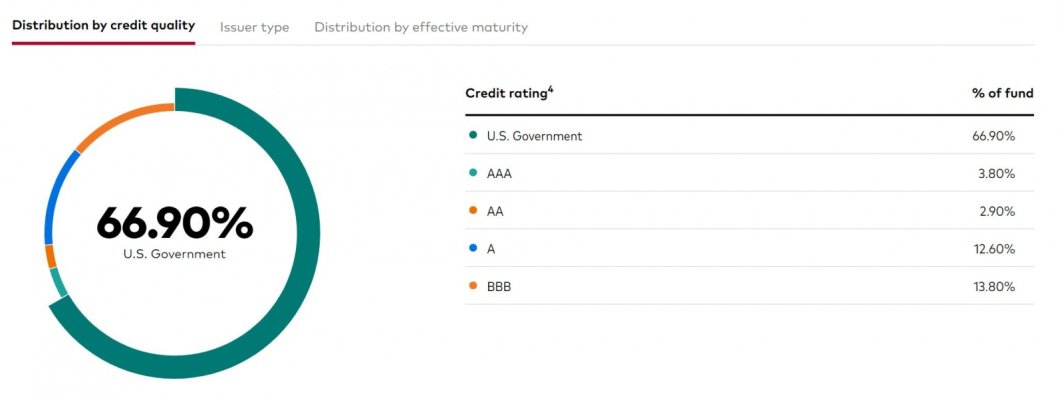

Overfunding makes inflation less of a concern, but I think I can achieve 2% real return in the long run with less risk than equities.