Sorry if this is considered thread hijacking but ... Would it make sense then to dump more/all into the Index fund? ...

No problem,

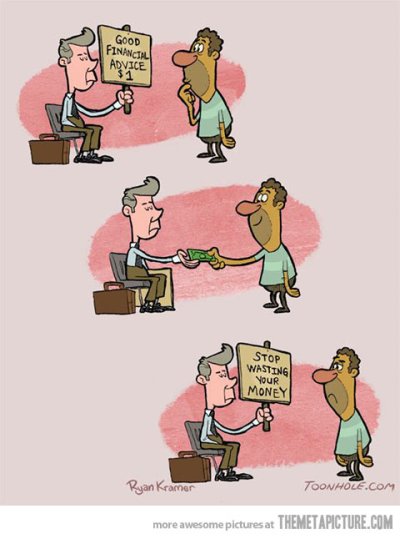

@MSUIndy. I'll comment on your question and bring the thread back to center by adding a few more links. I even remembered a funny one, so I'll start with that:

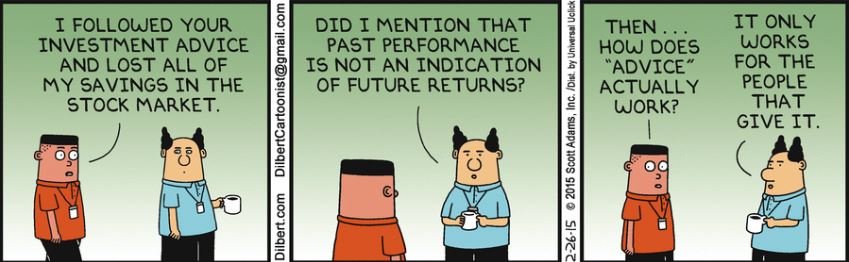

As others have pointed out, the answer to your question (as @Huston5 and

@DrRoy have said) is "yes." But your expectation that your actively managed funds will do about what a passive fund will do, before fees, is incorrect. In that video, Ken French is basically presenting William Sharpe's 1991 paper:

https://web.stanford.edu/~wfsharpe/art/active/active.htm In it, Sharpe shows that the

average performance of active managers must underperform passive investing by the difference in fees. You cannot invest in the average though; you have to invest in a few specific managers.

The results of active managers vary all over the map. In fact, about 7% of them produce such abysmal results in any given year that the funds are shut down. Further, the empirical data in S&P's semiannual "SPIVA" reports shows us that active managers' results vary greatly and their average performance is much worse than a simple fee comparison would predict. @VanWinkel's point on trading costs is one of several likely reasons. So --- Drs Sharpe and French are optimists! I think this is a good link to the SPIVA reports:

http://us.spindices.com/spiva/ but S&P's site is down right now so I can't check it.

Be sure to also study the Ken French video "Identifying Superior Managers." There is a SPIVA companion report card on "Manager Persistence" that IMO should be required reading for any investor. (Both S&P report cards come out every six months but the conclusions are always the same, so it really doesn't matter which versions you find.)