HI Bill

Thinks s/he gets paid by the post

- Joined

- Dec 26, 2017

- Messages

- 2,556

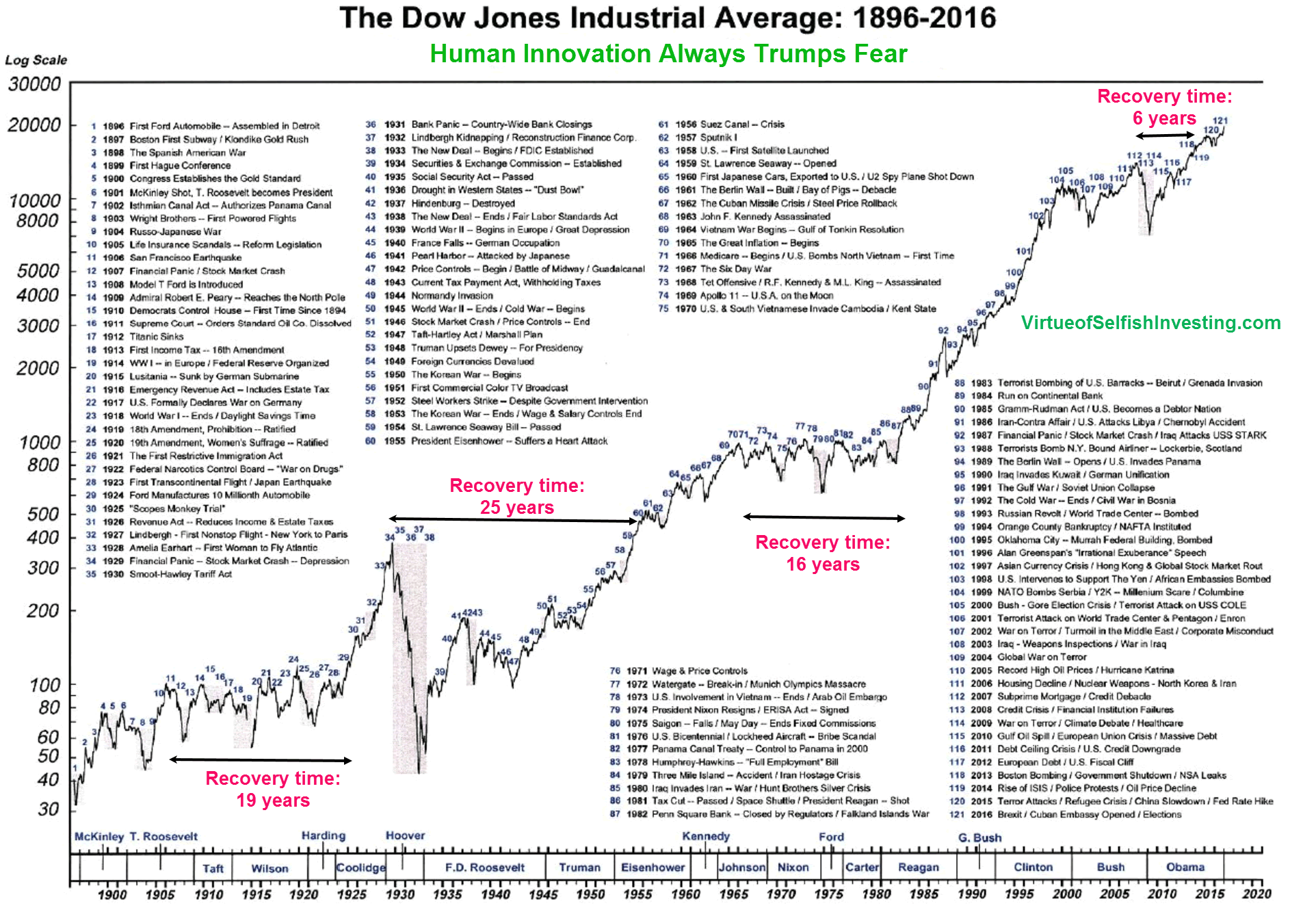

20 years ago, I too, said that the market was broken. At least, it didn't strictly evaluate P/E ratios. The reality is, that mutual funds and ETFs have further allowed destabilization of the markets, further disconnecting each stock's value from the underlying company's performance.That's why I'm 100% convinced this market is broken. We have never seen anything quite like it, and once we're back to Dow 26K (if we ever get there again in my lifetime), I'm selling every last share of stock and funds I own and going 100% cash the rest of my natural life. I want absolutely NOTHING to do with this type of market, because I'm convinced it's not operating in any way like it ever has before - and I no longer want to have anything to do with it.

IF everyone just invested $ regularly, and never panicked, or reacted irrationally to news, it would just go up, and up, and up. No more recessions. But that isn't the way the world works. The market is driven by fear and greed, high-frequency trading, computer algorithms, short sellers, and short sellers producing bad news to drop stock values. Since you can't accept this, it may be time for you to get out. I gave up long ago on fighthing the system. The only way to average 7% annual gains over the long term is to ingore the noise and invest.

In 2009, I had a doom-and-gloom coworker. He was convinced the markets were doomed and would never recover. He sold his equities at massive losses, making them permanent, bought annuities, and moved from high-cost of living Hawaii, to Texas. He was comfortable with his decision, and no longer had to worry about politics or the markets. Worked for him.

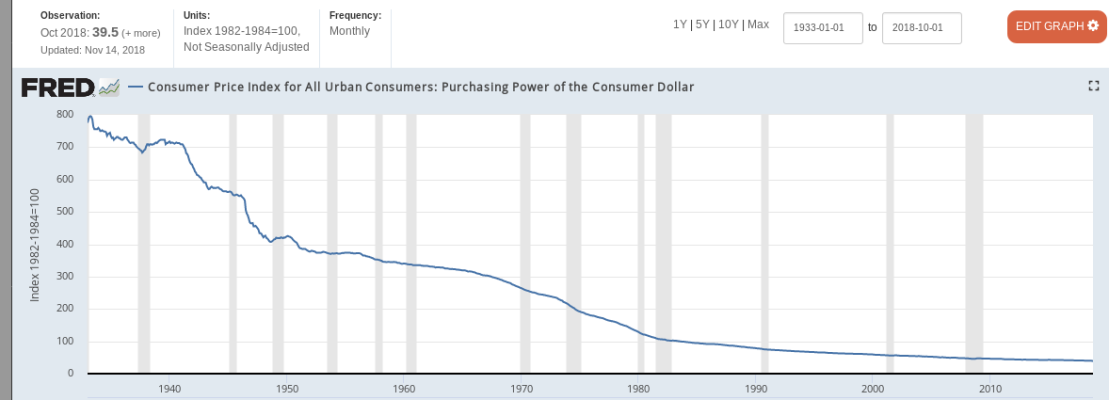

I hope you have a plan to keep up with inflation.

Last edited: