Interesting read:

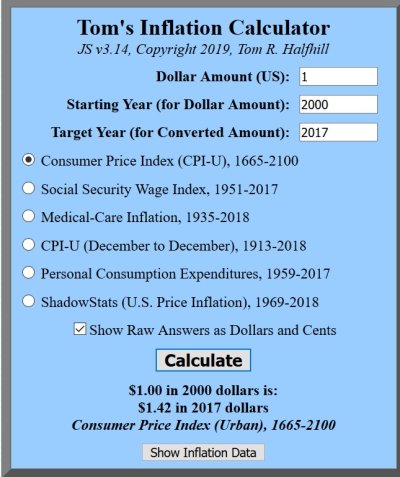

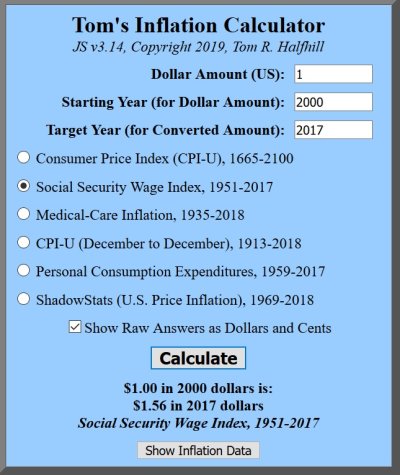

“Two recent recessions devastated personal savings. And at a time when 10,000 baby boomers are turning 65 every day, Social Security benefits have lost about a third of their purchasing power since 2000.”

https://www.washingtonpost.com/us-p...rkforce-one-last-mess/?utm_term=.584b15ab08a3

“Two recent recessions devastated personal savings. And at a time when 10,000 baby boomers are turning 65 every day, Social Security benefits have lost about a third of their purchasing power since 2000.”

https://www.washingtonpost.com/us-p...rkforce-one-last-mess/?utm_term=.584b15ab08a3