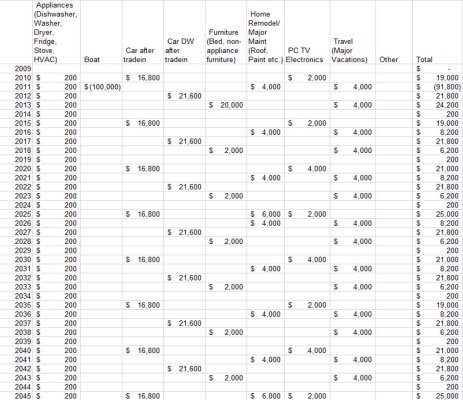

I am fine tuning my general plan for my withdrawal strategy and curious as to how many of you are handling your lumpy expenses. I have broken my lumpy expenses into 2 buckets: 1) Forecasted capital expenses such as 2 new cars every 5 years, new roof/HVAC every 15 years, appliances, etc. Eg. If I was to spend $50K every 5 years on a car, I would put away $10K/yr in this bucket. The thought here is I have a separate savings account for this and let it just build over the years until I need the $$. 2) Unbudgeted/Contingency expenses such as redoing the kitchen, refurnishing the bedroom, blowing out a ridiculous trip above and beyond the standard budget, buy the wife a fancy diamond ring. This is stuff that is purely discretionary and indulgent. One thought is to do the same thing as 1) and have a separate account I build and let grow, that we pull from time to time. Optically, I like this idea as it is separated from my invested accounts. However, since this is purely discretionary, I am wondering if I just keep it in my main AA mix and just pull it when/if I want to, just to make sure it stays invested and has some level of growth.

As a point of reference, I am somewhat backing into a gross withdrawal number (3% or less WR) and any excess falls into my 2) bucket noted above.

How do you handle your lumpy expenses?

As a point of reference, I am somewhat backing into a gross withdrawal number (3% or less WR) and any excess falls into my 2) bucket noted above.

How do you handle your lumpy expenses?

and I truly appreciate the peace of mind that this brings to me.

and I truly appreciate the peace of mind that this brings to me.