Spanky

Thinks s/he gets paid by the post

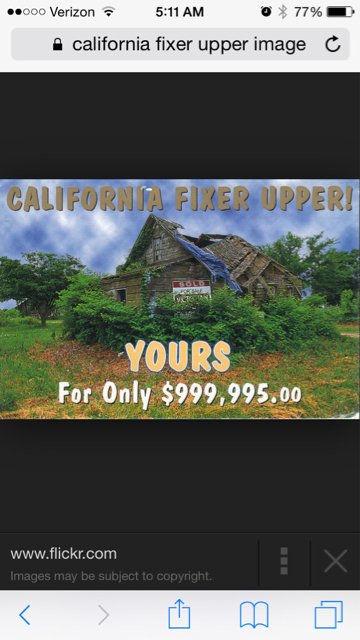

One possible way to reach FI early is working as a software developer or manager in Silicon Valley according to some of the discussion at What is the average savings of a software developer in San Francisco area? - Quora

Despite well-known high-tech compensation in the Bay Area, some of claims seem high, however.

Anyway, DD just started working as a software engineer there a year ago after graduation, making over $100K (just in salary) already. Cost of housing is very high (~2x average), but the pay definitely compensates it quite nicely.

37 single, $250k/yr including bonuses.

Net worth property $2.1m.

Overall net worth over $7m.

I still feel like I'm a small tadpole in a very big ocean maneuvering around to not get eaten to stay alive in this fast paced lifestyle.

Despite well-known high-tech compensation in the Bay Area, some of claims seem high, however.

Anyway, DD just started working as a software engineer there a year ago after graduation, making over $100K (just in salary) already. Cost of housing is very high (~2x average), but the pay definitely compensates it quite nicely.