VanWinkle

Thinks s/he gets paid by the post

This is pretty much the standard advice here, and it has the advantage of being conventional and there relatively immune to criticism.

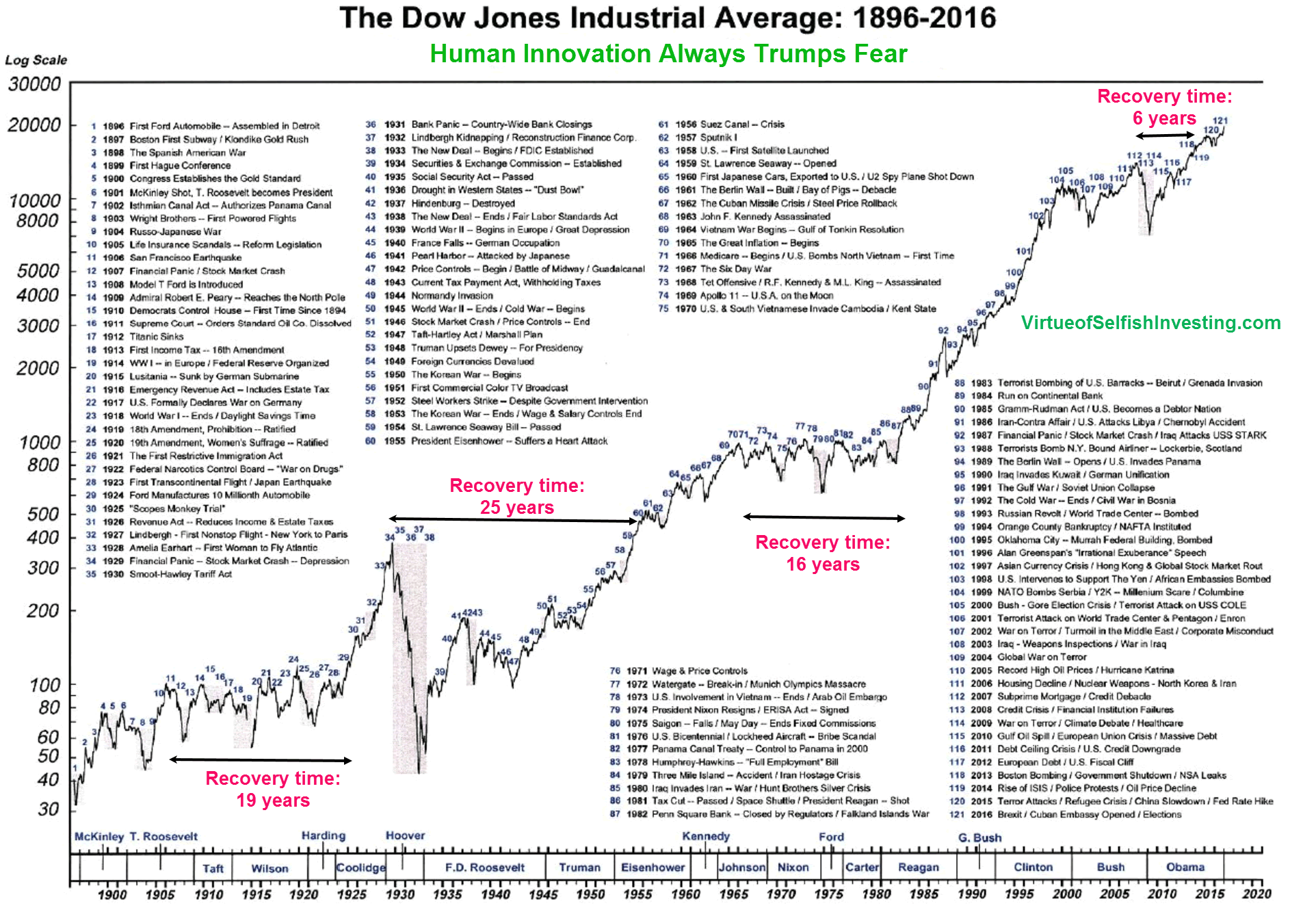

However, experience with markets suggests that there are better and worse times to have more or less money in US stocks. These times can never be absolutely known, but IMO using educated guesses about times to go heavy, and times to be light tends to improve results.

This is for large groups, not individual stocks.

Ha

According to all of the academics that follow information about market timing, no one knows how to do it, they don't even know anyone that knows anyone that can do it.

It usually leads to reduced results IMO.