Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

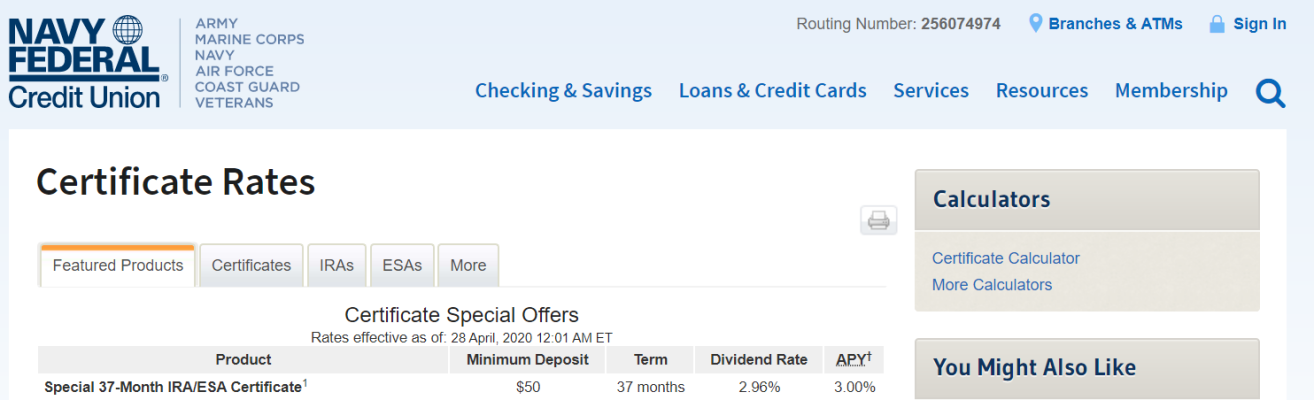

That is interesting in that I recently set up my Navy Federal bank account with Vanguard and Vanguard sent to small deposits to my account and a withdrawal equal to the two small deposits combined. I later got a letter from Navy Federal saying that they did not allow transfers out from a share savings account to another financial institution based on the 6-transactions per month limit and that it should be on my checking account (but I don't have a checking account with them). So it sounds like the restriction will change.

That happened to me as well when I set up the account at Navy and tried to establish a link to Ally. The easiest thing to do is set up a checking account as Navy and use it as the transfer account. That will require an extra step on PB's part to move the money into the interest bearing account at Navy, unless they have some sort of automatic transfer option that you could set up.