Our auto insurance for 2 cars went up 35%, no accident or any change in coverage/ deductibles 2.5 month ago. I got quotes from at least 5 other insurances but none of them could offer a better deal. I think it was my wife new electric car, we purchased 5.5 months prior to renewal and initial rate was lower about 20%.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Big jump in Homeowners insurance

- Thread starter dm

- Start date

Kind of late to think to ask this but does anyone increase their deductible to make up for the increases in price? I did that last year not sure how high of a deductible I'm okay with. My renewal should be soon so I will see what I get.

ER Eddie

Thinks s/he gets paid by the post

- Joined

- Mar 16, 2013

- Messages

- 1,788

Mine keeps going up, too. I'm tempted to just drop it. I am frustrated that I've paid premiums for 20 years and gotten squat out of it (besides "peace of mind"). I know it's irrational to think about cancelling my insurance, but it feels like money down the toilet.

If my house burned down, I could afford to rebuild it myself. It would be a financial hit of course, but I live in a small, modest home, and it wouldn't be more than about 200K to rebuild. I wouldn't enjoy paying that, but I could. I guess that makes me capable of being self-insured, right?

But I'm a conservative sort, kind of risk-averse in most areas, so I imagine that when the next bill comes, I'll suck it up and pay it. Tornados do come through here once in a while. We've also had two old houses in my neighborhood burn down within the past year or two (due to old wiring, maybe? not sure).

Besides, with my luck, I'd probably quit paying my insurance, and then have my house hit by a tornado the following Friday, lol.

If my house burned down, I could afford to rebuild it myself. It would be a financial hit of course, but I live in a small, modest home, and it wouldn't be more than about 200K to rebuild. I wouldn't enjoy paying that, but I could. I guess that makes me capable of being self-insured, right?

But I'm a conservative sort, kind of risk-averse in most areas, so I imagine that when the next bill comes, I'll suck it up and pay it. Tornados do come through here once in a while. We've also had two old houses in my neighborhood burn down within the past year or two (due to old wiring, maybe? not sure).

Besides, with my luck, I'd probably quit paying my insurance, and then have my house hit by a tornado the following Friday, lol.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I had asked about raising the deductible many years ago but $2500 was as high as they would go and it barely made any difference vs. the standard $1k. I would be ok with catastrophic coverage $10k deductible but I guess they figure many people could not afford to pay it. I’d be OK if they didn’t give me a whole new upgraded roof to replace my 20 yr old one with minor hail damage, but at least I’m ahead of the game now.

harley

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Kind of late to think to ask this but does anyone increase their deductible to make up for the increases in price? I did that last year not sure how high of a deductible I'm okay with. My renewal should be soon so I will see what I get.

Every time I've ever checked into raising my deductible (home or auto), the dollar amount of savings was insignificant. Especially with auto, the few bucks I'd save aren't worth the risk. I think I have a much higher chance of needing a claim for auto than home. But even with the home insurance the small savings wasn't worth it. If I was living paycheck to paycheck I might take the chance.

My deductible prior to last year on HO was only $500 so raising it to 1K seemed to make sense. I don't remember if I didn't like the other quotes or even asked for them. I remember asking my friend what he had on his house and I think it was like 1 or 2%. Not sure my insurer has that or not. Of course, then I had actual friends IRL . . .

Last edited:

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Several yrs back my deductible for wind damage was a percentage of the claim, maybe 2%. It seemed really sneaky. The deductible for everything else was $1k. I think the state may have banned that practice. I always ask about it and my last few policies do not have different deductible for wind damage.

My deductible is 1% of covered property (around $5,000). I've been hoping for a hail storm for years, as the roof would be around $30K to replace. Several of my neighbors have gotten new roofs over the last several months due to hail damage. It hasn't hailed hard here in the 13 years I've lived here. The roofer that did the roofs contacted me, but I'm hesitant to try to make a claim. I'm pretty sure a denied claim counts as a claim and I don't want to see my rates skyrocket due to a denied claim.

My increases have averaged 8% over the last 6 years. Last year was 7%. I'll find out what the damage is this Summer.

My increases have averaged 8% over the last 6 years. Last year was 7%. I'll find out what the damage is this Summer.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My deductible is 1% of covered property (around $5,000). I've been hoping for a hail storm for years, as the roof would be around $30K to replace. Several of my neighbors have gotten new roofs over the last several months due to hail damage. It hasn't hailed hard here in the 13 years I've lived here. The roofer that did the roofs contacted me, but I'm hesitant to try to make a claim. I'm pretty sure a denied claim counts as a claim and I don't want to see my rates skyrocket due to a denied claim.

My increases have averaged 8% over the last 6 years. Last year was 7%. I'll find out what the damage is this Summer.

I had no clue that we had hail damage. A neighbor informed us that he had been approved for a new roof. I called a local inspector and he confirmed we had damage also. One guy I called quoted $50k but offered 40% off if I signed the contract right away. He never mentioned anything about an inspection. The insurance approved $20k including my deductible and several upgrades. I used my neighbor’s roofer who used the same materials as the $50k guy.

Edit: since our damaged roof was 20 yrs old, I had assumed they would depreciate it and we’d still have to pay around 80% of the cost.

.

Last edited:

I had no clue that we had hail damage. A neighbor informed us that he had been approved for a new roof. I called a local inspector and he confirmed we had damage also. One guy I called quoted $50k but offered 40% off if I signed the contract right away. He never mentioned anything about an inspection. The insurance approved $20k including my deductible and several upgrades. I used my neighbor’s roofer who used the same materials as the $50k guy.

Edit: since our damaged roof was 20 yrs old, I had assumed they would depreciate it and we’d still have to pay around 80% of the cost.

.

I might have the roofer come out and climb the roof. I did have a couple of roofing companies come out last year just to take a look. Neither mentioned any hail damage and said I probably had another 5 years left (my roof is 22 years old).

My State Farm policy still pays out full replacement cost (less deductible). When I shopped around a few years ago, all of the companies I spoke with wanted to do a roof inspection and said that any future claim would be depreciated due to age.

Katsmeow

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 11, 2009

- Messages

- 5,308

I just got the bill for our renewal and it is a more than 50% increase, maybe 60% - didn't calculate exact amount. Last year was about a 25% or so increase. We've had no claims ever on our homeowner's policy. I think we will likely be going to someone else. Last year, we almost did.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

We had pea sized hail for 1 minute yesterday. This stuff wouldn't hurt anything.

I can tell you the hail-chasers will be coming through the neighborhood starting today. Most of these guys are scum balls.

This game is killing all of us.

I can tell you the hail-chasers will be coming through the neighborhood starting today. Most of these guys are scum balls.

This game is killing all of us.

Last edited:

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

Mine keeps going up, too. I'm tempted to just drop it. I am frustrated that I've paid premiums for 20 years and gotten squat out of it (besides "peace of mind"). I know it's irrational to think about cancelling my insurance, but it feels like money down the toilet.

If my house burned down, I could afford to rebuild it myself. It would be a financial hit of course, but I live in a small, modest home, and it wouldn't be more than about 200K to rebuild. I wouldn't enjoy paying that, but I could. I guess that makes me capable of being self-insured, right?

I get it. When my cars get old, I go in that direction and self insure. This year was an exception since used car prices went up, I decided to keep it on our 10 year old cars.

I wanted to mention one thing about homeowners: Loss of Use. Don't forget when your house gets hit by a tornado, you have to live elsewhere. Most policies have "Loss of Use" coverage, meaning you can get some type of limited coverage to pay for your temporary housing. That year you are out of your home can add up. We have a friend out of their home now at the 8 month mark. Our neighbor spent 12 months out. Another neighbor is having contractor issues and is at 2 years trying to rebuild. They maxed out the Loss of Use clause on their policy.

Kings over Queens

Recycles dryer sheets

- Joined

- Apr 16, 2023

- Messages

- 431

One thing to consider and many aren't talking about this is that carriers are looking to claw back on increases that were deferred during covid.

aja8888

Moderator Emeritus

One thing to consider and many aren't talking about this is that carriers are looking to claw back on increases that were deferred during covid.

And that will just set a new pricing floor.

Kings over Queens

Recycles dryer sheets

- Joined

- Apr 16, 2023

- Messages

- 431

Insurance rarely goes down.

Florida has been mentioned a lot in this thread, and that market is a flat out disaster.

Florida has been mentioned a lot in this thread, and that market is a flat out disaster.

athena53

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 11, 2014

- Messages

- 7,377

One thing to consider and many aren't talking about this is that carriers are looking to claw back on increases that were deferred during covid.

They still need the stats and analyses to back up their rate requests or the state Insurance Department won't approve them. (DS is upstairs as I type this, working on such a request for Commercial Liability coverage.

Even if regulators tried to hold down rate increases during COVID (and I have no idea if they did, and auto insurance companies VOLUNTARILY issued small refunds during the COVID lockdown to reflect reduced driving), no company is allowed to increase rates just because "we want more money".

Kings over Queens

Recycles dryer sheets

- Joined

- Apr 16, 2023

- Messages

- 431

No doubt.They still need the stats and analyses to back up their rate requests or the state Insurance Department won't approve them. (DS is upstairs as I type this, working on such a request for Commercial Liability coverage.)

Even if regulators tried to hold down rate increases during COVID (and I have no idea if they did, and auto insurance companies VOLUNTARILY issued small refunds during the COVID lockdown to reflect reduced driving), no company is allowed to increase rates just because "we want more money".

You make a very good point that I don't believe has been made in the thread thus far, that being the insurance company doesn't get to just raise their rates, they have to apply to the state and justify the requested increase with data.

I'd have to go check on the topic of auto insurance refunds during covid (this discussion is on house insurance). I recall a lot of publicity at the time and many carriers did refund premiums. I don't know if it was done by executive order of the Governor's of various states, or due to publicity.

Kings over Queens

Recycles dryer sheets

- Joined

- Apr 16, 2023

- Messages

- 431

This was easier to find than expected.

NJ mandated refunds in June of 2020, Insurance Department Bulletin 20-22.

I also saw reference to California mandating the same but didn't find their bulletin.

NJ mandated refunds in June of 2020, Insurance Department Bulletin 20-22.

I also saw reference to California mandating the same but didn't find their bulletin.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Still waiting to hear back from my independent broker on an alternative to current insurer’s 90% increase. Feels like they’ve dropped the ball (again). In the meantime I think I’ve decided to go with the guys that have my auto policy despite their requirement for a home inspection. Another annoying bit is s trend for insurer’s to automatically include what I consider to be “junk coverage”. In this case some type of mechanical coverage that’s really inexpensive but no details on coverage.

Our current insurer still has not sent us an official statement for next year's policy which starts on June 1. We answered a questionnaire last month about our house, which was built in 2019. We did have the roof replaced in 2021 due to the hail storm that came through Central Texas in April 2021, which I noted on the questionnaire.

Funny thing, the insurer contacted us late last week to ask for proof of the roof replacement, including a copy of the paid receipt. The roof replacement claim was filed with *them*. They should have had the documentation for this new roof. I finally got that squared away later in the day.

I don't have a warm fuzzy after this about what's to come for our premiums with them. The fact that they haven't sent us a notice yet and we're getting closer to end of this month leaves little time to switch insurers if it becomes necessary.

Funny thing, the insurer contacted us late last week to ask for proof of the roof replacement, including a copy of the paid receipt. The roof replacement claim was filed with *them*. They should have had the documentation for this new roof. I finally got that squared away later in the day.

I don't have a warm fuzzy after this about what's to come for our premiums with them. The fact that they haven't sent us a notice yet and we're getting closer to end of this month leaves little time to switch insurers if it becomes necessary.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sounds like you should consider being pro-active about getting some other quotes, Statsman.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

Here we go. Expect insurance to go up even more in future years.

We have discussed how roofers are aggressively [-]gaming[/-] using the system to replace roofs for people using insurance money (https://www.early-retirement.org/fo...ut-roof-replacement-and-insurance-117732.html).

Well, there's a new game in town, and it is the little plumbing leak. You know, a shutoff valve under the sink. Gotta leak? Time for a new kitchen, courtesy insurance.

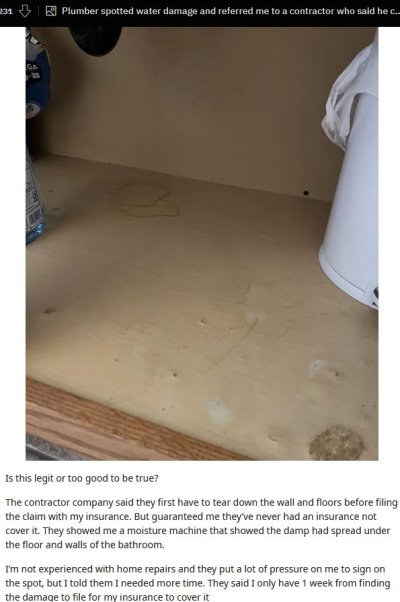

I'll summarize this reddit. Title: "Plumber spotted water damage and referred me to a contractor who said he could get my insurance to cover remodel". Now most of the redditors warned the poster that they'll fail at this quest, and get a ding on their record. Others report that perhaps it will work, but not without a lot of wrangling.

The point is there are contractors even trying this nonsense. Nothing good will come of our rates if this becomes a thing.

Source: https://www.reddit.com/r/Home/comments/136blpp/plumber_spotted_water_damage_and_referred_me_to_a/

We have discussed how roofers are aggressively [-]gaming[/-] using the system to replace roofs for people using insurance money (https://www.early-retirement.org/fo...ut-roof-replacement-and-insurance-117732.html).

Well, there's a new game in town, and it is the little plumbing leak. You know, a shutoff valve under the sink. Gotta leak? Time for a new kitchen, courtesy insurance.

I'll summarize this reddit. Title: "Plumber spotted water damage and referred me to a contractor who said he could get my insurance to cover remodel". Now most of the redditors warned the poster that they'll fail at this quest, and get a ding on their record. Others report that perhaps it will work, but not without a lot of wrangling.

The point is there are contractors even trying this nonsense. Nothing good will come of our rates if this becomes a thing.

Source: https://www.reddit.com/r/Home/comments/136blpp/plumber_spotted_water_damage_and_referred_me_to_a/

Attachments

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I do recall that during covid that some carriers voluntarily issued refunds because more working from home and less going out resulted in less driving and therefore less claims. Besides, it was good advertising....I'd have to go check on the topic of auto insurance refunds during covid (this discussion is on house insurance). I recall a lot of publicity at the time and many carriers did refund premiums. I don't know if it was done by executive order of the Governor's of various states, or due to publicity.

On the last part, no governor would have the legal authority to order a private insurer to issue refunds.

Similar threads

- Replies

- 5

- Views

- 449

- Replies

- 62

- Views

- 8K

- Replies

- 14

- Views

- 990

- Replies

- 17

- Views

- 1K

- Replies

- 144

- Views

- 8K