pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

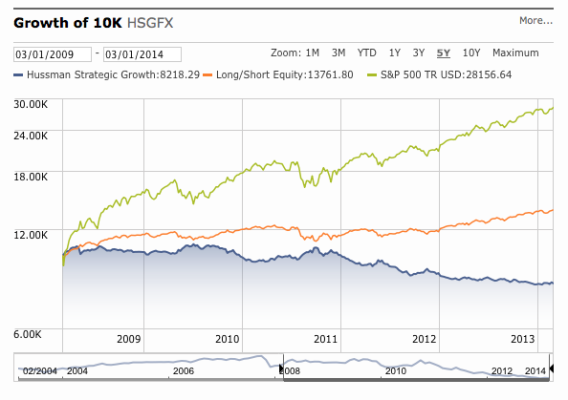

..I expect a real return of 2% - 3% over the next ten years..I'm much less confident that the stock market will provide that..I base most of my opinion on what John Hussman says as..

Per Vanguard's 2014 economic and investment outlook:

....the expected ten-year median return of the broad taxable U.S. fixed income market is centered in the 1.5%–3.0% range...

For the next ten years, our VCMM simulations project a median inflation rate averaging close to 2.0%–2.5% per year for the U.S. Consumer Price Index.... This is roughly consistent with the Federal Reserve’s long-term goal of inflation stability and is also near longer-term break-even rates in the Treasury Inflation-Protected Securities (TIPS) market.

So it looks to me as if real returns for bonds will be minimal, and not anywhere near 2-3% which seems to be wishful thinking.

https://personal.vanguard.com/pdf/ICREIO.pdf